I recently wrote this article for Money Magazine. Follow this link to view it.

The unedited version is below:

Just the other day, the daughter of a client of mine told me that she did not expect her father to last much longer. I had known that her father’s health had deteriorated somewhat, but he still seemed relatively sharp mentally up until the last conversation I’d had with him, around Christmas time.

The client’s wife has never been very involved in the family finances, and his son lives out of town. The daughter has been playing caretaker for some time. Now it seemed we needed to have a more in-depth conversation with everyone involved with regard to family finances, longevity and what happens after the patriarch is no longer with us or able to function as financial head of the household.

The loss of a loved one is unbearable, but far worse is losing a loved one to cognitive conditions such as Alzheimer’s disease or dementia. These decisions may cause personality changes. In some cases, a client may become belligerent or paranoid, especially when dealing with financial issues.

It is always preferable to have a client himself or herself acknowledge that something is wrong, but this may not always be the case. For this reason, financial advisers need to have a plan in place to address situations such as this one.

The first step is to get the family involved. Most of the time, the spouse or children will already be aware of the issue.

In this particular case, I could not discuss financial details with the daughter without a financial power of attorney. Fortunately, we were able to schedule a time for father, mother and daughter to meet and discuss family finances.

What if someone refuses to admit that he is losing his mental acuity? We dealt with this a few years back with another client. He was going through a divorce at the time — a process which may have either contributed to, or resulted from, his mental decline. We ended up being a part of an intervention involving the client, his children, his business partner and his pastor. The pastor referred him to a psychiatrist; luckily, the client pursued treatment that helped.

The key to handling many of these situations is having a ready stable of referable professionals in all aspects of life. In addition to the colleagues we deal with on a regular basis, such as lawyers and accountants, it is helpful to have contacts in the arenas of medicine and psychology.

Solid and consistent documentation is a standard in our industry, but it becomes absolutely imperative when dealing with cognitively questionable clients. Keeping communication records protects everyone involved and can go a long way to explaining client actions to family members if they are unaware of the problem.

Things don’t always go so smoothly. In some situations, you must fire the client. We have had to have these tough conversations in the past. It would be nice to say that we are always able to help facilitate a smooth transition, but many of these personality issues are beyond our control. When cutting ties, it is important to do it with an in-person meeting. We’re honor bound to do what’s best for the client, but it is also important to protect our practices. If we are unable to make progress, it may be best for them to find someone who can better help them.

I’m very thankful the daughter came to me, rather than my having to reach out and have what could have been an unpleasant conversation. At this point we have now gathered financial powers of attorney and reviewed updated wills and trusts, coordinating with the family attorney. The mother and daughter are much more aware of the family financial situation and are not near as fearful about the future. I expect the daughter will take a more active role in the management of the family’s finances. We want to make sure that everyone involved, is aware of, and on board with the changing of the guard.

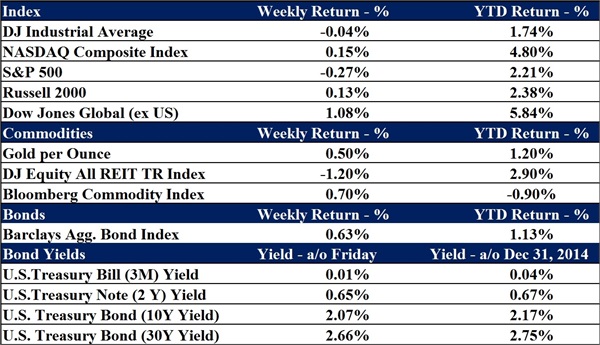

Data as of March 2nd, 2015

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, a registered investment advisory firm in Hixson, Tennessee. A 20-year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are unmanaged and cannot be investedinto directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.