For those clients who attended our most recent Forecast event, Jeff Weniger, CFA and Market Strategist for Wisdom-Tree was most entertaining. Our thinking continues to be very similar and I thought I’d share some of his recent reflections.

Jeff recently wrote, “There are 34-year-olds who have been in the business for 12 years and haven’t seen a prolonged value cycle. That almost includes me, pushing 40, gray hair, the whole lot. It’s been so long since the Graham & Dodd that I read almost 20 years ago has actually worked. At least as far as the traditional Morningstar style boxes are concerned, you start to forget what it feels like to see growth stocks really lag.

General Electric could once do no wrong, too. GE’s fall to earth after peaking at around $600 billion in 2000, a fall from grace accompanied by so many highfliers of the 1990s, ushered in a reversal in market leadership. It marked the moment that Value took the baton from growth. From GE’s valuation high to the stock market’s October 2002 low, the S&P 500 Value Index was able to pick up 12.82 percent over its counterpart.

But it wasn’t just the 2000–2002 bear market where value shined. When it came time for a fresh stock market bull from 2002 to 2007, the investment style crushed growth. Forget the 12.82 percent that value picked up during the bear; the real money was made in the next 72.25 percent from the market low through May 16, 2007.

Given value’s ever-so-slight leadership in last year’s second half amid the carnage in the FAANGs, maybe 2018 marked the moment the big darlings “pulled a GE.”

Click here for the link to his most recent article as well.

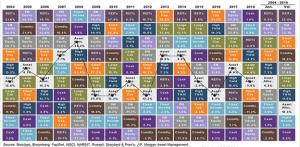

Since the beginning of 2016, it paid to be diversified until mid-June when “Trade Wars” and Federal Reserve tightening took center stage. Smaller companies and Emerging Markets outperformed until mid-year.

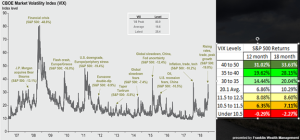

As can be seen from the chart above, by the end of the year, everything other than cash left investors wanting more. We noted that many clients were much more interested in CD rates toward the end of the year as the short term yields reached levels we haven’t seen in years.

We continue to caution clients against moving too heavily into Large U.S, companies, especially the most popular ones. As can be seen from the chart above, smaller companies still show better long term prospects over the last 80 plus years, but we would rather have clients practice disciplined diversification to enable more stable returns over time. Disciplined diversification as defined by the green boxes above, provides the most consistent results but can lag “the market” when “the market” is too narrowly defined. Disciplined diversification protected investors from the “Tech Crash” of the early 2000s, the “lost decade” that followed and the “Nifty Fifty” bust before this.

But how long should investors wait until value catches up with growth? How long should we patiently practice diversification while the S&P 500 performs better than anything else? These same questions were being asked at the end of the 1990s and those that abandoned time tested strategies to “join the party” in faddish “dot coms” suffered greatly when they realized the emperor had no clothes.

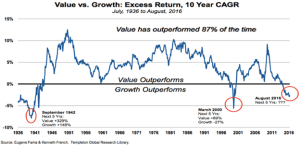

The chart above shows that Value has outperformed Growth 87% of the time over 10 year periods during the 80 year period from 1936 to 2016. Value has under-performed recently and has continued to under-perform over the last couple of years. In fact from the start of 2016 until November 2018, Value was lagging worse than all but three periods from the last century.

What you should notice is that after each of these periods, value investing entered a period where losses were minimized and recoveries came much quicker.

We continue to advise clients to focus first on what return is necessary to achieve their goals. The “Family Index Number” (link included) continues to be the most important benchmark for all our clients. Some want to continue taking more risk than the “Family Index Number”. I would refrain from cutting back on the risk profile until we start seeing new highs and less signs of bearishness and panic in the market. As Warren Buffett is fond of saying, “We prefer to be greedy when others are fearful and fearful when others are greedy.” This philosophy tends to be more profitable.

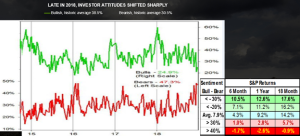

Our research shows that when greed as defined by “bullishness minus bearishness” reaches inflated levels like we saw at the beginning of 2018, troublesome times lie ahead. Early 2018’s readings showed multiyear highs in bullishness and multiyear lows in bearishness. When the majority of investors are this bullish, the research shows a negative expected return for the next six and twelve months, as can be seen from the chart above.

Conversely, we recently saw extremely negative “bullishness minus bearishness” readings. Thia leads us to believe better times lie ahead in 2019.

Volatility also reached levels in late December where the next 12 month historical returns were almost 20% on average.

We continue to re-balance portfolios twice a year to maximize the benefits of seasonal patterns. Making these adjustments in May and November tend to benefit clients over time. However, we feel that it is even more important to meet with clients to adjust risk profiles over time so we stay closer to the Family Index number and assess how much risk we feel we need to take. We have found that those clients who meet regularly and focus on long term planning tend to fare better in the long run. Those who have trouble finding the time do not tend to be as prepared. Adjustments need to be made occasionally and we feel it is best that all parties are involved in the process. We believe strongly that our WealthFit™ process makes a major difference in the lives of those who commit to being financially fit, but it requires commitment from clients and advisors.

Luckily for us, our clients are truly committed for the most part and that is why we all continue to thrive. I feel we are truly blessed.

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, and CEO of Innovative Advisory Partners, a registered investment advisory firm in Hixson, Tennessee. A 20+year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are unmanaged and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.