Have you ever watched Family Feud? Perhaps you were a child when Richard Dawson hosted the game show or maybe you enjoy the current version.

No matter, take a moment and:

• Name a three-letter word that ends in –ow

• Name a chess piece

• Name a one-word color for a pair of socks

• Name how many batteries are used in a flashlight

• Name one way people may make money investing in stocks

If you chose common answers to these questions, you may have come up with cow, king, white, two, and stock price increases. Of course, no matter what the question is, the common answer isn’t usually the only answer. That’s certainly true when it comes to investing in stocks.

Three Ways Stock Ownership Can Potentially Benefit Investors

Many investors choose to include shares of stock in their portfolios because stocks historically offer higher potential returns than other traditional investments, such as bonds and cash. The trade-off is stocks also have greater risk.

Shareholders don’t always realize an increase in a stock’s price is just one way shareholders may benefit from owning stock. Companies also return wealth to shareholders through dividends and stock buybacks. During 2015, between dividends and buybacks, companies are on track to return $1 trillion to shareholders.

Share Price Increases

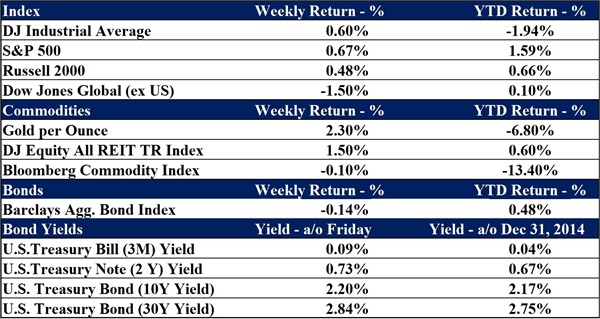

If you measure performance with benchmark indices, then stocks have delivered reasonably attractive returns over time. For example, the Standard & Poor’s 500 Index (S&P 500), historically, has returned:

- 9.6 percent on average, each year, from 1928 through 2014

- 9.8 percent on average, each year, from 1965 through 2014

- 7.6 percent on average, each year, from 2005 through 2014

It’s important to recognize, however, an investor who held the same stocks as the index would have experienced a pretty bumpy ride. The 1928 through 2014 period included eleven years when the S&P 500 was either up (1928, 1933, 1935, 1945, 1954, 1958, 1975, 1995) or down (1931, 1937, 2008) more than 35 percent.

One of the challenges of stock ownership is share values can move higher or lower depending on the performance of the underlying company, the perceptions of investors, or other factors over which the company and its investors may have little influence.

Dividend Yields

Some companies choose to pay cash distributions, called dividends, to their shareholders. These are often large and well-established companies that want to attract investors even though their growth prospects may not be as promising as those of smaller or mid-sized companies.

Once a dividend has been established, investors expect it to remain stable or rise. When a dividend is cut, it may be a sign the company is in trouble. Some experts believe companies that pay dividends are more efficient in their use of capital than companies that do not pay dividends.

Historically, dividends have played an important role in total return. In fact, since 1926, reinvested dividends have contributed about 33 percent of the total return of the S&P 500 Index. So, reinvesting dividends has the potential to improve a portfolio’s performance over time.

Some investors, especially those who depend on their investments to generate income for retirement, prefer to spend rather than reinvest their dividends. The dividend yield for the S&P 500 has been just under 2 percent in 2015. Of course, a company’s dividend yield may be higher or lower than the S&P 500’s dividend yield and is usually expressed annually as a percentage based on the investment’s cost, its current market value, or its face value.

Share Buybacks

U.S. companies have been on a stock buyback spree. A stock or share buyback occurs when a company buys shares of its own stock in the marketplace. Repurchased shares may be absorbed or held by the company. A share buyback may:

- Reduce the number of shares outstanding

- Improve shareholder value

- Increase a company’s return on assets and return on investment

- Improve a company’s price-to-earnings ratio

If the end effect of a buyback is the number of shares of stock outstanding in the marketplace is smaller, then the ownership stake of each investor increases. In these cases, the value of outstanding shares may increase as well.

If the company is issuing new shares at the same time it is buying shares, or if it is awarding executives and employees with stock options, then the number of shares outstanding may remain constant or increase. In this case, the value of shares may remain unchanged or decline.

Stocks have the potential to reward investors in a variety of ways. These include stock price appreciation, dividends, and share buybacks. The value of the company’s stock may increase because it’s growing well or because investors are enthusiastic about the company or industry. Larger companies with moderate growth potential may pay dividends to keep investors interested in owning shares and, during periods when companies have a lot of cash, they may choose to buy back shares.

We are continually on the lookout for companies that are reducing the number of shares outstanding, particularly when the insiders are also buying shares (especially the CEOs and CFO). When these factors are present, we almost always have a good value investment.

Data as of August 17th, 2015

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, a registered investment advisory firm in Hixson, Tennessee. A 20-year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are unmanaged and cannot be investedinto directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.