I was recently quoted in an article that was published in Forbes on how we have worked with one of our clients to reduce Social Security taxes and eliminate his need to take required minimum distributions.

To go to the Forbes site to see the article, click here.

The Road To A Tax-Free Retirement

Ashlea Ebeling

Am I paying too much in taxes? Can I afford to retire? These are the questions Joe Franklin, a certified financial planner in Hixson, Tennessee, hears every day. One of his favorite solutions for clients in their 50s and 60s is to stuff retirement accounts and do serial Roth conversions before they hit 70 ½, when you have to start taking withdrawals from non-Roth accounts. That can help you create a nearly tax-free retirement. Here’s how he’s helping one small business owner couple.

The businessman, John, is 68 and his younger wife who has a part-time role in the business, both contribute to a SIMPLE Individual Retirement Account each year.

SIMPLE IRAs are a great option for a husband and wife working together. With a SIMPLE IRA in 2015, you can make an employee contribution (yes, that’s for yourself) of up to $12,500 pretax, or $15,000 if you’re 50 or older. On top of that, as an employer you can also put in up to 3% of your net self-employment income (that’s your self-employment earning adjusted by half of self-employment taxes). Basically, if you make $100,000, you can put in another $3,000 as an employer match. The second spouse on the payroll can also save up to $15,000, plus up to 3% of pay matched by the employer spouse. An added bonus: The employer gets an income tax deduction for any employer match made for his employees.

In addition to contributing to their SIMPLEs for 2014, John’s wife also made direct contributions to a Roth IRA, putting away the maximum annual amount for folks 50 and older of $6,500 (the contribution limit is $5,500 if you’re under 50).

At the same time the couple has been building up their retirement kitty, Franklin has had John and his wife both doing serial Roth conversions to move their older retirement dollars from pre-tax dollars (that would be taxed when distributed in retirement) to Roth dollars. So far John has $110,000 in a Roth and she has $150,000 in a Roth. There’s still another $180,000 to move. “We’re staging it,” Franklin says. “There’s a few moving parts.”

When you do a Roth conversion, you’re paying the tax upfront when you do the conversion instead of later when you take it out of a pre-tax IRA. So it’s best to do a bit every year. Generally, you want to make sure the income you realize from the conversion doesn’t bump you into a higher tax bracket. Conversions from a SIMPLE IRA work pretty much the same as conversions from a traditional IRA to a Roth IRA. One catch: you cannot convert any amount distributed from the SIMPLE IRA during the two-year period beginning on the date you first participated in any SIMPLE IRA plan maintained by your employer.

The advantage of having Roth money in retirement is that you don’t have to take required minimum distributions, and when you do take money out of Roth IRAs, that doesn’t count as taxable income. For John and his wife, that should help them keep their taxable income below $45,000 a year, so they save on Social Security taxes (they’d be taxed on half of their Social Security income, not 85%).

Another wrinkle for John is to figure out how to structure the sale of his business. John is handing over the business to his son-in-law, so he’ll structure the business/property rental income to be stretched out over his retirement years, helping to keep his business income lower but steady during retirement. “He has to pay taxes on the conversion, but saves taxes on the back end,” says Franklin.

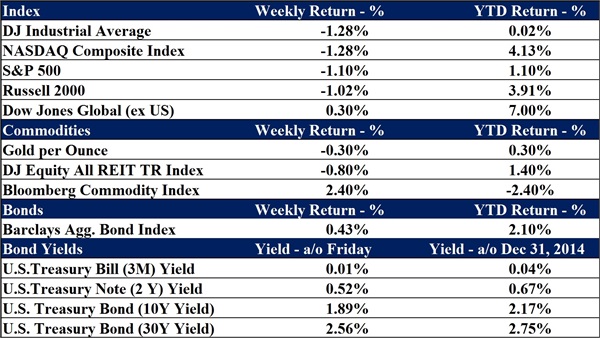

Data as of April 20th, 2015

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, a registered investment advisory firm in Hixson, Tennessee. A 20-year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are unmanaged and cannot be investedinto directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.