They are one of the worst aspects of owning mutual funds. Capital gains taxes on funds are charged typically in December, regardless of how long you’ve owned the fund or how much you’ve made over time.

Funds might sell appreciated securities for a variety of reasons. Perhaps a stock hit management’s sell target–even in a lackluster year like 2015–or a new manager came aboard and wanted to change up the portfolio. Or perhaps management had to liquidate positions to pay off departing shareholders.

Whatever the trigger, if funds have unloaded appreciated securities during the year, they have to distribute those capital gains to shareholders. If the shareholder owns the fund in a tax-deferred account, the distribution is a non-event from a tax standpoint. But if the investor owns the fund in a taxable account, he or she will owe capital gains taxes on the distribution. Those taxes will be due, unfortunately, regardless of whether those gains were reinvested right back into the portfolio and even if the investor didn’t sell a single share.

Say, for example, an investor has a $100,000 stake in a mutual fund that makes a distribution equivalent to 12% of its net asset value. If the investor is in the 25% income tax bracket, he or she will owe 15% in capital gains on that $12,000 distribution, or $1,800. Of course, a distribution in excess of 10% of NAV doesn’t come around every day. But in late 2015, six years into the current bull market, a number of funds, some of them prominent, are poised to pay out capital gains distributions in that ballpark.

Some of you in taxable managed accounts may notice that some of your funds may shift a bit in December. For the most part we are reducing our exposure to some funds that have declared higher capital gains distributions. If you have additional questions, please feel free to give us a call.

Even for investors in IRAs and Roth IRAs we want to note that prices of the funds will drop on the Ex-Dividend date. This causes accounts to briefly look like they are losing value. These dividends and capital gains show back up on the payable date which is usually just a few days later. We seem to get calls about this every year and we think it is a good idea for investors to know what is happening and what to expect. For this reason we have included some links to view several of these upcoming distributions so that investors are not surprised. We took a look at capital gains estimates from a number of funds. For each family, we’ve highlighted those funds whose distributions are around, or in excess of, 8% of NAV. (Note that these figures are all estimates; the actual percentage of NAV distributed will vary.) Many funds are set to pay out smaller distributions, however.

Please click on the names of the funds and the fund families to go to the fund family end of year capital gains distribution pages and pull up reports on the individual funds:

American Funds

American Funds lists its funds’ estimated capital gain distributions as a percentage of assets in ranges, to accentuate the fact that these are estimates rather than precise measurements. (The final percentage will vary based on the fund’s net asset value at the time of distribution.) Among the funds that the firm is anticipating will make the highest distributions are Growth Fund of America (AGTHX), with an anticipated long-term capital gain distribution between 8% and 10% of NAV; Investment Company of America (AIVSX), with an estimated capital gain distribution between 7% and 9% of NAV; and SMALLCAP World (SMCWX)(between 6% and 9% of NAV).

Franklin Templeton

Franklin Templeton also lists its funds’ estimated capital gain distributions as a percentage of assets in ranges.(The final percentage will vary based on the fund’s net asset value at the time of distribution.) A couple of the more widely held funds Mutual Global Discovery (MDISX) and Templeton Global Balanced (TZINX) will be paying 5% to 7.5% and 3% to 4% respectively. The record date for these two funds are December 17th and December 14th. In both cases the value of the funds may look like it drops by up to 7.5% on this date, but will be recovered when the capital gain is reinvested.

Fidelity

A handful of Fidelity funds are estimating capital gains distributions in excess of 10% of NAV, including China Region (FHKCX) (12.98%), and Capital Appreciation (FDCAX) (11.37%). Some Fidelity Contrafund (FCNTX), the firm’s largest offering, has an estimated capital gains payout of just over 4% of its NAV. Fidelity New Insights(FINSX), the smaller, more flexible version of Fidelity Contrafund is set to pay out a little under 4% to holders as of December 11th.

Blackrock

Blackrock also lists its funds’ estimated capital gain distributions as a percentage of assets in ranges. The Health Sciences Opportunities (SHSSX) should pay between 10% to 12% to holders of record on December 10th.. Again the value of the fund may look like it drops by up to 12% on this date, but will be recovered when the capital gain is reinvested.

Oppenheimer

Based upon the information coming from Oppenheimer, most funds have very few capital gains to pay this year. The Capital Appreciation Fund (OPTIX) is paying the most at 13.07%.

Hartford

Most of the Hartford mutual funds will pay out capital gains to holders of record as of December 14th. The Hartford MidCap Fund (HFMIX) and the Equity Income Fund (HQIIX) are supposed to pay out a little over 7% and the Hartford Global Capital Appreciation Fund (HCTAX) is supposed to pay slightly over 5%.

SunAmerica

The SunAmerica Focused Dividend Strategy Fund (FDSWX) is paying one of the highest capital gain distributions of any of these funds listed this year. It is set to pay over 9% to those who hold the fund as of December 14th, 2015. If you hold this fund in a taxable account and are concerned about these taxes or do not have offsets for this you may want to contact your advisor to look at a more tax-efficient option. Of course, holding this fund in an IRA, Roth IRA or 401k will have little to no impact upon you from a tax perspective. Just be prepared to see the value of the fund drop by up to 9% on December 14th up until the capital gain gets reinvested a few days later. Again for many with taxable accounts you may see a shift out of this fund in early December for this reason.

What now?

In IRA and Roth IRA accounts capital gains distributions are not much of an issue. For taxable accounts, investors’ best tack is to know what sorts of distributions are coming so that they can try to reduce the tax impact. Finding losers elsewhere is advised; selling those positions can offset the capital gain distributions. The large number of funds making capital gains distributions in 2015 accentuates the value of asset location–making sure that you’re placing tax-efficient assets inside of your taxable accounts and reserving less-tax-friendly ones for your tax-sheltered wrappers. The recent round of distributions argues that if investors want to help protect against unwanted distributions, their best defense will be more tax efficient funds and tax free funds. Feel free to give us a call if you would like to be able to develop a more tax efficient portfolio.

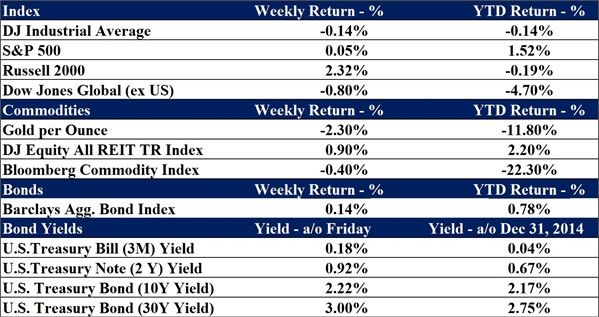

Data as of 11/27/2015

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, a registered investment advisory firm in Hixson, Tennessee. A 20-year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are unmanaged and cannot be investedinto directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.