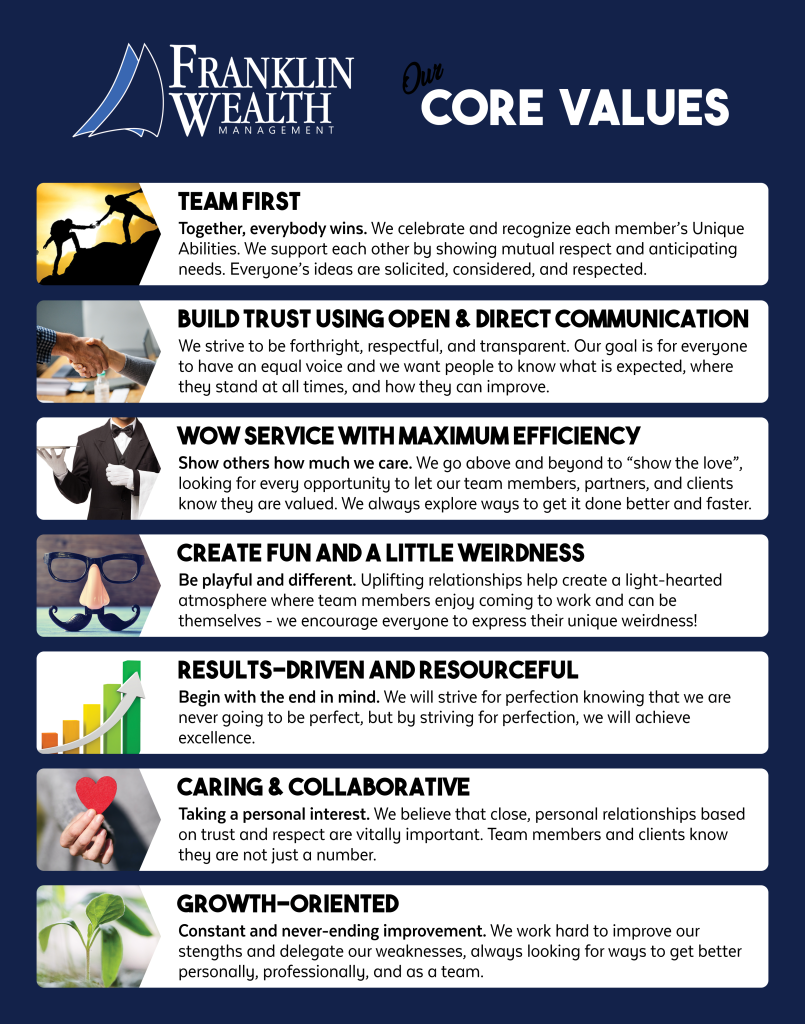

Our Core Values

Home » Our Core Values

WHAT DRIVES US

Our Core Values

Our core values are traits that represent our highest values, priorities, deeply held beliefs, and the core, fundamental driving forces behind all that we do.

WHAT'S THE GAME PLAN?

Core Investment Beliefs

Enjoy the difference of working with a Fee-Only wealth management firm and relax knowing that many of the brokerage conflicts and proprietary product issues have been eliminated. Learn the difference between working with Fee-Only Certified Financial Planners who act as Fiduciaries within an advisory relationship where the clients needs come first rather than just considering what is suitable enough to check the box and be able to purchase products.

Stick to the Plan.

While nobody likes to sell at a loss, it is important to let the process outweigh one’s emotions. Sticking to the game plan in the heat of the moment gives us the ability to better manage volatility and re-evaluate during the calm.

Be Wary of Crowd Following.

Not investing with the consensus of the population can be difficult, but rewarding. You may have heard of the old adage “Buy when there is blood in the streets,” or “You pay a very high price for a cheery consensus.” Contrarian thinking is hard, but do it often.

Use Effective Tools.

We use a variety of tools and analyses to help guide our investment decisions. Technical analysis is one of those tools that can help us see trends. We like trends because they are powerful and can buffer minor mistakes.

Follow the Current.

While we believe that chasing a position is never a good idea, we do think that there are times where it makes sense to add more to a position. If the conditions are right and the story hasn’t changed, add to positions when terms are more favorable.

Don’t Get Complacent.

We never want to fall in love with our opinion. When everyone is absolutely positive that things are terrible, often its best consider the contrarian view. You pay a high price in the market for a cheery consensus.

Assess Risk Accurately.

When investing, we always want to consider your risk tolerance when choosing investments, keeping in mind that the valuation of these positions and the companies matter. The price is what you pay, but the value is what you receive.

Buy Quality.

It’s harder to overpay for a company when buying quality. We prefer to buy great companies at great prices. However, without a catalyst, some companies can potentially stay cheap forever. Valuation, Quality and Momentum all play a part in our investment decision.