Each year when our anniversary rolls around, I’m typically looking for something new to surprise Jennifer with. We both love to travel, so this usually involves a trip of some type. We usually go somewhere warm to scuba dive or somewhere cooler for good snow skiing. Napa was the choice this year because we won the trip in a charity auction to anywhere Southwest Airlines flies within the continental United States, California seemed the best value, and neither of us had ever been to Napa before.

It is almost impossible to travel to California wine country without hearing the stories explaining how California wine became regarded as some of the best in the world. Europeans and especially the French had long considered their own wines to have more character and sophistication than those of other areas of the world. The best champagnes and the best Bordeaux of course would come from the champagne or Bordeaux region in France. California had no grapes of note to call their own, but they did have rich and varied soil types and a climate that was close to perfect for producing world renowned wines.

In 1976 it took a Parisian wine shop owner with a love for and knowledge of California wines to help the Americans gain some acclaim worldwide. Steve Spurrier (No known relation to the football coach) organized a blind tasting with eleven of the most prominent judges in Europe to sample 20 wines. To everyone’s surprise the Americans won first place for the red category and the white.

Stag’s Leap cabernet sauvignon 1973 and Chateau Montelena chardonnay 1973 were victorious.

Jennifer with her new bottle of Chateau Montelena Chardonnay and the winning bottle.

The French did not consider American wine making worthy of note. By not considering other areas of the world the judges blinded themselves to the other opportunities available to try and enjoy some of the best wines. By not considering some of the best smaller wineries, they were keeping themselves from being able to taste what they later judged to be the best wines in the competition.

EXPANDING OUR THINKING

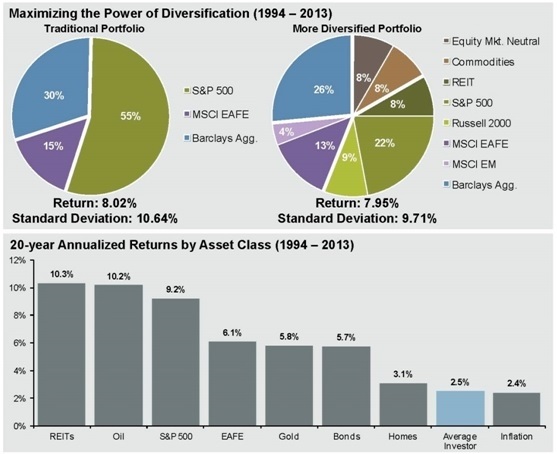

We in America are also sometimes blind to all the opportunities outside our own shores. With investments this is very much the case. The media describes the market as the Dow Industrials or more often today the S&P 500 index. In today’s world the S&P 500 comprises less than 10% securities that are US headquartered companies and traded on the exchanges. U.S. companies also comprise less than 40% of the publicly traded companies we can invest in throughout the world. So by expanding our universe to large and smaller companies in the U.S. we can increase our opportunity by a factor of over 10 or by a factor of over 25 if considering the opportunities throughout the world.

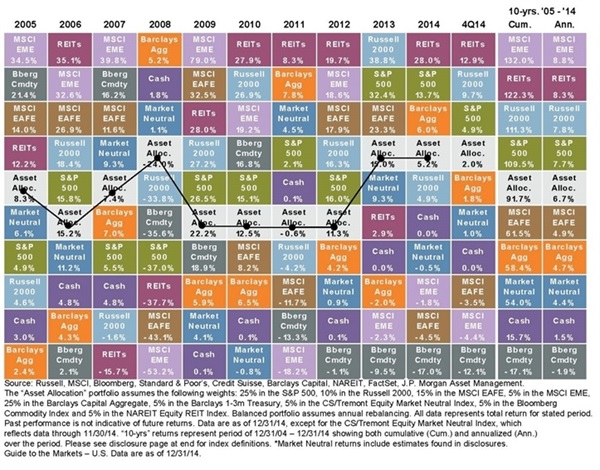

An investor in today’s markets can invest all over the world in stocks, bonds, and many alternative types of investments. Being more diversified can actually increase the expected return while reducing the risk of the portfolio (risk as defined by lack of certainty or stable returns). As you can see from the accompanying charts, the three best performing asset classes listed for the last 10 years were emerging market equities, REITs and small company stocks. Two out of three of those asset classes under-performed the “market” last year. Not having them in your portfolio, however would cause you to be more like the French wine tasters who could not believe that the upstart Americans could make a better wine.

Not every year is a great year for a given winery. So much is dependent on the weather. Being able to choose wines from all over the world allows us to experience the wines that had the benefit of superior growing conditions conducive to the wine they were growing. Likewise, being diversified may not seem to be as profitable as “owning the market” when the S&P 500 outperforms most of the rest of the world like it did last year, particularly in the second half of the year. If we are going to be more strategic we still want to own stocks, bonds and alternative investments from all over the globe and be inclusive of the “little wineries” that can make great wines or smaller companies that can produce out-sized returns.

2014 IN REVIEW

REITs and commodities gave investors the best returns in the first half of 2015 only to see commodities fall off a cliff in the second half. Small company investors were underwater most of the year until the fourth quarter. Those foreign investors who failed to have any U.S. stocks or bonds in their portfolio, lost money in 2015.

Within our Stock and ETF models we still want to maintain global exposure, but we did not feel comfortable holding too many non U.S. holdings or smaller companies throughout the year. As such we performed better than most global managers and funds in 2014. Although we were relatively eager to invest in bonds at the end of 2013, especially municipal bonds and emerging market bonds, this is no longer the case. Equity earnings yield spreads to bonds around the world are about as wide as they have ever been, telling us that stocks are much more attractive compared to bonds. We currently like emerging market bonds, as long as they are hard currency emerging market bonds (we usually use ETFs to get our exposure here). These types of emerging market bonds are dollar denominated and as such will not be hurt by a stronger dollar over the next few months or years.

The U.S. markets have been very choppy but resilient in the short run. The recoveries from any selloffs have been more rapid than is typical. This hurt us when we moved to protect portfolios in early February and we were a little late to get fully invested in October. We did not expect the market to turn as quickly as it did in either case.

The strength of the dollar has been the biggest story in our mind over the second half of the year. We have our issues in America, but they seem very minor compared to the issues facing the rest of the developed world. The U.S, Dollar and the British Pound are both strengthening versus the rest of the developed world. Stimulus measures in other countries designed to increase the money supply has investment dollars finding their way into U.S. markets. This will probably continue for the time being. When the flow from overseas stops, these foreign markets have further to run based upon more appealing valuations than what we see in the U.S. We do not know when the weather is going to change however.

STRATEGIC OR TACTICAL?

Within our Stock & ETF models, we invest globally, scouring the liquid investment universe for what we consider the best values. By employing some momentum screens and technical tools, we tend to avoid or quickly get out of many troublesome holdings and under-performing asset classes. This is less the case with our mutual fund models. Within these models we are more diversified and more strategic. We pick the funds based on good track records with a history of minimal downside volatility compared to peers in the same asset class. We have never allocated more than 12% to any one fund in our models and try to keep any one fund family to less than 20% of what is owned. Certain funds can perform well for many years in a row and suddenly falter. When they falter, especially when it is because the types of investments they own are out of favor, they usually recover and perform much better than the others after a time causing them to be wildly popular again. Pimco was out of favor in 2013 (as bonds faltered) and has largely recovered since then even considering the departure of Bill Gross from the Total Return Fund. Good Harbor seems to have lost its mojo this past year. Their technical timing process is currently out of step. Energy and commodities took a serious bad turn toward the end of the year as well. We expect the Tactical Income fund to recover and outperform most other funds as energy and commodities get popular once again. Predicting when this is going to happen is much like predicting the weather. We cannot predict with great precision the temperature on July 13th 2015, but we can tell you that generally it gets hotter in the summer months.

In our moderate mutual fund model we currently have the lowest bond exposure we have ever had. We also currently have the highest energy MLP exposure that we have ever had. We believe in REITs, BDCs and MLPs as bond alternatives for the foreseeable future and see little benefit to bonds currently except for stability in a stock market thunderstorm. Another seismic shift in yields like 2013 is possible, although we believe that yields are more likely to creep up more slowly over time.

When the oil and the energy stocks turn around, there is room for quite a lot of appreciation. The MLP pipeline companies and tankers are currently suffering with the rest of the energy companies but their profits are not near as susceptible to lower oil prices. Last year demand for oil increased at a good clip based upon the data we have studied and reviewed in our Forecast 2015 event the other night. The supply of oil increased faster than the demand and we now have more than is healthy for the market. It is somewhat likely that the pendulum will swing too far the other way again as well now that many producers are cutting back drastically.

One of the first wineries we visited on our trip was the Grgich winery. Mike Grgich started production in the mid-seventies, not long after the American wine took honors in France. He was the wine maker for Chateau Montelena and is making many fine wines to this day. From what we were told Danny Devito is going to be playing him in an upcoming movie and Tom Hanks is going to play one of the other major characters. We were told that the cardboard cutout of him is an actual life size cutout. Proof that good things and talented individuals sometimes come in small packages. We continue to scour the investment landscape for good investments in smaller companies as well as those not on U.S. soil. The smaller companies started to look better in the fourth quarter of last year and we expect they will continue to do well for the time being. It may take some time for the foreign investments to pick up steam. Within our mutual fund models we continue to own funds that will be able to pick up many great bargains at these prices. In our Stock and ETF models we prefer to wait until the tide starts to turn before dipping our toes in the water.

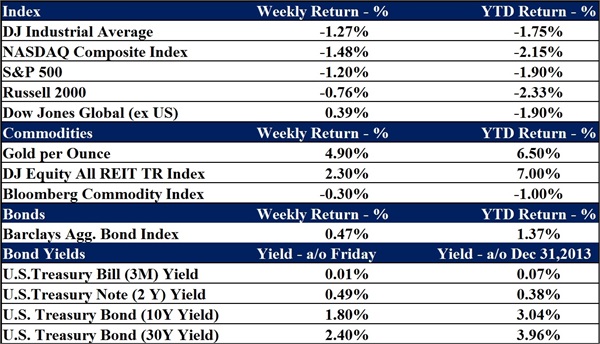

We are now two weeks into the new year. Gold, REITs and bonds to some degree have started off the year well, much like last year. Not much else is behaving as we would like so far, however.

Data as of January 20th, 2015

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, a registered investment advisory firm in Hixson, Tennessee. A 20-year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are unmanaged and cannot be investedinto directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.