In reading through Trusts and Estates Magazine online, I came across two sets of opinions regarding what parents should tell their adult children with regards to family finances and estate plans. With our young children, we have not had these conversations yet but plan to do so after they start learning how to manage their own money. I would personally lean toward more transparency with regard to where assets are located, how to get in touch with people they need to connect with and who is supposed to act as executor or trustee if something happens to us. I caution parents not to lead adult children into believing that they do not have to work, save or plan for the future because of a belief that one day they will inherit a sizable sum.

You might like to read more on this subject from our recent article in Money Magazine.

To access the Money Magazine article, please follow this link.

As Warren Buffett likes to say, we want to “leave our kids enough to do anything but not enough to do nothing.”

Below are two points of view on what parents should reveal to their adult children.

Avi Kestenbaum does not recommend reveal estate planning details in most situations

Most of the time, I would advise parents not to do so. In the majority of cases, doing so will lead to more aggravation and feeling of uneasiness and resentment and, potentially, more fights and disputes for several reasons. Let’s take the example of parents in their 60s telling their children in their 40s what they’ll be receiving, the parents are essentially begging their children to complain to them: “Why am I getting this, or why can’t I have more or have it sooner? Also, “Why is that sibling getting this?” Parents need to be strong and decisive. By law, they don’t have to leave their children anything—and I think by almost asking their children and, thereby, almost making them partners in the process, they’re creating more issues than they’re solving.

Second, parents may live another 20, 30 or 40 years. For the rest of the their lives, their children are going to be driving them crazy, asking: “Hey I want more, sooner, why am I getting this?” and now, the parents can’t change their minds because if they do, the other sibling may say: “Wait a minute, I was supposed to get that. You told me 20 years ago, now I’m getting something different or less.” Parents shouldn’t be badgered by their children and should have the flexibility to change their minds and not be unduly influenced or bound by prior statements.

Last, parents should be seen as parents, with respect and admiration, and I think if they invite a discussion of what’s in their will or estate planning documents, the children will see dollar bills in place of their parents’ heads like those we see in cartoons.

Of course, every family and situation is different. I’m not saying never to tell the children, but parents should consider all the factors. One important factor is: Are the assets being divided equally? If so, it’s less likely there will be fights unless one child feels he should be receiving more, such as when a business is involved and one child is working in the business or made it more valuable.

Avi Z. Kestenbaum is an equity partner of the Long Island law firm Meltzer Lippe and the co-chair of the firm’s Trusts & Estates Department.

“In general, transparency is the best approach”, according to Patricia Angus

In general, I believe transparency is the best approach to estate planning when a client has adult children. Of course, what “transparency” actually means will differ according to the client and the specifics of the estate and family members. In some cases, it will mean sharing all details of the will, trust(s) and other estate planning documents. In other cases, the details might remain obscure, but sharing certain kinds of information should take place. To determine where the client falls on that spectrum, some factors to consider include:

What to tell. At a minimum, family members should be told where the documents are located, who are the key advisors (lawyers, accountants, financial advisors) and what immediate steps they might need to take if an unexpected death occurs. Losing a parent can be hard enough, there’s no reason to add additional confusion and potential harm by leaving the family completely in the dark. I recommend calling the family together long before a client’s potential demise to start conversations that are deeper and more meaningful, focusing on values, purpose and family “legacy”—so that the focus after one’s life goes beyond “assets.” Parents can share their own guiding principles with children. This conversation is important if the parents intend to leave unequal bequests, especially if shared in a loving atmosphere. If there are special arrangements between parents and one or more children, parents must recognize the “truth will out,” and it’s their responsibility, not their childrens,’ to explain why.

How to tell: The more thoughtful families bring together all adult children to have a conversation, or many, focusing on meaning and purpose, rather than a “pre-reading” of the will. An ethical will can be shared before death as an opener to these conversations. For many families, an outside facilitator can help this process.

Special circumstances: There are certain families who are in a special position so that more (or less) disclosure is advisable. In a family business, succession planning for management and ownership should be seen as a process, not a one-time event. The family should set up a forum (for example, a Family Council or Assembly) for open discussion of operational and financial issues, as well as ongoing plans for leadership succession. Family members who are included in these discussions earlier can become responsible owners and make better decisions, such as whether to keep or sell the business. When family wealth is significant enough that the parents (or other ancestors) have transferred assets into trusts over which the children (and grandchildren) have “beneficial” ownership, they need to know so they can integrate them into their lives. Less disclosure (especially when entities aren’t in place) may be advisable if it could create harm in the children’s lives (such as putting a wedge in an unstable marriage). And of course the child’s mental capacity and emotional maturity are key factors—many children simply won’t be able to handle the information.

What not to tell: As life expectancy increases, most clients with adult children could potentially deplete their resources before their demise. With this in mind, it makes sense to withhold specific financial information and other details, not only to keep expectations in line, but also to preserve a sense of autonomy over their lives. Yet, even in those cases, it’s likely that one or more children will shift to taking responsibility for the parents’ affairs while the parent is still alive. Again, advanced disclosure will help both parent and child to smooth that difficult transition.

Patricia Angus, JD, MIA, TEP, is the founder and CEO of Angus Advisory Group LLC, a philanthropy and family governance consulting and educational firm.

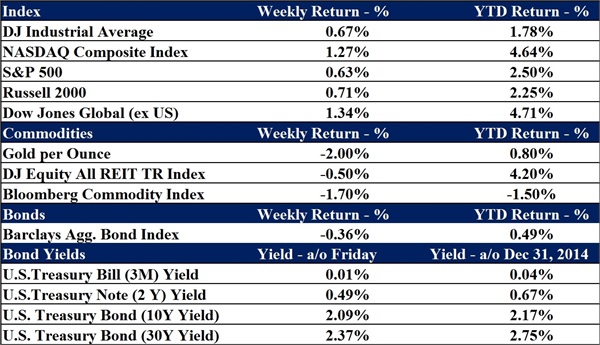

Data as of February 23rd, 2015

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, a registered investment advisory firm in Hixson, Tennessee. A 20-year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are unmanaged and cannot be investedinto directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.