The old adage goes, “the early bird gets the worm.” The same rings true of financial independence. Those that start young are more likely to build substantial wealth over the course their lifetime. Those that wait may end up being forced to make concessions on their standard of living during retirement.

Millennials are faced with a number of different challenges as they graduate from college, prepare for the “real world” and start out their new careers. From the many different options given by employers, often with no explanation, regarding their 401k plan to understanding how much house they can afford to funding their child’s college tuition, there are more choices and more complex choices to make today than possibly at any other time in history. According to Time magazine, millennials aren’t saving for retirement, or to gain financial independence and it is relatively simple to understand why. Many don’t understand that it is possible to save and prepare for the road ahead while still maintaining the same happy and adventurous lifestyle they’ve always had.

Most recent graduates find themselves feeling lost and unsure of what steps are needed to prepare for their financial future, and many others don’t think that they need to save yet. They believe that preparing for retirement is what you should do as you head to the Social Security office to turn your benefits on. Of course, planning for an event 30, 40, or even 50 years in the future can be a tricky process, but by hiring a financial planner to help you see and understand the how’s and why’s of investing you can easily walk away with the confidence that you need to accomplish your goals.

Working with a financial planner, however, is often a misunderstood relationship, especially when it comes to millennials. The many different types of advisors and the similar or shared titles do nothing more than add to the confusion. For those just starting out, there are two important questions to ask of your financial planner.

1) Are you a fiduciary?

This is by far the single most important question to pose to your financial advisor. If the answer is anything other than a simple and solid “yes” you may want to dig a little deeper. The fiduciary standard charges advisors with the obligation to hold your interests above their own. Look for the CFP® designation. All CFP®’s are fiduciaries and are therefore held to a higher standard than other planners. The CFP® designation also ensures that the planner is experienced and competent, as the CFP® is only attained after the completion of a peer reviewed case study. Registered Investment Advisory firms are also held to the fiduciary standard with regard to their fee based clients. A good video that describes the difference between a broker and a fiduciary can be found below.

2) How are you compensated?

Working with a financial planner on an hourly fee or predetermined fee basis maybe the most cost effective type of relationship for those that have not had time to accumulate substancial assets. Many planners have investment minimums which may be too high for many younger investors to meet. However, a financial planner, for an agreed upon ongoing amount, may be able to help you by drafting a comprehensive plan and then working with you to make sure you stick to that plan over time. By hiring a financial planner on a fee basis instead of a commission basis, you are better able to mitigate some of the risks involved in seeking financial advice. In particular from self-described retirement planners that earn commissions from selling proprietary products which may or may not be in your best interest to own. All too often clients sold into long-term products that are actually costing them their retirement as opposed to giving them their independence.

A good analogy to use here is the butcher and the dietician. If your doctor tells you to lose some weight and reduce your cholesterol, is the butcher really the best person to consult on the healthiest eating choices? Chances are they are going to be biased toward the cold cuts and filets whether that’s what you really need or not.

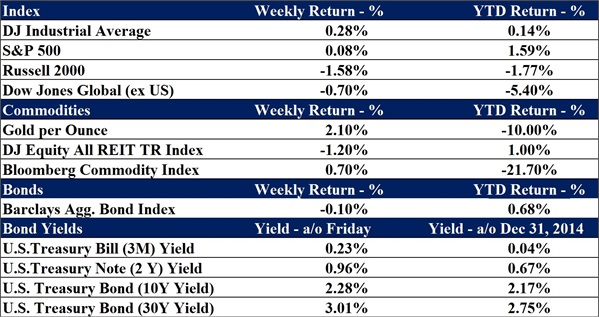

Data as of 12/4/2015

Tanner Beverly is a Paraplanner for Franklin Wealth Management and focuses his work on helping the next generation become and stay financially independent. He understands the unique needs and desires of those still in the wealth accumulation stage of life, as well as those prepared to take the next steps toward financial independence.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.