I don’t profess to being a huge soccer fan but watching the USA team progress in the World’s Cup has definitely gotten my attention lately. On Sunday night watching the match between the U.S. and Portugal I did my best to learn how the clock works and figure out how many points teams receive for wins, ties and losses to advance in the tournament. I truly enjoyed the game. The U.S. started slow, turned it on in the second half of the game and came away with a tie.

Some would say that they stopped playing in the final minute of the game and let Portugal score the final goal. Others would say that they played a great game overall, continued to progress in the overall points ranking and improved their standing in the World Cup tournament. I’ve come to a greater appreciation of these different ways of thinking lately in reviewing a concept called “The Gap” which is all about how we process our progress toward our goals and ideals in life and allow ourselves to feel good about the experience

IT IS ALL ABOUT PROGRESS, NOT PERFECTION

We all know people who we could consider perfectionists. These people are always striving to attain more and make things better, but never seem happy with what they have accomplished. Some of us may know these people intimately.

Entrepreneurs, professionals and other high achievers are many things, but one thing a lot of us are not as good at is keeping score. My recent involvement in a new program has led me to delve into a concept that is called “The Gap” by Dan Sullivan, founder and president of Strategic Coach. “The Gap” is the permanent distance between us and our ideals. Our ideals can be really useful for stretching ourselves and identifying goals, but falling into “The Gap” can have demotivating and depressing effects. Those of us who many would term perfectionists or who we might consider to have very high standards are unintentionally playing a game that we make impossible to win.

So what game should we be playing and how should we be keeping score so that we can always come away with wins whether they be small ones or a huge, significant game changing wins?

What many of us do is continually measure ourselves based upon where we are compared to where we want to be. The only problem with this is that we are always going to find ourselves disappointed with our results by measuring our results in this way. I very rarely find someone who consistently exceeds all his or her own expectations, goals and ideals. By continually measuring ourselves and our results against perfection and idealistic visions of the future (focusing on how far we are away from where we want to be) we unfortunately put ourselves in a state of perpetual disappointment and feelings of failure.

THE KEY IS TO MAKE IT EASY TO FEEL SUCCESSFUL

What is the difference between those achieve more, grow continually over time and feel successful versus those who continually feel like a failure? Its all about their frame of reference. Those who continually feel like a failure are always comparing themselves to where they would like to be in the future while those who allow themselves to feel success find ways to celebrate what they are doing right and focus on the progress they have made from where they were to where they are today.

Those who feel success allow themselves to be happy by changing the lens through which they see the world. A few weeks back I wrote a blog entitled “What Comes First, Happiness or Success?”. I would encourage everyone to read the blog and embark on the journey that allows them to feel happiness. In his book “The Happiness Advantage”, Shawn Achor details five easy habits that everyone can practice on a daily basis to increase their happiness. Why not take the time to do a few simple things every day to increase your happiness and feelings of success in life?

To see Mr. Achor’s recipe for happiness, click here .

In my business and personal life with employees, my wife and with my children, I sometimes look at a project, a result or a report card and point out what can be improved before taking time to praise and engage in the celebration of their accomplishments. This was made more evident to me in our Strategic Coach session on Monday in Atlanta. I plan to work on always finding something to praise and later come back and engage in dialogue about how much progress they have made but also ask them “If you were to do this again, how would you do it better?” I feel this is one area where I can generate substantial improvements over time.

What do we do if we are stuck in a rut and cannot seem to make any progress toward our goals? Change the goal to one we can make progress on. In life, we make our own rules for how we define success, what we are grateful for and how we perceive the world around us. Why not change the rules if we have made them so that it is too difficult to be successful? Why do we want to create a game for ourselves where it is too hard to score much less win?

The easiest way to set up ourselves for success is to measure our progress from where we were to where we are today. We can always be striving for the ideal, for perfection and heaven on earth, but if we are not there yet why not enjoy the journey and take time to celebrate our accomplishments.

So in choosing to play a game that is easy to win, we do not want to focus excessively on the problems or on rules that make things too difficult for ourselves. Instead we should be focusing on personal, financial and business improvement. Going for growth solves an incredible number of problems. It allows us to play a game that is about the future and enables us to evolve, respond to and transform any situation.

WORRIED ABOUT A PULLBACK?

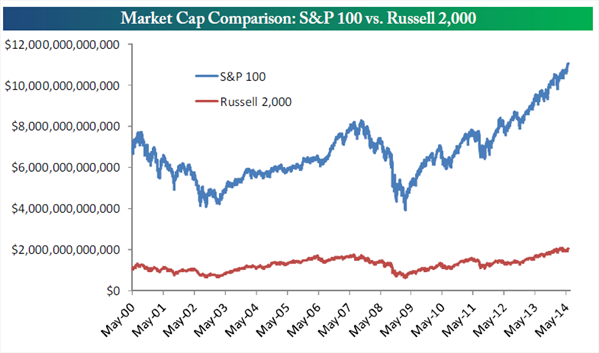

If you are concerned about a market pull back, what should you do? Consider your holdings and see if you are over-concentrated to a few specific stocks without knowing it. Likewise, someone who owns the S&P 500 index may not know how concentrated their portfolio really is.

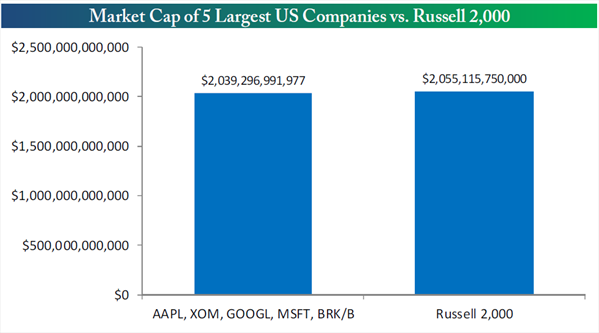

Look at this chart below. It shows that the market cap of Apple, ExxonMobil, Google, Microsoft, and Berkshire Hathaway have essentially the same market cap as ALL 2000 STOCKS IN THE RUSSELL 2000 INDEX.

The 100 largest stocks in the S&P 500 have a market cap of over $11 trillion dollars. The 2000 stocks in the Russell 2000 index have a market cap of $2 trillion. This means that the 100 big stocks drive the market. So when you see the S&P 500 up or down for the day, remember, it’s probably more of an indication of how well 100 stocks did that day. Owning the S&P 500 used to mean that you were somewhat diversified in most of the world’s largest companies because most of these were located in the United States. This is becoming less true over time.

As time goes on, in order to be diversified, it is evident that you need to own companies outside our borders. In our view, Europe is doing many of the things that they should be doing to dig themselves out of the hole they fell into over the last few years. They are enacting stimulus packages much like the ones we enacted in early 2009 and have continued to date. The only difference is that they have much more room for improvement than we do in the U.S. at the moment. Diversification outside the US and into other areas does not always work as well as if you are able to pick the area that is outperforming, like US Stocks last year. Diversification does tend to increase stability in portfolios and helps to increase long term returns over picking a narrow cross section of investments at random, however.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are un-managed and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.