Just about every month I come across someone who claims that their investments don’t cost them anything or someone who doesn’t seem to understand all they are paying in internal expenses. All too often (in the case of those buying commission based products) they have been told that something they bought does not contain any fees or expenses and they are led to believe they are getting something for nothing or even receiving a bonus of some sort.

Whenever someone conveys that they may be getting something that is possibly too good to be true, it typically means that the buyer should take a closer look under the hood to understand and research what they are getting into. It also pays to remember, a guarantee is only as good as the company or government backing it and it pays to check the ratings and financial strength of these companies and government entities.

But what are the expenses that brokers and agents regularly try to hide and how do these costs differ from the fees that fiduciaries and Certified Financial Planners charge?

Let’s cover Fiduciaries and Certified Financial Planners first:

Planning Fees:

In working with clients, as fiduciary Certified Financial Planners, we typically conduct a discovery meeting where we ascertain what our clients are trying to accomplish long term, where they are currently, and identify pitfalls they are aware they need to protect from as well as blind spots that can potentially hurt them in the future. We run multiple scenarios to stress test plans for how to best provide stable cash flow, maximize benefits, minimize taxes over their lifetime and pass on their assets to the next generation in a way the most benefits their heirs and charitable interests.

We pride ourselves on our comprehensive planning and there is a cost for engagement that can run to multiple thousands of dollars for engagement. But we have also found that one-time planning does not have a lasting impact, so we developed our WealthFit™ process a few years back to make sure that once our clients attain financial fitness that we continually work on to make sure they stay financially fit.

Some brokers/agents will offer abbreviated investment oriented financial planning at a reduced cost or even free in hopes they can sell a product down the road, but true Certified Financial Planners believe that the most important step is the planning itself and choose not to skimp on the process. We also believe that clients are more engaged and more committed to being successful if they have “skin in the game”.

Asset Based Fees and Retainers:

As part of our WealthFit™ process we are committed to meeting at least semi-annually to make sure the plan is initially implemented but also to make sure our clients stay financially fit. Each client goes through transitions as they get older, kids grow up, taxes become more of a burden, they look at succession options for their business and/or retirement, and want to best provide for heirs and charities down the road.

Client financial situations change over time and we want to make sure we address these issues as they develop. For most clients we charge asset-based fees that encompass all these WealthFit™ components. Those who think that these fees are just for investment management or to help with beating an index are overlooking all the other items that we are continually addressing to make sure “the garden doesn’t get infested with weeds”. We also want to address the blind spots that clients can’t see but are sometimes all to obvious to us and other family members at times.

As part of the WealthFit™ process we work to educate and enable spouses and other family members over time so they can develop more confidence in themselves and their future for when they are “on their own”. We occasionally work on a retainer basis but have found that we can best help when we can have a more hands on relationship with our clients.

With our WealthFit™ Process – Money doesn’t have to be complicated.

The key difference between fiduciaries and commission-based product providers from a fee / expense-based perspective is that with the former all the costs are front and center and hopefully as transparent as possible. With commission-based products, unfortunately many people are led to believe they are paying less than they really are and may only know the difference after they try to get access to their assets or become more educated.

Commissions & Trading Fees:

Most people are aware that in dealing with full service brokerage firms that they may need to pay commissions for certain types of products or for trading stocks & bonds. These costs typically range from 1% with stock commissions and bond spreads (the difference between the price the seller receives and the buyer pays) to upwards of 5% and even sometimes more than 10% for the most broker/agent friendly products that are sold to customers. The least expensive trading cost options are typically found in fee based accounts with trading costs from $0 to $26.50 per trade. Within the last year we were able to work out arrangements with two of our custodian firms to be able to eliminate these trading costs. As a fiduciary Registered Investment Advisory firm we have to pay higher internal costs to be able to eliminate these costs for our clients but we feel it is worthwhile to do so for those clients who wish to bring these costs to zero.

The most expensive types of products of course are sold with long surrender penalties (and hefty internal expenses) which don’t cost the buyer anything upfront but can cause extreme financial pain if they need their money back anytime soon (sometimes as long as 10 years or more). We would caution anyone to be aware of not only the upfront costs but also the back-end costs and annual internal expenses.

Internal Expenses:

Many Investors are becoming more and more aware of internal expenses for those products they can look up on Morningstar while at the same time completely unaware of the costs of spreads, caps and participation rates. It seems to be the most complicated products are being promoted as being “fee free” to the client while at the same time paying the broker / agent the most.

Studies have shown with portfolios and portfolio managers that in general, lower expenses translate to better returns, all things being equal. The median broker sold stock pooled portfolio has an expense ratio exceeding 1.35% whereas the median index portfolio is 0.20%. Portfolios traded on the exchanges tend to be more tax efficient and less costly with the median expense ratio at 0.35% and the lowest cost expense ratio is approximately 0.03%. Although more investors are aware of these expense ratios, many investors are largely unaware of what they are paying “all-in”. Another article explaining this in more detail can be found here.

Cost should not be the only criteria in choosing these products. We utilize models that focus more on stability well as low cost, tax efficient portfolios. For those wanting to look beyond just the expense ratios, we wrote a piece on this last year to help sort out ways to identify those that have proven to stand out over time (click here to read).

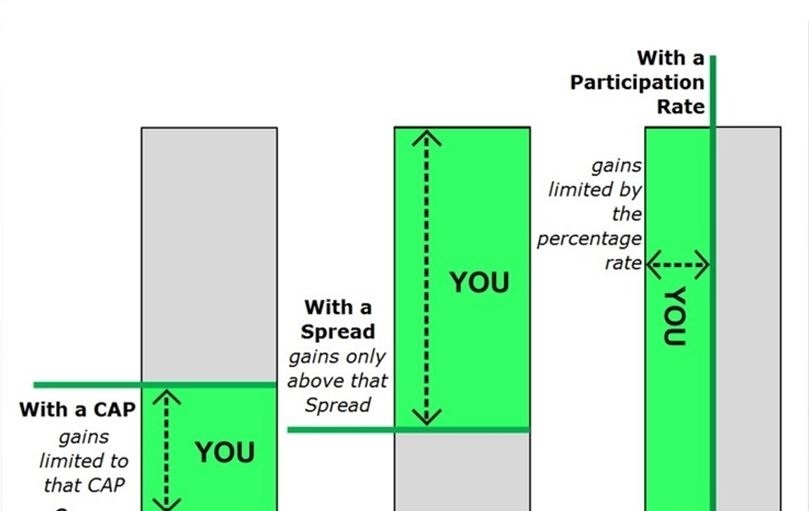

But what about these complicated products with spreads, caps and participation rates that are being utilized and promoted as “fee free”. The easiest for most to understand is the spread in that it is basically the same as an asset management fee in that the investor gets the return of a given index or portfolio minus the spread. The participation rate is the amount of the return remaining after the company subtracts their cut from the total, so if the participation rate is 75%, 25% of the return from the index is paid to the company holding the assets. Cap rates are basically a maximum return allowed to the investor by the company, so if an index earns 10% and the cap rate is 6% the company takes 4% from the total return.

Of course some of these products also have other embedded expenses, so it is most important to look under the hood to see what you are actually buying. “Fee free” seems to be just a way to re-package a product in a way to hide what is actually happening, especially with those products that pay the agents/brokers the most upfront and make it extremely difficult for investors to get their money returned back to them. A good article in Forbes about this can be found here.

Account Fees:

Most full-service brokerage firms charge a fee for having accounts with them. Currently these fees are around $40 a year but are sometimes waived if enough business is done with the company. If not enough transactions are made, these companies also regularly charge inactivity fees, which means that they feel they have not collected enough revenue from the account in the past year. In addition, these companies regularly make clients hold certain types of alternative investments inside brokerage accounts rather than letting them hold them separately but also charge the clients for holding these investments. Typically it is the firms that deal with comissionable products that charge these types of fees and this is why we in recent years have added additional custodians for our clients to work with to help provide alternatives.

It’s important to be aware of the different fee structures so that you know the total amount you’ll pay and what you get on an ongoing basis. Most firms don’t show the internal expense fees, so the client is never fully aware of the “all in” charges. Why? The simple answer is that it’s what the industry is used to, and the investing public didn’t know to ask. Today, however, investors are becoming more informed and should seek to better assess the value received versus fees that are being paid. In general, the industry hasn’t done the best job at being transparent where fees are concerned. Of course, those advisors that are acting as fiduciaries and Certified Financial Planners tend to do a better job of reporting so clients are always aware of their fees.

What to Look For?

Before hiring a Certified Financial Planner, be sure to ask about both the internal expenses as well as planning costs and external advisory fees. . Investors need to be able to see not just what is above the surface but also what is hidden under the surface as total fee structures are not always reported in a transparent way. Most investors do not know their “all in” costs and some do not realize all the value they may receive from a fiduciary Certified Financial Planner, especially during particular life stages that are critical. The most important aspect to consider is, “What motivation does this advisor have to work with me and my family throughout the rest of my life?” Is this a transactional process or are they committed to making sure you stay financially fit?

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, and CEO of Innovative Advisory Partners, a registered investment advisory firm in Hixson, Tennessee. A 20+year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are unmanaged and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.