Passing on the Savings

You’ve likely noticed all the ads for brokerage custodian firms rapidly slashing the cost of trades to zero on some of their most popular items, notably stocks and exchange-traded funds (ETFs). At Franklin Wealth Management, we had already negotiated with our two custodian firms, TD Ameritrade and LPL Financial to reduce costs for our clients. […]

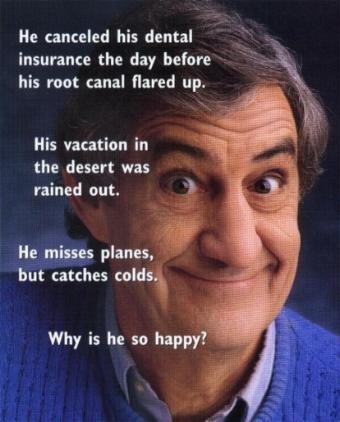

Tax Strategies for Year End – So Even Louie the Loser can Win!

With the end of the year rapidly approaching, there are many clients who are asking what they should be doing now to save on taxes before time runs out and we enter 2019. Even with the markets currently down for many stock indices, some clients may end up paying capital gains taxes on long term […]

Where are the Buyers?

THE MARKET HATES UNCERTAINTY There are plenty of Sellers out there who are concerned about the upcoming election, trade wars, rising interest rates and the like. As one market commentator put it last week, “The perfect storm was caused by a trifecta of news. First, China wanted to hurt the U.S., defend its currency (the […]

Which Body Looks Healthier?

Are We Too Obsessed with Our Weight and Waistlines? All too often the media and even medical professionals tell us that thinner and lighter is better. As can be seen from the pictures above, most would agree this is not always the case. Many world class athletes regularly weigh in at levels considered moderately overweight […]

Hidden Costs, Expenses & Penalties

Just about every month I come across someone who claims that their investments don’t cost them anything or someone who doesn’t seem to understand all they are paying in internal expenses. All too often (in the case of those buying commission based products) they have been told that something they bought does not contain any […]

It’s Good to be the Banker

Even when Not Playing Monopoly Thinking more like a banker can provide us many benefits from a tax re-positioning perspective and a loaning vs borrowing / cash flow perspective. Not too long ago, I and a client were interviewed by a reporter at Forbes about the benefits of making serial conversions to Roth IRAs over […]

Which of the Four Are You?

All of us are innately wired to react certain ways when it comes to making investment decisions. Some of us are spenders while others are savers. Some are thrill seekers while others prefer to play it safe. Each of these personalities has good qualities and areas for improvement. We’ve found that being “self-aware” is the first step […]

Never Buy This in December

It seems that every year in December we get a multitude of calls from clients regarding a pretty common occurrence for certain types of investments.This month, most pooled investments pay out their capital gains to shareholders and the value of the associated account falls for a few days until the money is reinvested or paid […]

Protecting Identity and Assets

A few years back one of our California clients experienced a data breach at their local bank and became increasingly concerned about making sure their assets were protected from potential identity thieves. These particular clients have English accents and it would be hard to impersonate one of them on the phone, but in any event […]

College Funding 101

Like many Tennessee residents, you may have found yourself doing a bit of shopping last weekend. Tennessee’s annual “Sales Tax Holiday” is a great time to load up on clothes, school supplies, and other necessities for the kids and grandkids. This annual event held during the last weekend in July signals the end of Summer […]