WealthFit™ Planning Process

Home » Unique Processes » WealthFit™ Planning Process

Wealthfit Discovery

Do you have a clear vision for what you want your future to look like? We will discuss what is important to you and your spouse, or significant other, including goals, concerns and financial issues that may need customized strategies. Numbers are important, but who you are, your goals, concerns and unique situation are much more important than financial figures.

For more on the Discovery Process including the workbook and accompanying video, please follow this link.

We want to keep you on track.

Even if we know where we want to be, we cannot get there until we gain clarity and pinpoint our current location. Before your first appointment, you can download our Confidential Profile and a Checklist of Items you may wish to gather together. In order to give us time to review your information and allow us to make the most effective use of our time in the meeting, you may wish to send or deliver this information to us beforehand.

Download the Confidential Profile and Checklist by following this link.

More information allows us to both understand you better and allows us to make better use of our time together. Usually after our second meeting we have a good feel for your situation and the time commitment. At this point we determine what type of planning is warranted. Please follow this link for more on How Are We Paid?

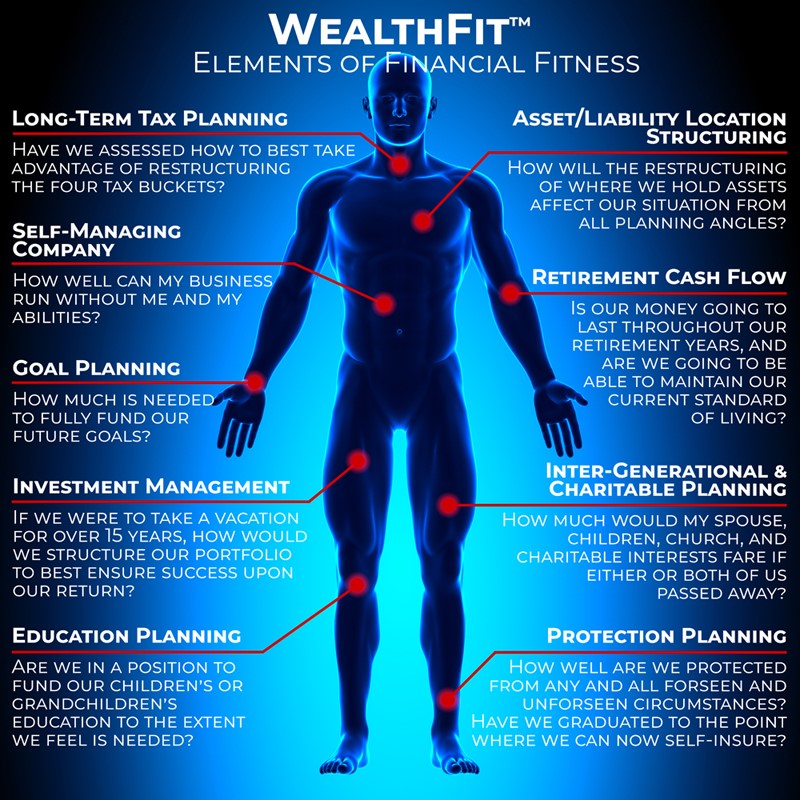

WealthFit™ Plan Design

After we have engaged in determining your vision for the future and pinpointed our starting point, we can then start creating your blueprints for achieving your goals and living out your dreams.

After the initial Re-Visioning meeting and agreement on the initial path forward, we believe in taking whatever time is necessary to develop your personal plan. This involves educating you on the what and why behind the necessary steps needed to get you closer to your desired future. Incremental steps are often necessary to make progress and as such we provide you with an implementation timeline and financial fitness checklist along with ongoing education and actionable steps along the way to move forward and to chart our progress.

WealthFit™ Implementation

After we have reviewed and revised the Implementation Timeline, we want to take action. We believe that plan implementation can sometimes feel like running a marathon, so we want to take it one step at a time. In designing the plan, we focus primarily on the big picture. During Implementation, we delve into the details, and we work as coaches to help you make sure we become as financially fit as possible. We believe in being comprehensive knowing that tax savings, cash flow optimization, protection & estate planning may prove to make a larger impact than earning an extra percent or two on investments.

WealthFit™ Conditioning

Much like physical fitness requires ongoing conditioning and work to stay physically fit, ongoing updates and attention to your financial situation are required to stay financially fit. Through our regular proactive meetings, we assess the progress of your goals on an ongoing basis. We work as a family of specialists to deliver regular communication, ongoing fun and educational events and track your progress via our proprietary WealthFit™ Meter.