“I am way less concerned with who you vote for than I am with how you treat the people that vote differently than you do.” – Anonymous

My wife Jennifer and I were watching the Vice-Presidential debate the other night and found it somewhat refreshing. They seemed to respect the debate process and although neither seemed to answer the questions asked, both talked about items of substance and made good arguments.

As we have commented before, we do not believe the next President will be able to save or derail the country or the economy on his own. However, we are very concerned about a sweep in either direction where one party gains too much power and feels they have a mandate to make wholesale changes. Sweeping changes would potentially lead to more of what we have already seen with increased divisiveness, riots, and talk of revolution. For more on this feel free to read Politics and Populism in 2020: How Will This Impact the Markets?

At some point before the end of the year, many are expecting another stimulus package. This stimulus is expected to cost another one to three trillion dollars on top of the three trillion dollars of stimulus already issued this year. Government spending on infrastructure, subsidies for state governments and business, checks for unemployment, bond buying by the federal reserve and other measures have worked to allow for one of the quickest recoveries on record. Additional stimulus could help ensure the economy continues to recover but we may want to consider the cost.

Possible Unintended Consequences of More Stimulus

Our citizenry and our markets seem to be developing a growing addiction to stimulus measures. The first measure of stimulus comes in the form of lower interest rates. Lower rates make for cheaper borrowing and encourages greater spending and investment, but how much lower can we go? Some economies such as Japan and parts of Europe now have negative short-term interest rates. Negative interest rates in the U.S. could cause investors to flee dollar denominated assets, severely hamper our reserve currency status and cause almost all pensions to be severely underfunded. The Federal Reserve in our view will be doing everything in its power to avoid this scenario as negative interest rates are likely to cause more problems in the U.S. than they solve.

The second measure of stimulus is commonly referred to as Quantitative Easing. The Federal Reserve is able to lower longer term rates and stabilize markets buy buying massive quantities of longer-term bonds. This also puts more money in circulation for spending and investment. As bond prices rise and rates continue to fall, investors grow disenchanted with bonds, CDs and other “safe” investments and increasing shift to equities. As we noted in our last article, when rates are as low as they are now, it is highly unlikely bond and CD interest payments are going to maintain purchasing power and keep up with inflation. We are moving to a new paradigm where retirees can no longer rely on interest payments to provide for their retirement (for more feel free to read The Current Income Investing Dilemma).

The Federal Reserve expanded its balance sheet from under $4 Trillion to over $7 Trillion buy buying newly issued Treasuries and corporate bonds starting in March. Eventually they will want to shrink this balance sheet when they feel the economy can stand on its own. The U.S. Government needed to use a third lever to stimulate the economy in March because they felt the Federal Reserve could not save the economy on its own. Because of this, Congress approved massive fiscal stimulus. Checks were written to almost every American with much of this invested rather than spent because there was no-where to go and nothing to do as citizens self-quarantined. Companies sat on cash because they did not know how dire the economy might become. But this stimulus was funded in the short run by putting our country greater in debt at the expense of future generations.

How Do We Fix the Debt Bubble?

The U.S. federal budget deficit is projected to reach at least $3.3 trillion this year. The Congressional Budget Office projects the 2020 deficit to be 16% of U.S. gross domestic product, which is the largest its been since the end of World War II in 1945.

One way to reduce the debt bubble and work to balance the budget is by becoming more efficient. Can our country grow its GDP by becoming more competitive with less taxation and less government spending? An example of this would be Ireland where low corporate taxes have been attracting business investment over the last decade and spurring GDP growth.

Another way to reduce the debt bubble and balance the budget is by increasing taxes and imposing more tariffs. Norway and Sweden have some of the highest income tax rates and both have been operating with budget surpluses.

The least painful way to reduce debt in the short run is by devaluing the currency. Currently the U.S. has one of the strongest currencies on the planet because other countries have been reducing interest rates to stimulate their economies with Japan and much of Europe sporting negative short-term rates. We are likely to embark upon this path as well, although we have already provided many reasons why we would not want to see negative interest rates. Printing more money would also help devalue the currency and reduce the debt bubble.

However, if the US dollar were to significantly depreciate in value and lose its reserve status, it would have a devastating effect on the finances of those countries holding those reserves as well as U.S. bond holders.

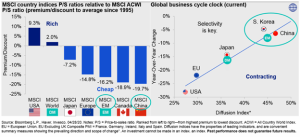

If someone is concerned that the U.S. markets are going to collapse after the election, why not consider moving more investments overseas? U.S. markets could be considered overpriced versus most of the rest of the world. Other countries’ economies have recovered faster as well with Asia Pacific countries currently looking the strongest.

The last time the U.S. dollar was this strong was in the early 2000s. This was one of the best times to invest in non-US companies and emerging markets in particular. Many also predict that a blue wave with democrats taking full control would accelerate the U.S. dollar’s decline making inflation hedges, precious metals and overseas investments more valuable. Many of these economies are emerging only in name as China, India, Brazil, Russia and South Korea are all among the top twelve in the world based upon Gross Domestic Product.

What Other Trend Changes Are Likely?

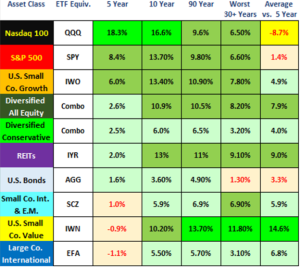

Considering persistent low interest rate expectations and a weaker dollar, the best investments over the next five to ten years are unlikely to continue their dominance. The strong dollar has propped up valuations in the largest most popular U.S. companies. The Nasdaq has outperformed all else with an average return of over 18% over the last five years. This is almost 9% higher than its long-term trend over its 45-year history. Conversely, non-US companies, REITs, and smaller companies range anywhere from 6% below trend to almost 15% below trend since 2015 with small, value-oriented companies showing the most room for improvement.

Smaller value-oriented companies are still down year to date and for the last two years, but they moved to new post pandemic highs this past week and are starting to gain strength. If we were to assume all asset classes in the chart below moved back to their long-term trend lines over the next five years, the best performer would be U.S. Small Value. Recovering to the long-term trend line would add 14.6% (3.1% per year). When we add the average trendline return of 13.7% to the mix, the five-year return expectation equates to 16.8%.

When Do We Expect These Trend Changes?

Newton’s first law of motion states that “An object in motion stays in motion unless acted upon by an outside force.” Trends in the markets also tend to remain intact until a catalyst acts to change the trend. Catalysts that are likely to cause changes in the near future include election shakeups, stimulus legislation, tax loss selling, actions by foreign countries including China, and actions from institutional investors.

We have already detailed reasons why the dollar may see significant decline over the next few years. The decline started in March and is likely to accelerate under several scenarios. The Federal Reserve has all but stated that they intend to keep rates low for an extended period of time, which is negative for the dollar. This trend is likely to continue for some time.

A repeal of the corporate tax cut would immediately cut U.S. company profits by as much as 14%. Those companies that benefited the most a couple of years ago will be hurt the most in this scenario.

Tax loss selling and portfolio “window dressing” will prop up the biggest winners and further damage the biggest losers as investors sell to lock in losses against their profits and tweak portfolios to make them look prettier for potential investors. After this happens, the biggest losers tend to recover the most in late December and January.

China has already created a blacklist of “unreliable entities” which includes many U.S. companies. Although China had already been engaging in anti-competitive measures, this is likely to escalate if the Trump administration retains power. Those industries China is targeting may be adversely impacted. In the “Made in China 2025” national strategic plan the ten industries that they are focusing on include: Information Technology, Robotics, Green Energy, Aerospace, Medicine, Medical Equipment, and others. Competition in these industries could severely disrupt some U.S. companies.

Other catalysts will undoubtably affect us. Very few anticipated the wide-reaching effects of Covid-19. The next “black swan” event will likely be nothing like what we have just gone through, but the unexpected has a way of impacting our lives.

For these reasons it makes sense to diversify well because it is highly likely that something unforeseen will adversely impact us. Proper diversification is the key to reduce risks without adversely affecting returns in the long run.

“Knowing how to deal well with what you don’t know is much more important than anything you know.” – Ray Dalio

Please visit and subscribe to our YouTube channel by clicking here.

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, and CEO of Innovative Advisory Partners, a registered investment advisory firm in Hixson, Tennessee. A 20+year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are un-managed and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.