How do we Protect from the A.I. Bubble Bursting?

It’s less than a month since “Liberation Day” alarmed a lot of business owners, causing anxiety about how to navigate the rest of the year. Car buyers were flocking to dealerships to purchase foreign-made automobiles. Shoppers were stocking up on what they could before prices went up. From the time the tariffs were announced on Wednesday the 2nd until the following Monday, markets were down over 12% and briefly declined over 20% from the February highs.

Many U.S. investors were anxious before the selloff. The unveiling of Chinese tech startup Deepseek started a minor panic in technology stocks. Anxiety about future tariffs also caused uneasiness before “Liberation Day”. However, the rest of the world seemed unfazed before Trump’s tariff announcements.

Many foreign markets are up strongly for the year and have already recovered to new multi-year highs. Poland (+42%), Spain (+39%), Greece (+28%), Austria (+26%), Chile (+24%), Germany (+24%), and Italy (+23%) are all up nicely year to date compared to the U.S. markets (-5%). The dollar continues to weaken, adding to the outperformance of investments based on alternate currencies.

These times of panic cause many investors to rethink how they may want to be invested. Many who were already invested overseas, invested in cash equivalents, gold, and high dividend-paying income stocks may have gains for the year. Unfortunately, investors often abandon one plan for another when they see other areas of the market doing better. They jump ship just in time for the “hot area” of the market to grow cold. Many forget that it is “Time in the Market not timing the market” that works best.

Elevators & Musical Chairs

Everyone wants to get in at the “Ground Floor”. They want to be able to buy at the low. But what if we have concerns that the lows may be many floors below where we are currently sitting? Such is the case with the U.S. markets. At the end of 2024, Warren Buffett was sitting on record levels of cash. The recent selloff likely uncovered a few values. But even with the recent selloff, U.S. Markets are still “significantly overvalued” based upon the “Buffett Indicator” which measures the total market capitalization of all U.S. companies divided by the GDP of the country. As can be seen below, the best time to invest in the U.S. was in the late 1970s, the 1980s, and early 1990s, and briefly in 2009, based solely upon this value indicator.

Since March of 2009, the U.S. has provided the best-performing markets in the world. Based upon the Buffett Indicator, the U.S. has been overvalued during much of this time. Investors like Buffett started freeing up cash over a year ago while others continue to play musical chairs with areas of the market showing the best momentum. The game in the U.S. has shifted from finding great values at the “Ground Floor” to determining which elevators will move from floor to floor the fastest and punching the exit button before they hit the ceiling.

This momentum game can be profitable, but is best played when taking into account valuations and other factors that may determine whether we are close to the ground floor or at least reached a floor from which we will start ascending again.

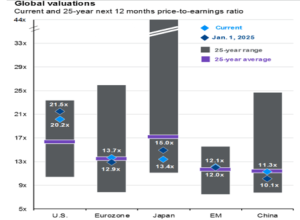

The chart below shows global valuations in areas such as the U.S., Japan, Europe, China, and Emerging Markets nations. All other markets are significantly cheaper than the U.S. All other markets are also closer to their respective floors derived from the 25-year low Price Earnings ratio. This makes these markets much safer when judged from a valuation perspective.

But which ones are showing positive momentum? Prior to the end of 2024, the United States had all the momentum. This year has seen a change in trend. From the chart below, we can see that Europe and China have improved the most year to date. Some emerging markets are also trending well. But the U.S. and Japan are moving in the wrong direction, and the U.S., unfortunately, has the furthest to fall from where we are to the “Ground Floor”. Values can still be found, and some companies are selling at compelling valuations, but many would rather wait for the elevator to start going up before jumping on board.

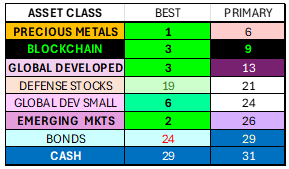

Year to date, cash has held up better than many other asset classes. It has become more difficult to exceed the cash yield. We have seen rates on cash equivalents rise from under 1% a few years ago to over 4% today. As of the end of April, precious metals, blockchain investments, developed markets outside the U.S. and Japan, emerging markets, and bonds have all fared better.

Buffett has shifted to cash for the majority of his publicly traded portfolio, but many who own these other types of investments are faring better than even Buffett, year to date. As previously mentioned, these non-U.S. markets are not only moving up but also closer to the “Ground Floor” than the U.S. markets.

The Best Opportunities are Found at “Turning Points”

U.S. markets still look overvalued, especially when comparing to markets in Europe and other countries. We may not be close to the bottom for some time. We may be close to a short to intermediate term bottom, however.

If CEOs are buying more than selling, it may be a good time to buy. Unfortunately, the last time the CEO buy/sell ratio was positive was in 2022. CEOs are not nearly as bullish as we typically see at market lows like March of 2020 or November of 2008.

Some people believe that we may be heading into a recession. Based upon what we are seeing from the treasury yield curve and other factors, a recession has a relatively high likelihood. If this happens, U.S. equity markets are also likely to move lower from here. In these cases longer-term treasury bonds and gold tend to hold up well. If you want to watch more on gold versus cash versus treasury bonds, you may want to click on and watch the video link at top of this article.

We want to be aware of when “Mr. Market” is overly depressed and it’s time to start buying or when “Mr. Market” is overly excited and we want to free up some dry powder for the future. We typically note extremes in Volatility and Market Breadth at these turning points. The week after “Liberation Day”, market breadth reached a 5-year low and Volatility spiked to a level last seen in March of 2020, during the pandemic.

Forced Liquidations also become prevalent during market bottoms. Billionaire Investor Howard Marks in his bestselling book, “The Most Important Thing” notes:

“Believe me, there’s nothing better than buying from someone who has to sell regardless of price during a crash. Many of the best buys we’ve ever made occurred for that reason. A couple of observations are in order, however:

- You can’t make a career out of buying from forced sellers and selling to forced buyers; they’re not around all the time, just on rare occasions at the extremes of crises and bubbles.

- Since buying from a forced seller is the best thing in our world, being a forced seller is the worst. That means it’s essential to arrange your affairs so you’ll be able to hold on—and not sell—at the worst of times.”

Many may be surprised to know that even Warren Buffett often starts selling long before or long after the market peaks. Buffett kept buying until September 2008, long after the October 2007 market peak. Buffett has been selling Apple shares and bank stocks and freeing up cash since 2022. The S&P 500 and the Nasdaq reached their highest levels to date in late February, earlier this year. This time around many may say that Buffett was selling too soon.

The biggest mistake “smart” investors make involves growing too confident and too aggressive. They want to accelerate their gains by taking on leverage, borrowing on margin to buy, and using derivatives to supercharge their returns. Unfortunately, this also supercharges their losses. It does not matter how good your past returns are. A phenomenal percentage times zero always equals zero. Taking on too much leverage has wiped out many smart investors.

Your Family Index Number

When planning finances for clients and preparing for the future we derive two numbers for them. One of them is the “F.U.N. Index” number and the other is the “Family Index” number. Some clients are fearful of venturing outside of C.D. and “safe” fixed interest rates to earn more. Unfortunately, when figuring out the return they need to achieve their goals, they may need to invest in equities and other types of investments to earn more over time and be able to do all the things they have planned. Returns are better when we are able to venture outside of “guaranteed” investments (nothing is ever truly guaranteed). History has shown that owning equities and other alternative investments outside of C.D.s and bonds helps provide positive returns in years like 2022 when interest rates gave us the worst year for bonds we have seen in over 100 years. Those who were better diversified lost less and many who were protected from inflation may have had positive returns that year. Once we have addressed the “Family Index” number, we can start thinking about fun. “F.U.N.” comes later, but may not be as far around the corner as you might think.

If you want to learn more about how to invest by getting in on the ground floor like Mr. Buffett, feel free to watch the video link above.

Joe Franklin has been named by Forbes as one of Tennessee’s Top Advisors!

Franklin Wealth Management

4700 Hixson Pike

Hixson, TN 37343

423-870-2140