A Discussion of Passive vs. Active

Warren Buffett is widely acknowledged as the greatest investor alive today. Last year he was ranked the third wealthiest person in the world, down from number one a few years back. Despite his roots as a value investor whose favorite holding period is forever, in recent years he has been known to value quality companies over an appealing purchase price. In Superinvestors of Graham and Doddville he writes how those with the correct temperament and training have proven to have outperformed market indices over time. Of course, we are probably asking too much for any investor to always outperform. Buffett’s acumen seemed to be failing both last year and in the late nineties. His company, Berkshire Hathaway lost almost 20% in 1999 during the technology bubble and lost over 12% of its value last year when the S&P 500 was slightly down. Many felt that his “stubbornness” in holding on to oil and railroad companies in 2015 hurt him more than it should.

Although he has consistently shown himself to be better than average with a track record averaging over 21% that goes back almost 60 years, since the end of 2008 he has underperformed the S&P 500 by 2.5% per year and only earned 4.2% per year for investors in Berkshire Hathaway since the beginning of 2008.

Is this why the world’s greatest investor advised his wife invest in index funds?

Buffet has reiterated time and again that for those without the time, the interest or the temperament, investing in indices makes a lot of sense as long as you maintain a buy and hold philosophy and don’t chunk it in all at once. Buffet tells us, “If you like spending 6-8 hours per week working on investments, do it. If you don’t, then dollar cost average into index funds. Don’t put your money in all at once; do it over a period of time. This accomplishes diversification across assets and time, two very important things. There is nothing wrong with a ‘know nothing’ investor who realizes it. The problem is when you are a ‘know nothing’ investor but you think you know something.” He expands upon this line of thinking, “ETF’s are a fairly low cost way to get into a market or industry. We don’t hold any and never will. I recommend index funds for people who don’t want to spend time studying the market. If you don’t bring anything to the game, you shouldn’t expect to win. Maybe for a small investor, continuous investment in index funds might work – but not for us. I like the businesses we’re in, so I wouldn’t be giving up any of my businesses.”

Passive benefits over Active Investing?

So what are the benefits of passive index investing versus a more active investing approach that has worked so well for Mr. Buffett over the years. What can we take advantage of and watch out for when looking at these approaches?

As Buffet has noted, we also believe that passive investing in indices is one of the easiest ways to diversify for smaller investors. It is relatively easy to get started, investing a few hundred dollars a month, which is also beneficial in eliminating errors associated with bad timing. The costs are usually less when investing in indices and the structure of these types of investments tends to be more tax efficient (all else being equal) if investing outside of IRAs, 401ks or other types of retirement plans.

It is also worth noting that unfortunately some of the best wealth managers are limited by the number of new clients they can accept and it’s hard to get a lot of value out of an advisor when starting out unless you can reach their minimum fee level.

If markets are acting more efficiently without any bubbles or busts, indexing also makes a lot of sense, especially if you believe that the largest companies are going to do best going forward. Most indexes are weighted toward the largest companies and will do better than a more diverse portfolio when these companies are attracting most of the investment capital. Passive investing tends to work better for large company stocks than other types of investments because information is more readily available and mispricings are less prevalent.

Behavioral biases and performance chasing also work against active management more than indices. Managers tend to attract the most assets when investors get overly excited about the types of investments they handle. They have typically gone through a period of outperformance and it is harder to find more good opportunities. They are also often forced to sell when they would rather be buying when the types of investments they own are “on sale”. This affects indices less and is something to consider for smaller investors.

What if we feel the stock market indices are too unpredictable?

Most individuals and families as they approach retirement feel they need to be more conservative. A portfolio owning entirely stocks makes little sense in this instance. To gain more consistent returns, diversification is often necessary but index investing is not particularly adept when considering bond or other income oriented investments.

When considering bond indices, the largest percentage of the portfolio is concentrated in the countries and companies that have issued the most debt. This causes the portfolio to be more heavily weighted toward those bonds from companies or countries that may be struggling. The strongest companies and countries tend to have little to no debt in comparison. We recommend reserving index investing primarily for the equity sleeve in portfolios.

How do we know that we are adequately diversified?

Another issue that some investors encounter when investing in indices may be thinking they are diversified in a broad based index and not realizing that their portfolio is more susceptible to downturns than if they further diversified their portfolios.

This was the case in the late 1990s when many investors concentrated their portfolios in the S&P500 index and others further concentrated in the Nasdaq 100 index. Although they did not fare as poorly as those who concentrated in the tech heavy Nasdaq, investors in the S&P500 as of late 1999 had to wait almost a decade to see positive returns again.

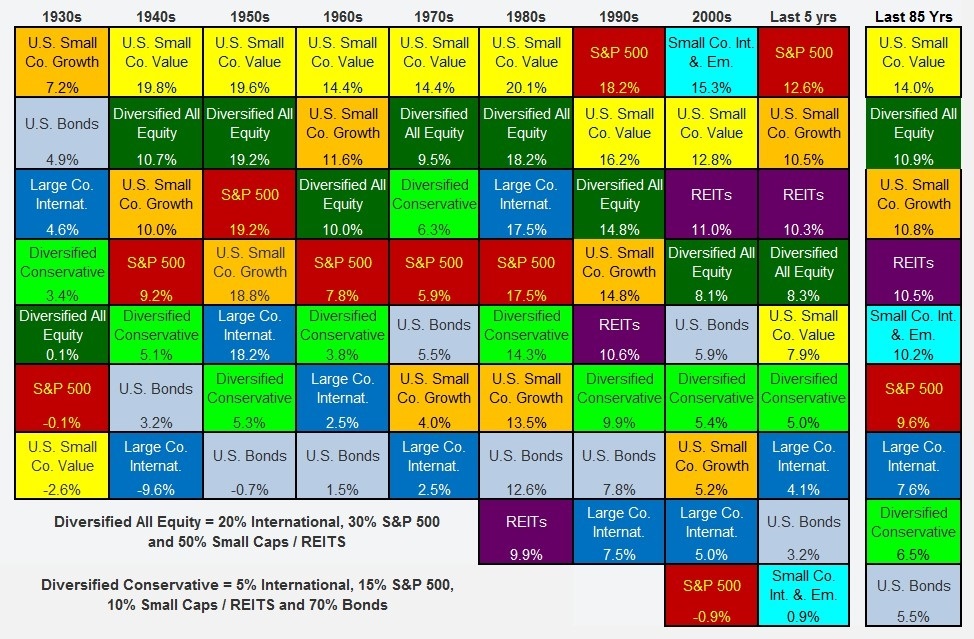

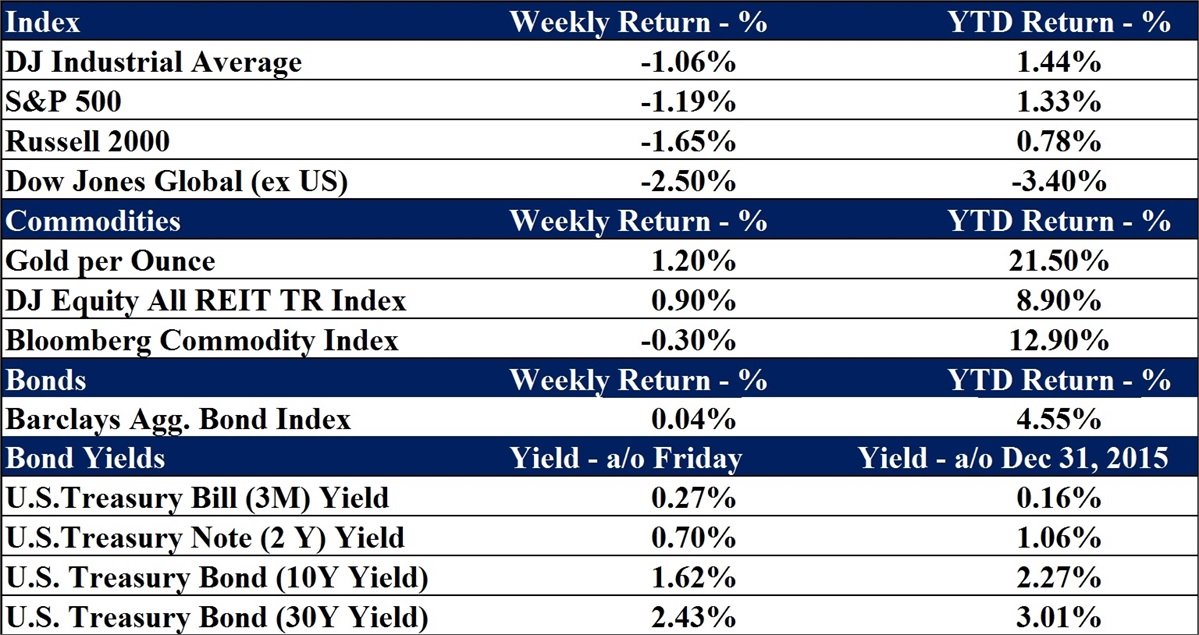

Data from Morningstar Investor 12/31/2015

The chart above shows how a more diversified all equity index portfolio would have performed in the decade of the 2000s and every other decade back to the 1950s. It is interesting to note that this portfolio owning small US and non-US companies, large US and non-US companies, REITS and other equity holdings outperformed in all decades except for the 1990s and the last five years. Those who have only considered investing in the S&P 500 index may be doing themselves a favor by studying this chart.

Active benefits over Passive Investing?

As we noted above, passive fixed income investing tends to concentrate portfolios in the more troubled companies and countries. Studies have also shown that managers investing in smaller companies tend to outperform their indices on a more consistent basis than those investing in the largest of companies.

It is also hard to develop a customized portfolio when investing in indices. If an investor does not want to own tobacco stocks or wants to develop a portfolio for specific specialized purposes, it is much easier to do this by having an investment manager buy specific securities for you in your own individual account. Income oriented investors also tend to be better served by having a customized income account.

In SuperInvestors of Graham and Doddville, Warren Buffett explains how knowledge, interest, understanding and primarily temperament make the biggest difference for who consistently do well over time. Studies have shown that focusing on companies with insider buying, company buybacks and various other quantitative factors have led to long term success.

Buffett and other like minded managers prefer buying companies with superior brands or superior business models (barriers to entry) selling at attractive prices. He states, “When investing you don’t have to invest in all 10,000 companies available, you just have to find the one that is out of line. Mr. Market is your servant. The market is the greatest game in the world. There is nothing else that can, at times, get this far out of line with reality. For example, land usually only fluctuates within a 15% band. Negotiated transactions are less volatile. Some get this; others don’t. Just keep your wits about you and you can make a lot of money in the market.”

Buffet also tells us, “There’s a certain degree to which ideas that are nutty take hold and propagate. Max Planck [remarked about] the resistance of the human mind to new ideas: ‘Science advances one funeral at a time.’ The key is to have a ‘money mind,’ which is not IQ, and then you have to have the right temperament. If you can’t control yourself, you’re going to have disasters. The whole world in the late 1990s went a little mad in terms of investments. What we learn from history is that people don’t learn from history. Grade yourself on your temperament. Temperament is the ability to not be swayed by the market. See what you are supposed to see.”

So what if you find yourself wanting to sell everything at the bottom or get overly aggressive at the top? You can take solace in the fact that you are not alone. The uncomfortable truth is that your temperament may hinder your ability to do well with your investments and achieve your long term goals. You may need someone to help you stick to your plan and maintain a level head during trying times.

The benefits of working with a Wealth Manager:

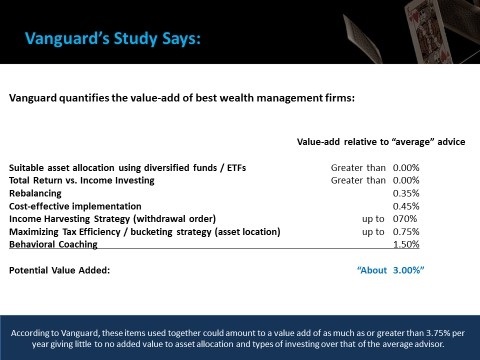

Buffett says, “If your wife is going to have a baby, you’d be better to call an obstetrician than do it yourself. If your pipes leak, you should call a plumber. Most professionals add value beyond what the average person can do for themselves.” The good news for investors in the coming years is that the government is requiring advisors be held to the Fiduciary Standard and put their client’s welfare ahead of their own. So where does an “above average” advisor add value. According to Vanguard, they feel that the added value is not in investment strategy or choosing the best allocation of investment products.

Follow this link for the full study.

The findings from their research can be found below:

One reason we developed our WealthFit™ program was to focus our activities on where we continually add value for clients and provide better tracking for where clients currently stand in their continual path to improved financial fitness. All of the items noted by Vanguard in their study are part of our WealthFit™ process, but the study limits itself to primarily to investments, cash flow management and touches on long term tax minimization planning. Estate planning, protection planning and other items are not even taken into consideration. In fact, when running stress test for clients, we find that social security maximization, asset location for long term tax benefits, income harvesting strategies and other items make a bigger difference for clients over time than taking more risk to earn an extra percent or two.

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, a registered investment advisory firm in Hixson, Tennessee. A 20+year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are unmanaged and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.