September 16th was the fifteen-year anniversary of my father’s death. As many know, he passed away suddenly in a car accident and for over three years my brother and I dealt with complications shutting down his practice, wrapping up business interests and trying to close out the estate through what turned out to be an arduous, expensive and lengthy probate process.

Transforming Trials Into Blessings for Others

Our experience was one that I would not wish on anyone and has served as a catalyst that drives my passion to be a blessing to others and help them avoid some of what we experienced. Dad had done everything most people would have advised him to do in setting up his estate plan. He worked with one of the most prominent attorneys in town to craft his documents to create a well thought out blueprint for what should happen upon his demise. He set up revocable trusts and irrevocable life insurance trusts, bought insurance to provide liquidity and help pay potential estate taxes, and named executors, trustees and the like. But he made many mistakes along the way that come about all too often when people stop short of implementing well thought out estate plans.

Papa John holding his grandson Jack at the Lookouts in 2008.

One thing my father always drilled into my head is that it is okay to make mistakes. Those who reach the highest peaks do so because they have failed more than most anyone else. Michael Jordan missed over 9000 shots in his career, and Babe Ruth held the record for most strikeouts in the Major Leagues for decades after he retired. The key is to keep moving forward. Those who are most successful learn from their mistakes. Those who become more successful even more quickly learn from other people’s mistakes. I like to think my brother and I have learned from my father’s mistakes in this case, but I feel it is even more important to help others learn from some of these lessons.

Even though the focus of our practice has changed over time to focus more on financial stewardship, giving and inter-generational education / planning, I’ve been thinking more lately about why I got into the financial industry and how my focus has changed over time. Many people think of retiring when they realize it is time to leave the past behind and move onto the next act of their lives. Why not think of re-focusing instead?

“Uncle Phil — Donald Duck”

Some of my earliest memories of things involving finance were during Christmas time in the mid-seventies. My parents both grew up in a town with one red-light, one IGA supermarket, and lots of farm equipment. We’d visit the family farm in Clinton Kentucky during the holidays and spend time in town with my Granny and Granddaddy Franklin. When I was 3 or 4 at Christmas time, my uncle Phil gave me a Donald Duck piggy bank. I would walk up to my parents, grandparents, and my uncle and hold up my piggy bank. Uncle Phil and others deposited several coins to start my collection that year, and I learned addition and subtraction from counting change.

My fondest childhood memories are from our year in Australia

When I was seven, my father accepted a one-year fellowship at St. Vincents hospital in Melbourne, Australia. We traveled and did more as a family that year than I can remember before or since. We saw most of the continent, including penguins in Tasmania, the Kiwi in New Zealand, and the Kangaroos, Wallabies, Platipi, Emus, and other animals across the country. As a kid, I remember being at the beach many weekends and camping out under eucalyptus trees with the Koalas. Our year in Australia and all the fond memories of our travels are one of the big reasons we have taken our kids on numerous “learning expeditions” during the summers and breaks from school over the years. Someday I hope to take them back to Australia and show them the house we lived in during a year of my childhood.

I remember the meat pies and raisin bread were yummy, and vegemite was terrible. We had a car, but I barely remember riding in it because we walked or took the trams almost everywhere. Santa visited during the summer, and we got new bikes. My brother learned to ride that year, and we wore out several tires skidding on the sidewalks. It was a year of innocence, wonder, exploration, and new experiences.

I believe these experiences and the ability to imbed into various cultures make us better able to understand the world from a macro perspective and become more well-rounded.

We moved back to Nashville after I turned eight, and Dad joined the Plastic Surgery Group at Erlanger, moving us to Chattanooga by the time I was eleven. It was expected that my brother and I would both become surgeons like dad or possibly run a hospital pharmacy like mom. But this was not where my passion was. Dad was called into the medical profession and went through schooling for many years to hone his craft. It was his passion, but I was called to do other things.

Growing up I loved games of all types, especially board games and card games.

The best games were always the strategy games like Battleship, Stratego, Risk, and Monopoly. If the result of the game was solely about the role of the dice, it was never quite as fun. Even in grade school I loved a challenge. My “Granddaddy Franklin” was a master checkers player. I learned later in life that my father had only beaten him once and never played him again. The best part of the challenge was that I knew that Granddaddy would not just let me win. I had to earn it. We would play every year during the holidays, and I finally won against him when I was around 12 or 13.

I got more into sports in high school, playing football and running track while at McCallie. I think I was the only kid that played football or ran track that was also on the math team. My parents got divorced when I was in 8th grade, and I was an angry kid. Sports were a great opportunity to take out my frustrations in a more constructive way. My football coach, Pete Potter, was a great mentor at the time, teaching us to be mentally tough and push ourselves further than we thought we could go.

Chess is a game that we have been able to teach and play with our kids. They also play Uno and Skipbo with us now, but I really look forward to the time when we can teach them games like Rook, Spades, Hearts, and Poker. I knew I had found a keeper with my wife Jennifer, when I realized how much she enjoyed playing games. Although her favorite game is Scrabble, we spent a lot of time playing Rook and games of all kinds before the kids were born.

Many great investors are also great Bridge or Poker players. At Vanderbilt, I may have spent more time playing cards in my freshman and sophomore years than I did going to classes. When I discovered investing and finance in college, I knew this was a game that was truly challenging. There is an element of study, reading, research, strategy, and probabilistic thinking. One of my favorite classes in college was one where we researched and invested in a real money portfolio. I was always good at math, especially good in probabilities and statistics and eventually changed my major from Mechanical Engineering to Math with a concentration in Actuarial Science. After college, I almost became an actuary but eventually decided becoming a financial advisor was the best route for me.

I was attracted to investing because it is fun, but I became more enamored with financial planning because it is purposeful, and it makes a bigger difference in peoples’ lives. When you can work with a client for over 25 years and see them from pre-retirement, make sure funds last over the long-term, grieve with them when they lose their spouse, help them make sure things are going to be okay for the next generations, and maintain a great friendship, there is little that is more fulfilling. It is the relationships and what we do to help money last, maximize cash flow, minimize taxes, and help train the next generations to be good stewards that make more of a lasting impact than earning just an extra percent or two.

Formative Financial Studies

The most formative book that I read as a young investor was The Richest Man in Babylon by George Clason. “Part of what you earn is yours to keep,” is something I put into practice while still in college. It still impresses me how much further someone can go by starting earlier than another who starts ten years later. The Warren Buffet Way was another formative book from college days. I feel that Buffet is one of the best role models we can all look to from the standpoint of making sound financial and business decisions. Ever since reading The Millionaire Next Door in the late 90s, I’ve recognized that Buffett is the Quintessential “Millionaire Next Door”. I’ve always tried to live my life this way and associate more with those who have this philosophy.

My father encouraged me to read Rich Dad, Poor Dad in my mid-20s. This is another great book that teaches the value of thinking differently from those that choose to be in the “Rat Race.” We played Cash Flow with dad several times and my wife Jennifer and I played it often before we were married.

Most financial books, advice, and news have a materialistic, consumerist perspective. We’ve approached financial advice from this perspective for a long time as this is more in tune with conventional wisdom and best practices. In recent years, we have been refocusing on more biblically based planning, learning and growing through our affiliation with Kingdom Advisors, and continued study.

The Bible has roughly 2350 verses concerning money, almost twice as many as the verses about faith and prayer combined. Jesus in his ministry taught more about money than anything except for the Kingdom of God. We are spending more time talking with clients about financial stewardship, giving and training the next generation to also be good stewards. We believe that biblically focused financial planning is more purposeful, making a difference in this life and the next, furthering His kingdom.

Finding Freedom

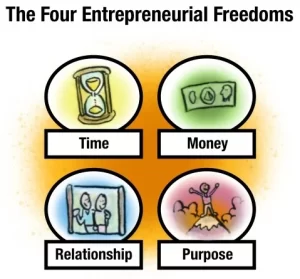

At an early age, I was starting businesses. I dropped out of college originally because I felt more fulfilled starting and running an office for Cutco cutlery. My parents were not happy that I did not feel like going back to school at the time, but I valued my freedom. In life we all want to maximize our freedom to choose how we can spend our time and money in the most fulfilling ways. We are also able to choose whom we spend our time with to fully cultivate and enjoy the most uplifting relationships. Our country was founded and originally focused on providing maximum freedom to her citizens through the Bill of Rights. These freedoms are what I am always looking to maximize but “Freedom of Purpose” is what I value most.

Making Dreams a Reality

At Franklin Wealth our Mission is to inspire and empower everyone to turn their dreams into reality and achieve purposes greater than themselves. In recent years, I’ve struggled with my purpose and finally realized that God has me right where he wants me. I just want to keep my focus on Him and furthering His kingdom. Discovering and integrating my God given purpose into my life and work is likely the biggest issue I’ve been working through over the last decade. I believe part of my purpose is helping others discover and fulfill theirs as they move onto the “3rd Act” of their lives.

Forbes recognizes Joe Franklin as one of the Top Advisors in Tennessee.

4700 Hixson Pike

Hixson, TN 37343

(423) 870 – 2140

www.Franklin-Wealth.com