“When I find myself in times of trouble, mother Mary comes to me, speaking words of wisdom, let it be.” – Paul McCartney

As the lyrics suggest to the classic song “Let it Be” written by Paul McCartney, in times of trouble people turn to soothing melodies, songs that uplift the soul and words of wisdom from trusted advisors and timeless classics of ages gone by. People may be gripped somewhat by fear during these times, afraid to do what they should. It tends to be a good time to reflect, regroup and seek good counsel, however.

As time goes on people become engrossed in talk of “easy money”. Greed becomes more prevalent in the psyche of the average investor. This is the time to be more aware of where you might be stepping because the landmines are much more prevalent at market tops than at market bottoms.

Lately many investors have moved from easy listening to heavy metal in the markets. They are starting take much more risk than previously. This is not necessarily a bad thing if they are able to maintain a diversified portfolio and still able to move to protect themselves in time for the market pullback that invariably comes

The average individual’s “Appetite for Destruction” has risen recently, especially when it comes to taking on margin debt to achieve their investing goals. As we noted in our publication at the end of March, this increased borrowing tends to reach its apex just before the market peaks. As Axl Rose says in Welcome to the Jungle, “If you’ve got the money honey, we’ve got your disease.” A wise investor takes heed of these things.

“DIVERSIFY OR UN-DIVERSIFY?” THAT IS THE QUESTION.

We can think of each given time period as a different melody or a revisiting of a similar of a previous melody in the long piece of music the markets play over time. Various artists are going to be able to excel in playing different types of music with varying vocal or musical ranges and different styles whether they be Jazz, Classical, Country or Hard Rock. One musician may be an accomplished Opera singer, but may not be able to sing worth her salt when asked to perform a Country tune. Another may be a great Jazz guitarist, but may not be able to play a Jimmy Hendrix guitar solo.

Just as with musicians, professional investors tend to perform best in certain types of market conditions. The question is, “do we want to hire the musician or money manager that performed the best most recently, or the one that is going to play the upcoming tune well?” If we knew what was coming next, it would make our selection easier, but given the randomness most people tend to choose the musician or manager that performed best most recently. This is done in spite of the fact that the market very rarely picks a tune much like the last one for its next piece

The market is both somewhat predictable and to a large degree random. In figuring out what the next song is going to be, very rarely are we going to be able to choose the exact piece that we are asked to play next. We can sometimes predict within a certain range, however. To play the next selection, an enlightened individual will choose an accomplished musician or manager with a diverse skill set or an ensemble cast that can perform all pieces well.

Just as with picking musicians for the best ensemble cast for the future, we want to pick investments and investment managers with an eye toward the future. Investing by looking in the rear view mirror is not near as profitable as looking at the road ahead. Choosing a mix of investments rather than one style or one asset class proves to hold up better in good and bad markets rather than limiting your range of investment vehicles.

RECENT UPDATES

During the last week of April the Federal Reserve announced another reduction in bond purchases despite a miserable reading on first quarter economic activity. In a unanimous decision the Fed said it will reduce its monthly bond purchases to $45 billion from $55 billion. At the current pace the historic stimulus measure would conclude as early as October. At the same time it repeated the refrain that the benchmark interest rate would stay near zero for a considerable time” after its bond buying program comes to an end. The Fed also stated that its long-term inflation goal of 2% remains on pace with its consumer prices up only 0.9% for the year through February.

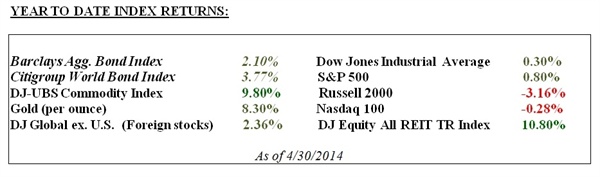

What we have now is a two-tiered market with the large caps (S&P 500 and Dow) right on the verge of setting fresh bull market highs as well as all-time highs. The lower tier is now represented by the Nasdaq and small company stocks represented by the Russell 2000. The Nasdaq is 5.3% below its March 5th bull market highs and the Russell 2000 is 6.8% below its March 4th bull market highs.

The obvious question is, “will the Nasdaq and Russell 2000 pull the S&P500 and Dow lower?” Quite frankly, it is a worry to see the Nasdaq and Russell 2000 underperforming. However, it could be argued that they had gotten ahead of themselves.

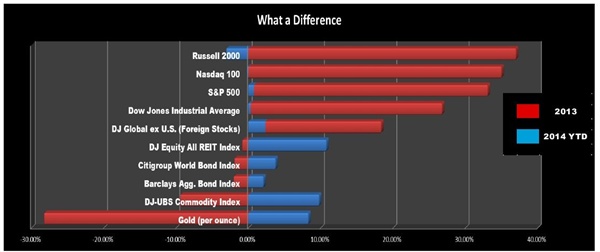

In our models we have been getting a bit more conservative, reducing our exposure to the most speculative momentum types of investments. We have been doing this slowly over time selling various holdings as they start to look weak or hit our sell targets. It has been interesting this year to see last year’s winners performing relatively poorly while last year’s losers are now leading the pack. Commodities, REITs and bonds are giving us better returns than stocks year to date. It could also be argued that these underperforming asset classes of 2013 had moved too far negative and a return to more normalized market conditions was in order.

IT’S A NEW YEAR AND A NEW MARKET ENVIRONMENT

From what we have been seeing recently, many investors increasing US Stock exposure and moving away from a lot of other types of investments. As usual, investors are pouring money into the hottest thing at the time, particularly large company U.S. Stocks.

If your timing is right 100% of the time, moving the majority of your portfolio into the hottest thing or hopefully tomorrow’s hottest thing is definitely better owning a lot of different types of investments.

However, you are also subject to more risk than if you were to invest in a more diversified fashion. As you can deduce, we believe in having a good mix of flowers in your preverbal garden so that something can always be blooming.

Otherwise you may find yourself in a boom or bust scenario (see Large Cap US in 2008 and 2000 – 2002).

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are un-managed and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.