Three Steps to Ensuring an Efficient and Effective Estate Plan

By Carter Payne & Joe Franklin

As financial planners, we are frequently meeting with new clients who don’t yet have all their ducks in a row financially. The one area where we find people are most often unprepared is estate planning, likely because dealing with end-of-life scenarios is not fun – and it can be scary and intimidating. However, there are a slew of reasons why it is critical you get this done – and done right. You want to be sure your wishes are carried out, your assets are transferred efficiently, and your costs and taxes are minimized.

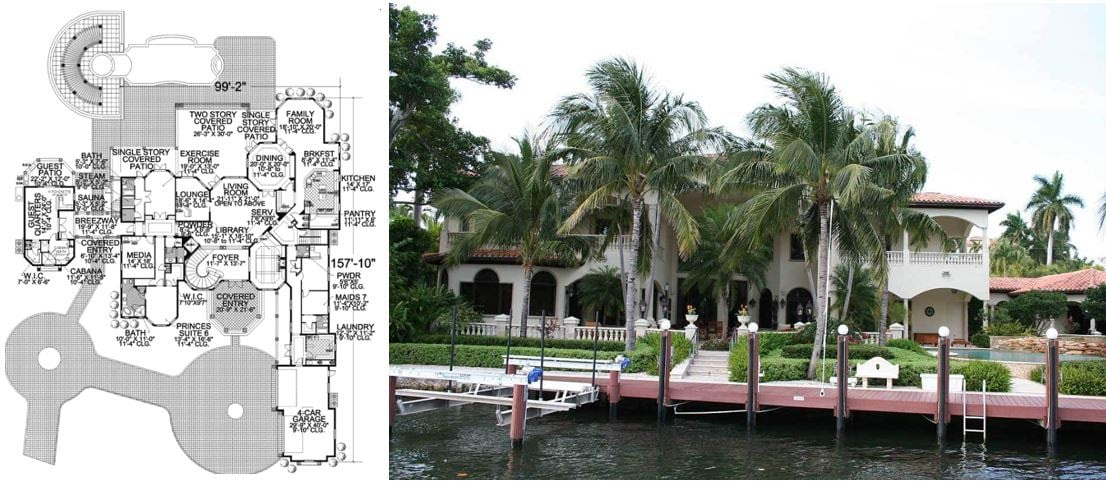

Creating Blueprints with Your Attorney is a Good Start. Afterwards, we want to Build the Structure to Ensure Your Estate Plan is Effective.

There are three key components to getting your estate in order. First, you want to have effective and efficient estate blueprints in place. Second, you want to make sure you work with someone to make sure everything is implemented properly. Third, you want to include those closest to you in the details – the most important aspects of the plan, where to find a copy of the plan, and where to locate other important documents.

This checklist is designed to ensure that you have covered all your bases in creating an estate plan – and to ensure that your family knows what to do in the event that one of their parents passes away or becomes unable to make financial or healthcare related decisions.

- Create an effective and efficient estate blueprints. When creating an estate plan, you want to be sure you create an effective plan, one that accomplishes all your goals and wishes, as well as an efficient plan, which speaks mainly to the time and cost of executing that plan. There are many different types of estate plans and documents, and creating the right plan for you depends on your situation – your goals, wishes, assets, and even your family dynamic. You will want to engage an estate attorney to draw up the blueprints and create the documents, and you will want to engage your financial advisor to help you think through all the aspects of your situation and to ensure your plan is executed – and funded.

- Involve financial professionals in creating that plan. Your financial advisor along with an estate attorney will walk you through all of the following documents and which ones are most appropriate for your situation:

-

- Will – specifies how your property and assets will be distributed when you die. It can also address care for minor children or adult dependents, gifts to church or charities, and end-of-life arrangements. Without a will, the state you live in will distribute your assets according to its laws, not your desires.

- Durable Power of Attorney – names someone to make financial decisions for you if you are unable to.

- Living Will – tells health care professionals how you want to be treated if you cannot make your own decisions regarding emergency medical treatment.

- Durable Power of Attorney for Health Care – names a person who will make health care decisions for you if you are unable to communicate them yourself. This person should know you well and be very familiar with your values and wishes.

- Trust – names someone (a trustee) to hold and distribute property on your behalf. Trusts can be either Revocable (also known as a Living Trust) or Irrevocable. There are many different types of trusts designed to address a wide range of needs.

- Make sure to work with your financial planner to ensure that once you have your blueprints created, you are now able to build the structure to ensure your estate plan is complete and effective. All too often clients meet with an attorney, get paperwork signed and think they are done. This is just the beginning of a well crafted and effective estate plan.

- Involve your loved ones in planning for the future. To the level you are comfortable with, you will want to involve those closest to you in your estate plan, especially as you get older or begin to see your mental capacity diminish. A “family meeting” with you, your loved ones, and your financial advisor is a great way to get everyone on the same page. Your advisor should be happy to facilitate this meeting.

- Provide Powers of Attorney for your financial accounts. If you happen to have a stroke, start to have memory issues or are in a coma, you will want to have designated someone to take over your financial affairs. Having a backup is a good practice as well, if your primary power of attorney pre-deceases you. A best practice is to provide this to your financial advisory firms ahead of time and ensure they are aware of and can identify the individuals you have entrusted your assets to in case of emergency.

- Look at Multiple Contingencies. Generally, your spouse is your primary agent on most estate planning documents, and if your children are grown, they will normally be your backups. There will often be situations, however, where other family members or close friends will serve as agents and backups. Regardless of who plays a part in your estate plan, you should talk to them about it before including them in your documents.

- Make sure those closest to you know where to find your important documents. Store all of your estate planning documents together in a safe place, possibly even a fireproof safe. Those who play a key role (and other loved ones) should know where all of your estate planning documents are kept. You do not want people searching for your documents in a time of crisis.

- What should those closest to you do when they notice diminished mental capacity? When this happens, notify the financial advisor involved so that the advisor and their staff can be on the lookout for unusual requests or anything else out of the ordinary.

- Review your plan on a regular basis. It is important to review your estate plan annually and when a major life event occurs, such as a health event, death, divorce or move. Life can change suddenly and often – you want to be sure your estate plan reflects those changes.

Forbes Recognized Joe Franklin as one of the TOP Advisors in Tennessee

Franklin Wealth Management

4700 Hixson Pike

Hixson, Tn 37343

423-870-2140