An Opportunity to Help my Mother

My mother has been filing taxes on her own over the last few years. Even with my step-father passing away in 2020, she did not have many issues filing taxes until this year. In 2021, we were able to defer six months of the gains in her portfolio by utilizing an Opportunity Zone Fund. Sadly, this caused taxes to become suddenly more challenging to prepare.

Most accountants understand what it means to defer the capital gains with Opportunity Zone funds in client portfolios. They know that this is very similar to deferred payments via a 1031 exchange on property. The difference is that the Opportunity Zone deferral is allowed for gains on any asset. In contrast, the deferral with a 1031 exchange is only allowed to defer payments on the property if later invested in a “like-kind” investment property. This flexibility allowed us to defer significant capital gains for several clients last year on sales of stock in their portfolios as well as other assets.

We provided solid gains for our clients in portfolios last year from purchases made in 2020 and 2021. However, when looking for holdings that we could sell to offset some of these gains in taxable portfolios, we could find very little to sell at a loss as of early November. We subsequently purchased the Opportunity Zone fund in mid-November. Consequently, then deferred all gains from Mid-May through the purchase date. This situation made filing taxes more difficult for my mother. Unfortunately, turbo tax did not have a module for Form 8949 (Sales and Other Dispositions of Capital Assets), which is required to recognize the assets sold and the capital gains deferred via the Opportunity Zone investment. Being the dutiful son, I offered to help her file for this past year.

It’s been over 20 years since I have tried to file taxes personally or for anyone else. For example, I used the Turbo-Tax Self Employed version because she has farm income in Kentucky, and I figured this version would have everything she might need. However, I found out differently when reporting the capital gains deferrals made in November. The first attempt to reach someone through the online chat was ineffective because I was quickly disconnected. Apparently, I confused them when I was explaining my concerns. Fortunately, a few moments later, I connected with someone much more knowledgeable who had over 12 years of experience answering questions for Turbo-Tax. Regardless of her vast experience, she had never dealt with this situation. Instead, she was able to connect me to instructions on how to account for items on Form 8949, and we found a workaround within the software. These instructions involved making separate entries manually with cost bases as zero on the various dates of sale for the stock gains and entering the capital gains deferred (a negative number in this case) on the purchase date of the Opportunity Zone fund.

Form 8949 and Form 8997 (Initial and Annual Statement of Qualified Opportunity Fund (QOF) Investments) are required to report separately, but we were able to finish up her taxes. These are the items which we are required to register via this form:

(i) qualified opportunity fund investments holdings at the beginning and end of the tax year;

(ii) current tax year capital gains deferred by investing in a qualified opportunity fund; and

(iii) qualified opportunity fund investments disposed of during the tax year.

What Are Opportunity Zones?

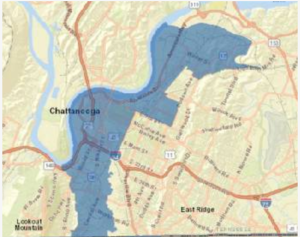

Qualified opportunity zones were created through the Tax Cuts and Jobs Act on December 22, 2017, with the first areas designated on April 9, 2018. A qualified Opportunity Zone is an economically-distressed community where new investments, under certain conditions, may be eligible for preferential tax treatment. Localities would qualify as “QOZs” if they were nominated for that designation by a state, the District of Columbia, or a U.S. territory. That nomination was certified by the Secretary of the U.S. Treasury via his delegation of authority to the Internal Revenue Service (IRS). Areas of Hamilton County designated as Opportunity Zones are in the highlighted area of the map below.

|

Individuals can invest in property within the Opportunity Zone or the funds. In this case, we utilized a publicly-traded fund because we prefer the flexibility, the liquidity, and the daily pricing of this type of investment. With Opportunity Zone investments, capital gains can be deferred until the end of 2026 if reinvested within 180 days. Investments made last year can also reduce this capital gain by up to 10%. Furthermore, no capital gains on the appreciation in the Opportunity Zone are taxed if held for at least ten years. Please view the timeline below:  The timeline above is for a different Opportunity Zone Fund than what we bought for clients. We prefer publicly traded funds to private funds. If you have additional questions for filing your taxes after investing in Opportunity Zones or wish to know more about how you can save taxes by investing in Opportunity Zones, please feel free to email or call.

|

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, and CEO of Innovative Advisory Partners, a registered investment advisory firm in Hixson, Tennessee. A 20+year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.