Owning stock in the company you work for, can give you a feeling of ownership and “skin in the game” when it comes to delivering results to the bottom line. For some, it has also been an effective way to accumulate personal wealth and a larger retirement nest egg. While there are some pluses to owning employer stock, there are additional risks, tax pitfalls and opportunities that you should know about.

The following are a few Do’s and Don’ts when it comes to owning employer stock.

Do – Take advantage of stock purchase plans that offer a discount.

If your company allows you to purchase their stock at a discount then this is a no brainer. For instance, if you are employed by XYZ Corporation and they offer a 15% discount on their stock trading at $10.00 per share you will be able to purchase the stock for $8.50. You can then immediately sell the stock a realize an 18% profit. The $1.50 profit you realize at the time of the sale will be taxed as ordinary income.

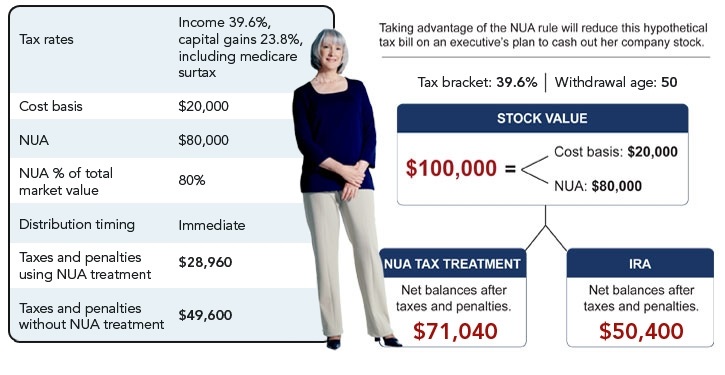

Considering the net unrealized appreciation rule

Assumptions: (1) Company stock with a $100,000 market value, a $20,000 pretax cost basis, and NUA of $80,000 is distributed in kind from a 401(k) plan as part of a lump-sum distribution; (2) in the NUA scenario, the stock is immediately sold after being distributed from the plan; (3) in the rollover IRA scenario, the stock that was rolled over to the IRA is immediately sold and the proceeds distributed in cash; (4) 39.6% federal ordinary income tax rate on the $20,000 basis in the NUA scenario and on the entire $100,000 in the IRA scenario; (5) 20% federal long-term capital gains tax rate, plus a 3.8% Medicare surcharge on the NUA in the NUA scenario; and (6) the participant is subject to an early withdrawal penalty of 10% on the $20,000 cost basis in the NUA scenario and on the entire $100,000 in the IRA scenario. State and local taxes are not taken into account. All the other non-stock assets distributed from the plan are assumed to be rolled over to a tax-deferred account to maintain their tax-deferred status and are not considered for purposes of this example.

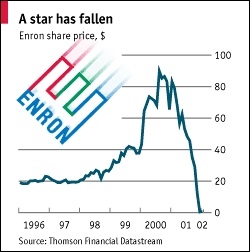

Don’t – Be tempted to hold stock for longer periods to avoid paying taxes.

While you may be tempted to avoid paying ordinary income taxes or capital gains taxes by holding onto the stock indefinitely, this could backfire on you. Employees that owned stock in Enron, WorldCom or General Motors ended up holding the bag as their stock became worthless when those companies filed for bankruptcy. While there can be more restrictions due to insider trading regulations, higher level executives and company insiders that hold lots of company stock may want to utilize tax loss harvesting techniques to reduce their exposure to capital gains taxes while diversifying their position. Hedging techniques can also be used to manage risk on very concentrated positions.

Do – Review potential tax benefits of pulling out company stock from 401k Plans or Profit Sharing Plans when you retire or leave employer.

Before rolling over your 401k or Profit Sharing Plan to an IRA or another companies 401k, you should determine if it would be beneficial to pull the stock out directly and roll the remaining funds over. The IRS allows special tax treatment called Net Unrealized Appreciation (NUA) for stock that was purchased inside of 401k or Profit Sharing Plans. Instead of paying income taxes on the full value of company stock withdrawn, you are required to pay ordinary income taxes on the cost basis or original cost when the shares were purchased. In addition you may be subject to a 10% penalty for distributions prior to age 59.5, unless you separated after age 55. When the stock is sold, you are required to pay capital gains taxes on the amount of appreciation. In order to qualify for NUA treatment, all vested funds must be distributed or rolled over. We have seen instances where the basis was 10% or less of the current value, quite a tax savings indeed. Below is a case study illustrating the potential savings.

Considering the net unrealized appreciation rule

Considering the net unrealized appreciation rule

Assumptions: (1) Company stock with a $100,000 market value, a $20,000 pretax cost basis, and NUA of $80,000 is distributed in kind from a 401(k) plan as part of a lump-sum distribution; (2) in the NUA scenario, the stock is immediately sold after being distributed from the plan; (3) in the rollover IRA scenario, the stock that was rolled over to the IRA is immediately sold and the proceeds distributed in cash; (4) 39.6% federal ordinary income tax rate on the $20,000 basis in the NUA scenario and on the entire $100,000 in the IRA scenario; (5) 20% federal long-term capital gains tax rate, plus a 3.8% Medicare surcharge on the NUA in the NUA scenario; and (6) the participant is subject to an early withdrawal penalty of 10% on the $20,000 cost basis in the NUA scenario and on the entire $100,000 in the IRA scenario. State and local taxes are not taken into account. All the other non-stock assets distributed from the plan are assumed to be rolled over to a tax-deferred account to maintain their tax-deferred status and are not considered for purposes of this example.

Don’t – Hold too much in company stock.

As early as grade school we are told not to put too many eggs in one basket. As a general rule, we recommend not having more than 10% of one’s total wealth in a single publicly traded company. Seeing a major decline in the value of that company’s stock could put the retirement of your dreams out of reach. Even large, well established companies are not immune from seeing sharp declines in their stock’s price. Consider General Electric, which traded over at over $41.00 in 2007, prior to the financial collapse. It traded at around one fifth of that value when it bottomed in January of 2009 and has yet to recover to pre-crisis levels as it is only valued at around $32.00 per share over 7 years later (still 22% below it’s high from 2007).

Decisions regarding employee stock plans and retirement distributions can be very hairy as there are significant tax, retirement, investment and estate planning implications. Consulting with a qualified financial professional is always recommended.

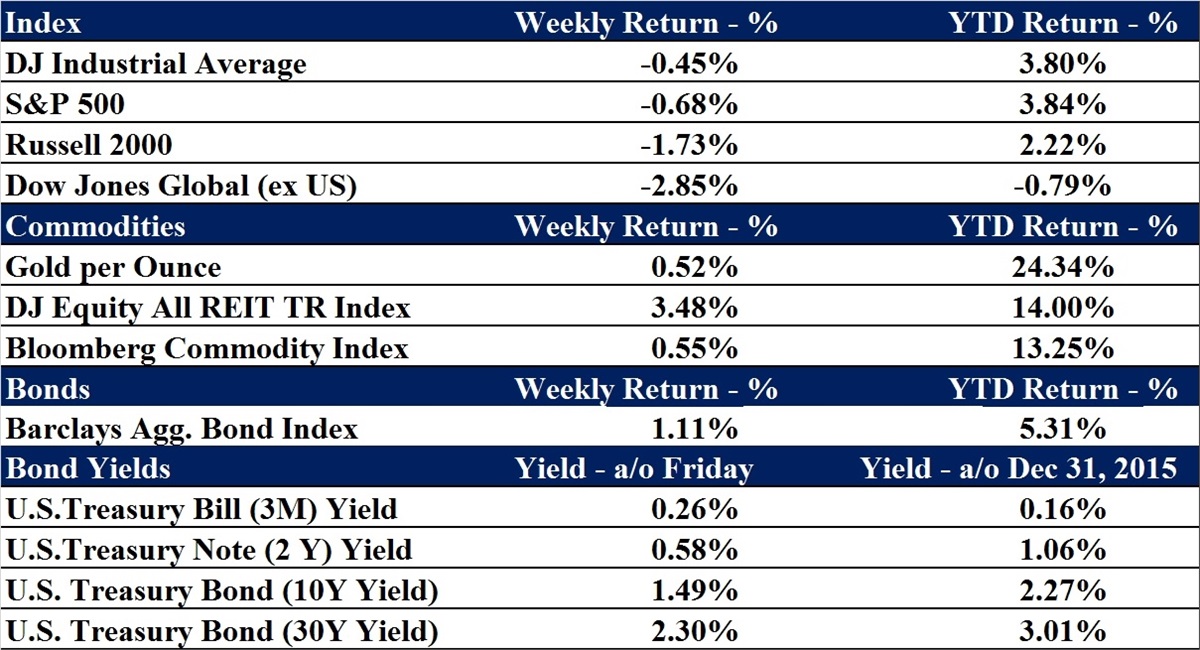

Data as of 6/30/2016

Nick Hughes is a Wealth Advisor with Franklin Wealth Management, a registered investment advisory firm in Hixson, Tennessee. In addition to advising clients since 2007, he has contributed to articles for Market Watch and FinancialPlanning.com and is a regular contributor to the Franklin Backstage Pass blog.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are unmanaged and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.