Why bond investments may prove inadequate for retirees

I remember a time when someone could own a portfolio of CDs and government bonds and reasonably expect to earn enough income to provide for all expenses. While these days are not necessarily gone, an investor needs to have accumulated two to three times as much (not accounting for inflation) to be able to draw the same amount income from a similar portfolio today. To achieve the same returns, it has become necessary to take more risk than it did ten, twenty or thirty years ago.

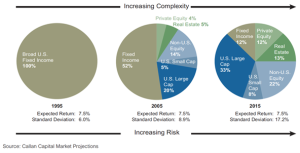

As can be seen from the chart below, in 1995 a portfolio earning 7.5% could be comprised entirely of US bonds. However, over the last 20 years, to achieve comparable returns outside of expense riddled, overprescribed insurance products, investors have been required to triple the level of risk in their portfolios. Those who cannot stomach these downturns have been forced to temper their standard of living expectations.

I never thought I would see clients excited to achieve savings account and money market rates slightly better than one percent* and three to five-year fixed annuity rates at three percent. With investors flocking to safety and the federal reserve aggressively buying bonds, investors have grown disheartened by the interest rates in “safe” instruments that are available. U.S. government bond and CD yields have reached the lowest levels of the past century and these extremely low rates make it hard for some investors to achieve their stated income goals without moving up the risk spectrum.

Why are expected bond returns so low?

We expect US Bond Investments to give extremely low returns over the next decade unless bond yields go below zero. Negative interest rates in the United States are not out of the question, considering much of Europe and Japan has seen this happen over the last decade. These negative interest rates would enable the U.S. to more easily afford interest payments but could possibly hasten the demise of the dollar as the world’s reserve currency. I do not see the Federal Reserve allowing this to happen except during brief panic periods.

Bond returns tend to be dominated by the interest rate they pay. The last time U.S. bonds were paying close to the low levels seen today, bonds and CDs lost purchasing power. As can be seen from the chart below, interest rates and bond returns at less than two percent failed to keep up with inflation rates which ranged from a high of 5.34% in the 1940s to a low of 2.23% in the 1950s during the last period we saw U.S. interest rates below two percent.

Why would anyone want to own bonds now?

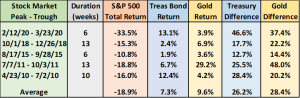

The primary reason someone would want to own bonds is to provide risk reduction and protect in market downturns. Gold also provides some of the same benefits in that investors tend to flock to U.S. Treasuries and gold in times of perceived trouble. When the market drops, treasuries and gold tend to hold up relatively well. Many times, both long term treasuries and gold start to appreciate before the market has reached its peak. A conservative investor can protect a portfolio from a market panic and even profit if he owns enough gold and treasuries during these panic periods.

The chart above illustrates this over five periods in the last ten years when the S&P 500 declined more than 10 percent. The average outperformance of long-term treasuries and gold during these periods was more than 20 percent.

How do we position ourselves given these ongoing concerns?

In the long run a conservative investor learns how much risk he can stomach and compares this against his family index number (defined as the rate of return he needs to achieve for his money to last throughout retirement). Hopefully, this family index number can be achieved without having to increase the risk parameters, but with bond yields at all time lows, this is becoming increasingly difficult.

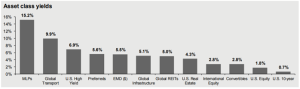

The key is to diversify as much as possible and to allow protection with U.S, treasuries and gold in panic periods and also achieve our income requirements from other sources as well. Current yields from alternative asset classes are much higher than what you can find in U.S. bonds or even U.S. equities currently. Bonds have rarely been this overvalued relative to stocks. Invariably, bonds prices will come down and yields increase to more closely match equity values and income yields or equity values will continue to increase allowing earnings yields to more closely match bond yields. We believe the former to be the more likely scenario, except during periods of panic.

Why have dividend paying stocks performed so poorly?

Dividend paying stocks have underperformed over the last couple of years, especially year to date. These slower growing companies have chosen to reward shareholders with a dividend payment and by buying back stock rather than reinvesting earnings to grow more rapidly. It just so happens that most companies in the “virtual economy” pay little to no dividend with a few exceptions.

In our early 2016 article, entitled “Got Milk”, we encouraged investors, explaining that dividend investing was even more profitable when stock prices became depressed and the dividend yields were higher. The follow-up article in 2017 entitled “Where’s the Beef” validated this line of thinking as dividend income investing outperformed most everything else during the intervening period.

The 1930s and the 1990s were other periods when growth companies so thoroughly commanded investors attention over dividend payers. Looking forward, this leads us to consider what did best in the 1940s and the 2000s. Dividend payers performed relatively well in both these decades. Smaller dividend payers and smaller companies that were trading at discounted values performed best. Looking at the 1940s in particular, it makes sense to reduce the reliance on bond investing as a means to achieve investment goals until interest rates increase to levels that make bonds attractive once again.

Where are the best values and the best dividend yields?

Outside of the U.S. we see much more attractive valuations and higher dividend yields. United States equity valuations have increased to the point that the dividend yields from U.S. companies are lower than almost all other countries. Foreign companies have much more upside than U.S. counterparts, especially if the U.S. dollar starts to decline and the U.S. economy continues to have trouble restarting. Many other countries are already well on their way in recovery. Investing in growing economies that have already come out of recessionary periods tends to provide greater success over time.

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, and CEO of Innovative Advisory Partners, a registered investment advisory firm in Hixson, Tennessee. A 20+year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are un-managed and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.