Pros, Cons, Opportunities and Traps in building an Income Portfolio

Last year we wrote a piece entitled “The Current Income Investing Dillema” in which we explained how building a portfolio solely of Treasury bonds and CDs would likely provide inadequate returns over the next decade. We also touched on when it might still make sense to own U.S. Treasuries and precious metals to diversify the portfolio and protect from market panic periods. This article can be reached by following the link below for those who need a refresher.

Read “The Current Income Investing Dilema” by clicking here.

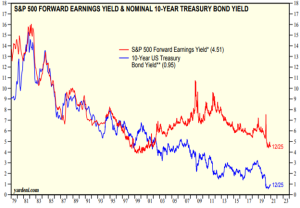

In this article we noted, “Bonds have rarely been this overvalued relative to stocks. Invariably, bond prices will come down and yields will increase to more closely match equity values and income yields or equity values will continue to increase allowing earnings yields to more closely match bond yields.”

We feel that investors are better served focusing on strategy and processes, seeking to understand opportunities and threats in the market rather than focusing on products. Products are too often designed to combat what happened in the rear-view mirror rather than seeking to look ahead to best develop portfolios to take advantage of future opportunities and avoid current risks. Investors tend to be so focused on what just happened that they completely ignore what is in the road ahead of them. Investment products are invariably designed based upon the immediate past while insightful strategies tend to look at the long-term using history as a guide. We have found that even the best investors fail to recognize threats and opportunities because what may be happening has not happened before in their lifetime. A study of longer time periods adds more clarity in these situations.

Don’t You Feel Stocks are Expensive at these Prices?

In the 2020 income article we did not touch on where we felt investors should turn for higher income in today’s environment. Many feel that equities look expensive now, but not when comparing to treasury bonds. We would rather say that equities (especially growth companies) look expensive, but bonds look even more expensive. In a world where the earnings yield for U.S. equities has historically roughly equaled the 10 year treasury bond yield, the Federal Reserve has pushed the bond yield to near zero levels in an effort to get consumers to spend and investors to take more risk.

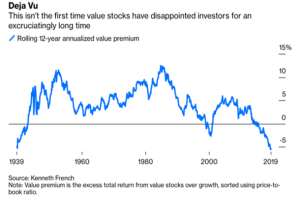

Many US and international dividend-paying value stocks can pay healthy dividends and may be less potentially volatile than growth stocks. They’re also inexpensive by historical standards because investors have focused on growth stocks and are willing to pay a premium for them. Attractive opportunities may exist in industries including leisure and travel, financials, industrials, materials, oil tankers, energy, semiconductors, and financial firms with larger-than-average dividends. As Jeremy Grantham recently noted, “Value stocks have had their worst-ever relative decade ending December 2019, followed by the worst-ever year in 2020, with spreads between Growth and Value performance averaging between 20 and 30 percentage points for the single year!”

When Will Investing for Income Become Popular Again?

We do not know when income-producing value stocks will come back into favor, but we know these things go in cycles and just as has happened every other time, growth stocks will eventually lose out to dividend-paying stocks for a time. Over the past 90 plus years when measured by 12 year rolling periods, income focused value investing outperformed growth investing during all periods except for the late 1930s, 1990s and 2010s.

The trap when investing purely for yield is that many times the most troubled companies and industries temporarily pay the highest yield as the price of the companies tend to retract. This is often just prior to a period when companies are compelled to cut or completely discontinue their dividend payments. Last year we saw airlines, cruise ships and many other industries where dividend yields alone looked attractive. Many of these same companies and industries completely eliminated their dividends in the following months. Carnival Cruise Lines paid a yield in excess of 15%, Delta Airlines paid a yield in excess of 8% and AMC Entertainment (movie theaters) paid a yield in excess of 30% just prior to cutting these dividends altogether in 2020.

Currently energy companies, miners, financial companies, reits and utilities tend to pay the highest yields. The key in investing for equity income involves investing in temporarily unloved companies and industries with good yields that have improving fundamentals. We want to make sure that earnings, profit margins and returns on invested capital are improving when we make these capital commitments.

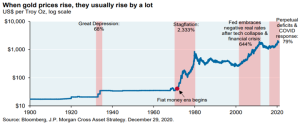

Many who read the 2020 income article asked us about our thoughts on investment in precious metals. Gold and silver prices appreciated in 2020 as many sought safety and wanted to hedge from inflation. But precious metals alone do not produce earnings or income. To get income from these types of investments, why not look to invest in those companies that mine for the precious metals? If precious metals prices increase due to dollar devaluation and inflation, these mining companies should continue to do well and be able to increase their dividends over time.

In general, the non-US versions of these companies pay higher dividends than U.S. based companies. Those foreign companies that trade on U.S. exchanges tend to pay higher dividends but also tend to be less liquid because not as many shares are traded. Over the next few years, we anticipate a growing demand to be able to buy shares of foreign companies directly on the foreign exchanges with the most shares traded to be able to get better prices and more easily acquire or unload positions. Strategies that enable investors to have access to these exchanges are likely to gain favor.

We want to watch out for those types of investments that may be hard to liquidate, especially in-light-of stretched valuations and increasing volatility. Volatility helps us find greater bargains but sometimes turns good bargains into even better bargains when we buy too soon. Patience is almost always a virtue when investing. Some types of reits, energy investments, private equity, venture capital and business development companies (especially the non-traded versions) are notoriously hard to sell when funds are needed. Many of these investment companies provided access to markets that was hard to come by a decade ago. They provided debt financing and capital to companies that banks and other institutions were not able or willing to in the period shortly after the financial crisis. But now that lending and capital markets are operating more efficiently, there is less reason for investors to consider these less-liquid investments. We feel the best time to invest in these vehicles is when companies have less access to easy financing and capital. In periods like today, the pickings tend to be slim for the investment companies that are now forming even though they are increasingly popular.

Do we want to Trade Less Liquidity for More Opportunity?

Any time we can find something trading at a price significantly less than what we feel it is worth now and in the future, we want to take advantage of the discrepancy. Usually the largest discrepancies can be found in less liquid markets, in smaller companies and undiscovered or temporarily unloved companies and industries. Foreign markets are giving us many of these opportunities currently and we feel these markets will continue to gain favor as the dollar continues to decline versus other currencies.

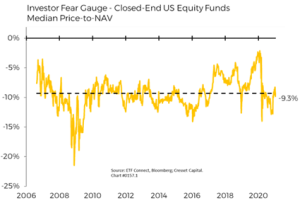

Closed end funds also offer us the opportunity to buy at a significant discount in some cases. These exchange traded funds are different from most in that they only offer a limited number of shares and typically are offered to the investing public by brokers (raking in fat commissions) in initial public offerings. These IPO periods are typically the worst time to buy them because most start trading at a discount within the next 90 days as the brokers find something new to sell. Many brokers rationalize selling these because the IPO desk only offers the “good IPOs” to those who also sell these to their customers.

However, these same Closed End Funds that start out at a 5 percent or more premium in the IPO sometimes trade at 10, 20 or even 30 percent discount after a few months. The best of these offer returns similar to regular mutual funds and if you can buy them when they are temporarily unloved can later trade closer to or at a premium to what they are worth. Many services show the current price compared to the net asset value which is what the closed end fund price would be if it were converted to a regular open-end fund. Some activist investors will sometimes buy up enough shares to force this conversion and make a tidy 10, 20 or 30% profit seemingly overnight.

These funds range from tax-free bond funds to equity funds to hedge fund type strategies. Unfortunately, some investors only pay attention to the current-yield and bid up these funds to premiums without paying attention to what they are really worth. They typically offer higher yields than most other types of funds because they take on additional leverage, which can be a benefit in good times and a curse in panic periods. The other issue is that these funds tend to trade with less daily volume than typical ETFs or open-ended funds and for larger blocks may be hard to buy or sell unless spreading the order out over a number of days. This can be problematic in panic periods if an investor wants to liquidate.

Other Strategies that May Benefit from Increased Volatility:

With volatility at higher than average levels currently, many investors are benefiting from option writing strategies. Selling puts to purchase stocks and generate extra income has become increasingly popular. Likewise, selling calls against current positions, while it may limit upside has also become popular for those who desire more income. The higher the volatility in the markets rises, the more profitable these strategies become, and they can be utilized to reduce the overall risk in portfolios if utilized correctly. Unfortunately, many times the utilization of these strategies leads to excessive leverage and more risk taking than desired. It is good to remember that most things are good in moderation but become problematic when taken to extremes.

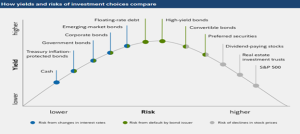

What Bond and Bond Like Investments Make Sense Here?

Any time markets and economies start to recover high-yield bonds and preferred stocks tend to become more attractive. They are the debt or quasi-debt version of value-oriented income stocks. As an example, many feel that bonds with double-digit yields issued by energy, metals companies and others are currently being mis-priced or ignored and some of these bonds may have too much distress priced into them.

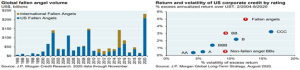

Many people like to call those bonds and preferred stocks that are temporarily out of favor, Fallen Angels. They sport BB ratings and may have fallen during a temporary weak period. BB-rated bonds sit one notch below investment-grade BBBs. These bonds currently represent around 55% of the high yield market and many feel they offer higher yields with less interest rate risk than BBBs. As fundamentals improve for these companies, bond ratings are upgraded and the bonds appreciate in value. Because a lot of uncertainty has been priced into BBs, they could deliver strong returns if markets head higher or preserve capital if interest rates rise or credit spreads widen. In 2020, the weight of fallen angels in the high yield BB rating category increased from 18% to 30%

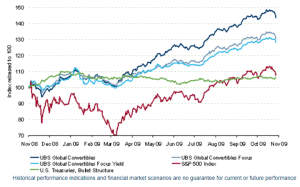

Another way to invest in growing companies and increase income in the portfolio is by owning convertible bonds and convertible preferred stock. Many of these companies’ stocks are expensive, and convertible bonds can be an attractive way to get exposure to them and get income at the same time. Convertibles offer the potential for capital appreciation of stocks, but also potential downside protection because they are considered bonds that are senior in the capital structure. Convertibles tend to be less sensitive to such interest rate risk and market declines than both stocks, and traditional corporate bonds / preferred stocks.

Just as with the equities, the non-US versions of these bonds, preferred stocks and convertibles pay higher interest than the U.S. based companies’ versions. The rest of the world is not as richly valued as the U.S. in general. As the dollar has continued to appreciate versus other currencies over the last decade, U.S. investing has gained in popularity around the world. This trend started to change in March of 2000 when the Federal Reserve lowered rates to almost zero, started buying bonds, and started printing dollars to increase the money supply. If the trend for increased stimulus, more debt and continued dollar printing continues, foreign investments (especially growing emerging market economies) will become more valuable as will precious metals, commodities and other inflation hedges. When considering where to store cash and generate income, we want to make sure we protect from these inflationary factors.

Issuing dollar denominated debt tends to protect from the worst types of inflation like was seen in pre-World War II Germany. We would also like to think that our elected and appointed officials can remember the 1970s and work to prevent something similar from happening. Considering all that has happened so far and additional measures our government is taking, the risks of inflation and dollar devaluation continue to mount. Investors would be wise to do what they can to protect from this.

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, and CEO of Innovative Advisory Partners, a registered investment advisory firm in Hixson, Tennessee. A 20+year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are un-managed and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.