“We don’t have to be smarter than the rest; we have to be more disciplined than the rest.” -Warren Buffett

Being a sports fan, I like many others, have been starved for the excitement of watching champions at work: Watching a crushing hit, a spectacular goal or an amazing play that many others may not appreciate because they may not have played the game. The NFL draft and the recent documentary on the 1990’s Chicago Bulls entitled “The Last Dance” have helped some of us overcome this hunger and thirst for sport that has eluded us the last few months.

When watching “The Last Dance” recently once scene really stuck with me. Michael Jordan was talking about how hard he pushed himself and others and the sacrifices he made to win. Jordan tells us in Episode 7:

“When people see this they may say, ‘He really wasn’t a nice guy. He may have been a tyrant.’ Well that’s you, because you never won anything. I wanted to WIN, but I wanted them to win and be a part of that as well. (pausing – and starting to get choked up) I don’t have to do this. I only do this because it is who I am. That’s how I play the game. That was my mentality. (With emotions getting to him and tears forming in his eyes he continues) If you don’t want to play that way, don’t play that way. BREAK”

Link to Video: Michael Jordan choking up when talking about his win at all costs attitude

Winning isn’t very fun, until we can celebrate the championships that come to those that have the discipline, the drive and the work ethic to make it to the top. Investing to win can be boring. Boring investing is one thing, but there are even times when we overcome the boredom of being disciplined, and the result still feels like, “This STINKS!”?

Let me show you using some data from Morningstar and a hypothetical portfolio that is the definition of boring.

- Equity 60% = 40% Large Companies, 5% Small Companies & 15% International

- Fixed Income 40% = Barclays Aggregate Bond Index and 10% High Yield Index

Considering this portfolio, let’s review returns (rounded) and a fictional, yet conceivably plausible, investor reaction:

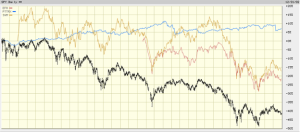

- From April 1st, 2000 through December 31st, 2002 => S&P 500: -39% vs Boring: -18%

- Investor reaction: “The Boring portfolio stinks, I lost money, I’m going to cash.”

- Takeaways: Bonds, Small Companies, and International Companies outperformed the S&P 500. Owning anything but the S&P 500 helped our portfolio, especially bonds.

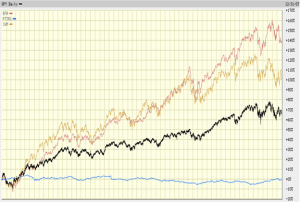

- From January 1st, 2003 to December 31st, 2007 => S&P 500: +83% vs Boring: +74%

- Investor reaction: “Ehhh, I did ok.”

- Takeaways: International Companies & Small Companies outperformed the S&P 500 (Bonds Lagged Equities during the bull market). Owning any equities but the S&P 500 was best.

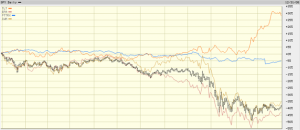

- From January 1st, 2008 to December 31st, 2008 => S&P 500: -37% vs. Boring: -24%

- Investor reaction: “The Boring portfolio stinks, I lost money, AGAIN! I’m going to cash.”

- Takeaways: Diversified Bond Portfolios lost less and Long-Term Treasuries appreciated in value. Long Term Treasuries perform better than cash in panic situations.

- From January 1st, 2009 to December 31st, 2019 => S&P 500: +351% vs. Boring: +192%

- Investor reaction: “I paid my advisor a fee for the past ten years for his “diversified portfolio,” and I would have been better off just holding the S&P 500 for no fee!”

- Takeaways: Small Companies Outperformed the S&P 500 until mid-2018. Diversification outside of the S&P 500 (2018 -2020) has not been this out of favor since the beginning of 1999.

- From January 1st, 2020 to March 31st, 2020 => S&P 500: -20% vs. Boring: -13%

- Investor reaction: “The Boring portfolio stinks, I lost money for the THIRD TIME DURING a market selloff AND didn’t make as much money as the S&P 500 when it went up. THIS STINKS.”

- Takeaways: Diversified Bond Portfolios lost less and Long-Term Treasuries appreciated in value. Again, Long Term Treasuries perform better than cash in panic situations.

- Total Return from March 31st, 2000 to March 31st, 2020… => S&P 500: +155% vs Boring: +176%

- Investor reaction: “The Boring portfolio seems like it stunk, but over the past TWENTY YEARS, I ended up making more than the S&P 500. That actually DOESN’T STINK!”

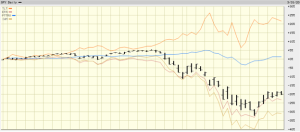

Portfolio Loss

If investing is entertaining, if you’re having fun, you’re probably not making any money. Good investing is boring. – George Soros

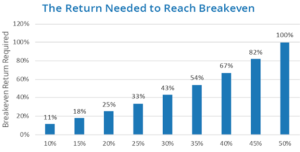

To understand why this is, refer to “The Return Needed to Reach Breakeven” graph above. This graph shows the return required to get back to breakeven after a sell-off. For example, when the S&P 500 sold off nearly 40% in the first period of the example above (April 2000 – December 2002), it took a return of 67% to get back to even. Conversely, the 18% Boring Portfolio sell-off required less than a 25% return to breakeven.

That’s why it feels like it stinks even when you are actually winning – the perception of the subsequent +83% return on the S&P 500 versus the +74% return for the Boring portfolio is out of context relative to the previous period returns.

- Takeaways: Small Companies Outperformed all else by a large margin over the last 20+ years. International Companies Outperformed until 2015. Bonds helped to protect from downturns.

Over the Long-Run, being diversified helped to protect from three bear markets and the “Lost Decade” for Large Company U.S. Stocks. In fact, if we want to outperform the S&P 500 over the Long-Term, it makes sense to own a greater percentage of Small Companies than what we showed as the “Boring Portfolio”. A portfolio with a larger percentage of Smaller Companies that had prospects to be “Tomorrow’s Blue Chips” may have even been considered somewhat “Exciting” during the 2000s and the first half of the 2010s.

“Investing is not a contest or a game – your benchmark should be progress toward the success of your plan and reaching your goals.”

With that in mind, remember this: I believe most of the success you have as an investor comes down to two big things that you can control, with or without an advisor:

- Knowing your Family Index Number and playing to WIN based upon your goals for the future.

- Realizing that most of the returns you achieve over a lifetime will be dependent upon just a few key lifetime decisions…and those decisions are generally related to your behavior – good or bad.

“The single greatest edge an investor can have is a long-term orientation.” –Seth Klarman

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, and CEO of Innovative Advisory Partners, a registered investment advisory firm in Hixson, Tennessee. A 20+year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are un-managed and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.