The Key is Starting with Great Questions

When you read something particularly good, it’s hard not to want to share with everyone. Many ideas are original but sometimes other ideas are just too good not to share. Ben Carlson wrote a particularly good blog last month that I felt I should share with everyone and add a few thoughts of my own.

You should read the whole blog here since I paraphrased some of it below and only copied a few of his questions to preach some dogma. When I read his blog it makes me proud that there actually are other thoughtful professionals out there serving in the best interests of their clients in a world full of slick product pushers with proprietary products.

Read Do You Really Know What You Own?

There are good questions that can be helpful but then there are great questions that really change the way you approach a decision or problem…

Here are some good questions, along with what I consider to be even better questions:

Good Question: “How do I keep my investment fees in check?”

Great Question: “How do I keep my behavior in check?”

Fees are always an issue in the absence of perceived value. At Franklin Wealth Management, we consistently work to educate clients and minimize the impact of known faulty behaviors (ours and our client’s) from impacting strategy.

Read our article on Brain Games

Good Question: “How do I get to the point where I know what to do in every market scenario?”

Great Question: “How do I get to the point where I’m comfortable doing nothing most of the time with my portfolio?”

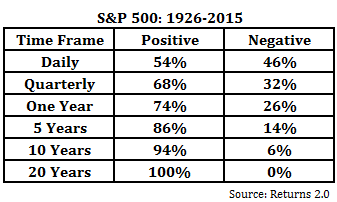

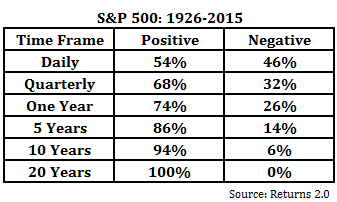

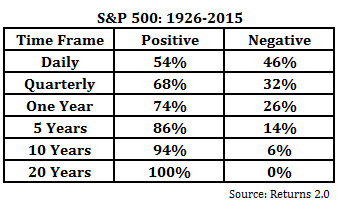

Time is on your side. We want to outline a plan that meets your objectives, over time. Invest for those objectives rather than the short-term. Here’s one reason I know…

Good Question: “How do I decide when to add new investments to my current line-up?”

Great Question: “How do I define what I won’t invest in?”

Have an investment strategy that is an output from your financial planning efforts. IPOs, new catchy funds, Hedge funds, securities that your podiatrist tells you about, and anything you read in any daily periodical as a “recommendation” should fall into the category of things you decide in advance not to invest in. Anything you are just hearing about is probably already well overdone.

Read Wall Street’s Pigs and Wolves

Good Question: “What are the general buy and sell guidelines for my investments?”

Great Question: “What are my checks and balances to ensure I’m not making it a habit of buying high and selling low?”

Investing is actually quite simple. Those who try to make it more complicated sometimes end up hurting themselves. Also, know what you may need money for inside of the next 18 months and have that already set aside in cash. March 8th of 2009 or February 11th of 2016 was no time to decide you needed cash. If you don’t need cash, you should have no need to sell low.

Good Question: “What’s my investment strategy?”

Great Question: “What’s my investment philosophy?”

Tactics = short-term. Strategy = Long-term. Philosophy? Your philosophy is generally shaped by your experiences, your background and your interests. My philosophy is closely tied to the concept of “Margin of Safety”, past history, probability and statistics. Over time even those with poor tactics can still do well. The following chart bears this out.

Oh wait, you’ve seen that before? Good. Action is for Vegas…and they serve free drinks. We do too actually…but for a different reason. Swing by the shop any time.

Good Question: “How do I better understand how the markets operate?”

Great Question: “How do I better understand how human nature operates?”

Read The Little Book of Behavioral Investing by James Montier. Much of our Brain Games workshop earlier this year was based upon this book.

Good Question: “How can I plan for a unknown future?”

Great Question: “How do I learn to focus on what is within my control?”

We have less control over the markets than many think. What is within your control should be outlined in your financial planning efforts by identifying your investing philosophy (and/or subscribing to someone else’s…like ours) and a corresponding investment strategy.

Good Question: “How can I make better decisions during stressful market situations?”

Great Question: “How can I automate good decisions ahead of time?”

Automation can be accomplished by having a financial plan that results in the creation of an investment strategy then outsourcing the day-to-day management of the investing to someone who lives and breathes it every day.

That’s not to say you can’t do it yourself…you can. I can make a big investment in my own lawn equipment, mow my own lawn, do the edging, bag the clippings and later give my wife a big sweaty hug every Saturday or I can outsource it to a professional landscaping company so I can enjoy my yard, relax on the lake and consume a cold frosty beverage on Saturday (or read a stack of research on Sunday). Time is a limited resource.

Good Question: “What’s the optimal asset allocation?”

Great Question: “What’s the optimal way to stick with the allocation I’ve chosen?”

I sense a theme!

Good Question: “What’s my investment plan?”

Great Question: “How do my investments fit into my overall financial plan?”

Here we go again!

Good Question: “How do I figure out who to trust when looking for financial advice?”

Great Question: “How do I weed out my sources of information to know who to ignore when looking for financial advice?”

Hint: Most sources of information rely on advertising, and advertising is driven by viewership/readership. Any guess on how they keep those metrics up? You guessed it – straight forward conviction about boring time-tested ideas that require broken record alerts…Maybe not.

Good Question: “How can I improve my money management skills?”

Great Question: “How can I improve my emotional management skills?”

Spend more time understanding Behavioral Finance than you spend on trying to hone money management skills. Again, try picking up The Little Book of Behavioral Investing. Or you could be a client and I’ll politely lecture on it because the probability and statistics of investing are fascinating…see this chart:

Whoops, I think I did it again…I might be thinking too much about time on the lake in my boat rather than mowing the yard at this point.

Good Question: “How do I plan for an uncertain future?”

Great Question: “What’s the best way to prepare for a wide range of outcomes?”

As much as it may be exhausting to read this point, it is the main bedrock of Franklin Wealth Management’s conviction and philosophy…get a plan, create an investment strategy, invest in that strategy knowing the probabilities and statistics of success over the long-term, don’t get swayed by people in this industry with great suits and firm names with something flashy to entice you to buy and go have a frosty beverage in your back yard or in your boat on the lake. A good portfolio is good enough…and we believe that it’s a waste of time to try to find silver bullets, “ideas of the day” and products from salespeople at the big Wall Street firms in the equity space.

And remember…

Get a plan, create an investment strategy and invest in that strategy knowing the probabilities and statistics of success over the long-term. But, you’ve probably heard all this before.

Our Income Model:

Income investing was particularly out of favor in 2015, but it seems to be gaining ground again in 2016. Our primary criteria for inclusion in the Income Model is that any new purchase has a dividend yield at least 50% above the current yield of the Russell 3000. Currently the average dividend yield is almost three times the Russell 3000 which leads us to believe that income investing still has more room to rebound.

New holdings for our Income model are added via five primary methods:

1) We find high dividend payers with large new stock repurchase plans or insider purchases and low price to sales ratios.

2) We find high dividend payers with good price and earnings momentum.

3) We find high dividend payers which also have earnings yields of at least 10%.

4) We find high dividend payers selling at deep discounts to net asset value with strong long term track records

5) For diversification and risk reduction purposes, we occasionally round out the portfolio by buying into a bond index or more narrowly defined index with a higher dividend yield.

In looking at the factors that are most important for inclusion in the Income Model, we would rank them as follows:

1) Dividend Yield (50% more than the current yield of the Russell 3000)

2) Earnings Yield

3) New Share Repurchase Programs and/or large Insider purchases

4) Current Quarterly Earnings Acceleration

5) Annual Five Year Earnings and Revenue Growth

6) “The Moat” – A Strong Sustainable Competitive Advantage

We are not as concerned about the current price of the securities or how they have behaved recently as long as the dividends remain stable or are increasing. “If you bought the cows for the milk, why worry about the price of beef?”

Read Got Milk?

Recently, new additions in the Income Model have primarily included those with higher earnings yields as well as strong current quarterly earnings acceleration. Those we have sold or reduced did not score as highly on these two metrics.

Please feel free to call or email with questions.

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, a registered investment advisory firm in Hixson, Tennessee. A 20+year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are unmanaged and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.