Our “Goldilocks” by the campfire. She’s not too worried about the bears.

This past Fourth of July weekend, we enjoyed a dad’s and daughter’s camping trip at Fall Creek Falls. As Sydney is getting older it seems we have less opportunity for daddy, daughter time, so I jumped at the chance to spend the weekend with her and her friends in the woods. She’s not too old yet to no longer enjoy getting dirty, hanging with her dad by the campfire, shooting bows and arrows and general outdoor fun with her friends. The first night after we had finished eating supper by the campfire, a visitor stopped by and told us that they had spotted a bear (or something resembling a bear) not far off from where we were camping. After hearing this, we made sure to take precautions and store anything away that might attract a hungry animal, other than the dads.

My Goldilocks (Sydney) was not visited by bears that night. We took precautions and conditions were such that none were tempted to come our way. Likewise, although the U.S. markets currently look expensive, conditions are such that the probabilities of an imminent downturn are slight. Indications show that bears may be on the horizon but not in the immediate vicinity.

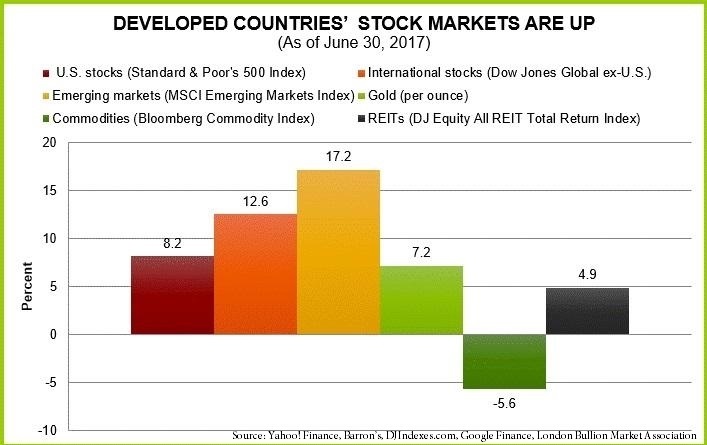

In our Halftime Report last week, we explained how we felt the markets are increasingly reminding us of how things felt in late 1998 and early 1999, but U.S. markets currently look strong. In our view, the current bull market is growing increasingly old, but is still healthy. Other international bull markets are in the younger stages and have a longer life expectancy but some would say the U.S. markets are almost as vibrant. U.S. stocks have done well year-to-date, but not quite as well as international markets and especially emerging markets. Staying diversified has certainly paid off in 2017 so far.

So Why are the Bears Staying Away?

As Jeremy Siegel, author of “Stocks for the Long Run” noted recently, “We have a Goldilocks situation going on now.” He stated that earnings looked good adding, “but much more important than that is the maintained or upward guidance for second, third and fourth quarter — something we’ve not had for years.” The good earnings news comes even as economic growth remains relatively slow. That means inflationary pressures shouldn’t force the Federal Reserve to speedily raise rates.

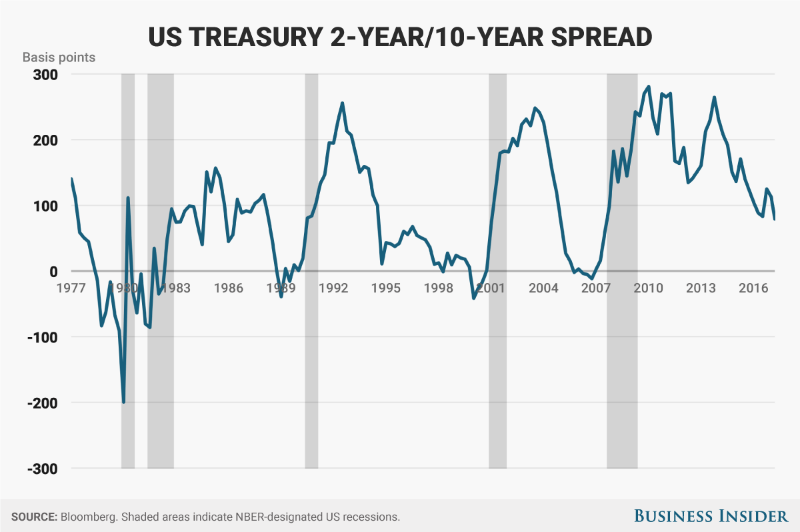

The U.S. Federal reserve continues to raise rates slowly while long term rates are held down by foreign demand and lower inflation expectations. This has caused the yield curve to flatten, but it has not turned negative as it typically does before impending recessions. Central banks outside the U.S. continue to stimulate their economies, providing a catalyst for out-performance of their respective markets.

What are we concerned about?

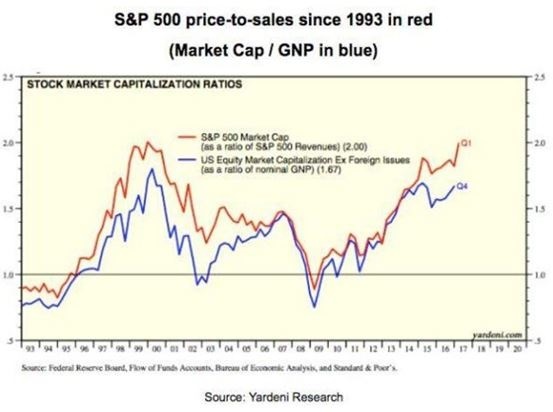

We are experiencing the 2nd longest U.S. bull market of the past century with valuations approaching all-time highs. The chart below shows the price-to-sales and market cap to GNP ratios from the early nineties to today. As can be noted, the current price-to-sales ratio is even higher than late 1999, but profit margins are healthier now than at that time.

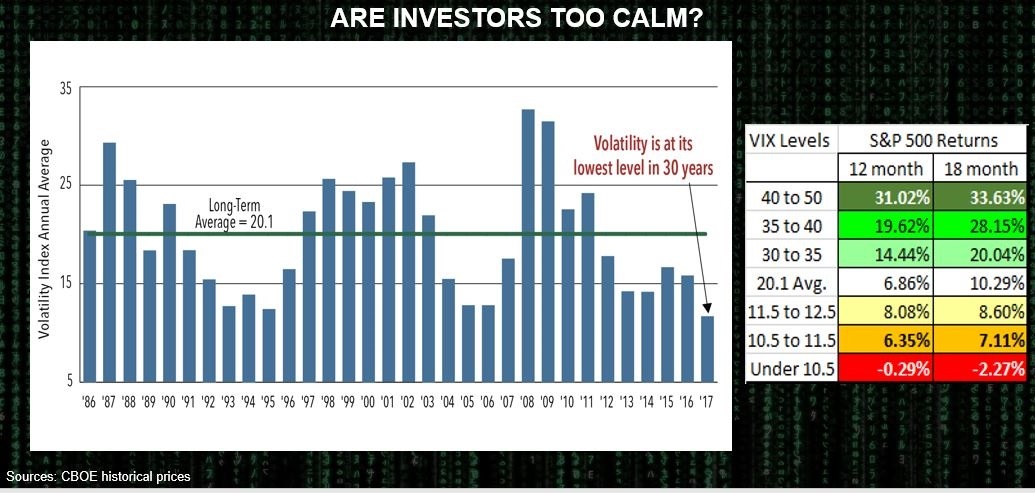

Many are concerned about the current lack of volatility in the U.S. markets as well. 2017 is shaping up to be the least volatile year of the last 30 plus years. A lack of volatility does not necessarily translate to an imminent crash or correction however. The data shows that a lack of volatility has little bearing on market performance over the next six months but historically the markets are down over the following 12 and 18 months. Keep in mind that we have seen this level of confidence in the markets (as defined by the VIX fear gauge) very rarely over the last 30 years. We are charting new territory here.

We may become concerned if fiscal stimulus measures, deregulation initiatives or tax reforms fall flat. There is also the possibility that inflation could pick up more quickly than expected, global upheaval could derail the smooth ride or the economy could falter and earnings could grow more sluggishly than we expect.

How can we best protect from the bears on the horizon?

Smaller companies in the U.S. stand to benefit more than larger companies from deregulation and lower corporate taxes and are less sensitive to currency fluctuations. For U.S. large companies, we advise utilizing strategies to hedge and limit downside exposure in this environment.

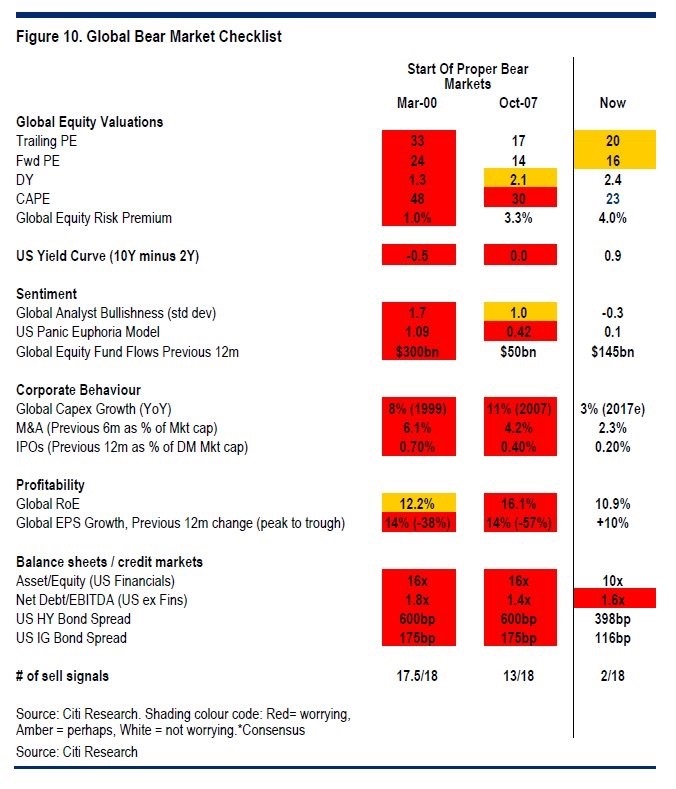

Central banks overseas are stimulating their respective economies and valuations are much more appealing. Increasing exposure to non-US economies makes sense in this environment. When we consider U.S. markets, the bears may be closer to the campsite than they are in other parts of the world. If we study the following Citigroup global bear market checklist, we can note only 3 of 18 areas to be concerned about when considering world markets currently.

As we’ve shown, U.S. markets are starting to show more cracks than world markets as this bull market ages, but there is no imminent sign of danger. More corporate profits today tends to keeps the bears away.

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, and CEO of Innovative Advisory Partners, a registered investment advisory firm in Hixson, Tennessee. A 20+year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are unmanaged and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.