How Long Do We Wait?

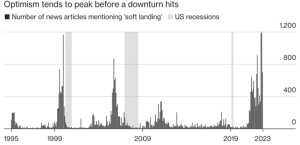

The newscasters keep telling us that we are heading for a soft landing and that the economy is strong. At the same time, Warren Buffett and many other investment managers are sitting on record amounts of cash. From what we can tell, Warren Buffett is more bearish now than he has been since 1974. He wants to have plenty of cash available to buy companies when they get cheap enough. But the average investor and the media seem to think the party will never end.

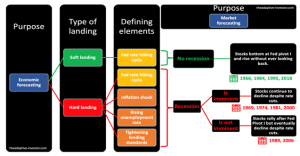

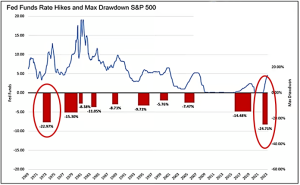

I’ve spent over a quarter of a century advising clients about retirement, tax strategies, and investing. During this time, the U.S. has gone through 5 hiking cycles where the Federal Reserve was working to stave off inflation. The first of these hiking cycles in the mid-1990s never led to an inverted yield curve or a rise in the unemployment rate. We experienced a soft landing in 1995, and the rest of the decade gave us a booming stock market.

Things have been different ever since then. Every time inflation started to rear its ugly head, the Federal Reserve started raising rates, the yield curve inverted, banks tightened their lending standards, unemployment started spiking, and eventually we entered into a recession and a “hard landing.”

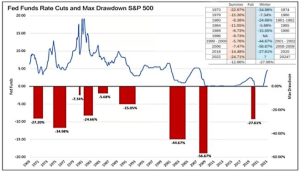

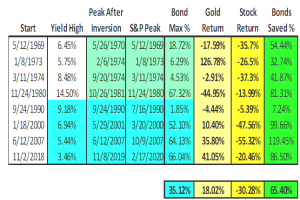

In some of these cases, like 2019 and 2006, the markets continued to rally even after the Federal Reserve started cutting rates. Typically, the stock market peaks before the Federal Reserve cuts rates and the markets enter a bear market selloff. Going back to 1968, when there has been an inverted yield curve, at least 2 consecutive months of increasing unemployment, and the Federal Reserve cuts rates, the average market peak is 67 days before this rate cut.

The selloff during a rate hiking cycle pales in comparison to the market selloff once the Federal Reserve starts cutting rates. Prior to 2022, the worst “summer” selloff was less than 23%. The 2022 selloff exceeded this. Market selloffs that coincide with recessions are worse. The average “summer” selloff is less than 13% while the average “winter” selloff is over 27%.

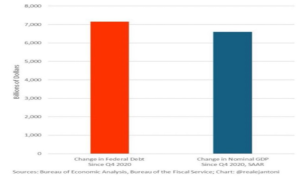

Government spending has kept the recession at bay. The U.S. has spent over $7 Trillion over the last couple of years to grow the economy by a little over $6 Trillion. We’ve been running the economy on “borrowed” time. Job openings tend to lead the stock market, but the market has been acting stronger for a few months now.

How to Recession Proof Portfolios

When the Federal Reserve cuts rates tomorrow, it may be wise to follow Warren Buffett’s lead and start raising cash if you have not done so already. Those who want to profit the most from a “hard landing” recessionary selloff will look to long term treasury bonds and gold as key parts of their portfolio.

Treasuries are becoming less popular now that many countries want to limit their exposure to U.S. dollars, but we expect U.S. treasuries to continue to be the best flight to safety investment for most retirees for the rest of their lifetimes. Since the 1960s, those who invested in long-term treasuries during recessions have fared best, followed by those who invested in gold. Investors made the most profits shifting to longer term treasuries when the Fed funds rate dropped below the 10-year treasury yield.

When will the market peak? It’s possible this already happened in July. It’s also possible we could go several months before this happens. Warren Buffett would tell you that he has no idea when the markets will peak or what will happen next week or next month, but he does have a feel for when markets are expensive, the economy looks weak, and it may be a good idea to raise cash.

More Data:

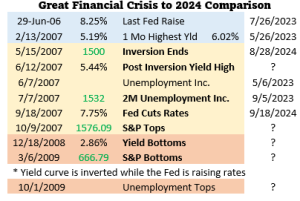

Here we are looking at how the dominoes fell prior to the “Great Financial Crisis.” During this period, we did not have the rampant government spending that we are seeing currently or the amount of borrowing on credit cards. However, consumer spending was fueled by people taking equity out of their homes. Many people had negative equity with their homes because banks and mortgage brokers were incentivized to lend based upon income with no documentation and aggressive home appraisals.

Before the Great Financial Crisis, the Federal Reserve stopped raising rates in mid- 2006. Shortly after, short-term bond yields peaked at 5.19%. The yield curve returned to normal in May of 2007 and unemployment reports showed at least two months of increases in July 2007. The Federal Reserve then cut rates on September 18th, 2007 before the market peaked on October 9th of that same year.

These things tend to repeat. This time around the short-term bond yields peaked at 6.02% on May 26th of 2023, the Federal Reserve stopped raising rates two months later on July 26th, & unemployment reports showed two months of increases in early September 2023.

Most recently the yield curve returned to normal when considering the 10 year treasury yield is once again above the 2 year yield as of August 28th and the Federal Reserve is expected to cut rates tomorrow.

During the Great Financial Crisis, the markets peaked in less than 30 days after the first Federal Reserve Rate cut. Looking at the last 8 “hard landing” recessions going back to the late 1960s we would expect the market to have already peaked prior to the first Federal Reserve rate cut (the average number of days the market peaked prior to the cut is 67 days). The most probable market top would be the high we saw in July. We can look to three periods out of eight where the market moved higher after the first rate cut. The first was 1989 (406 days), 2019 (203 days) and 2007 (21 days). In any event, we still feel that getting more cautious with a greater percentage of portfolios in treasuries and gold is warranted.

Joe Franklin has been named by Forbes as one of Tennessee’s Top Advisors!

Franklin Wealth Management

4700 Hixson Pike

Hixson, TN 37343

423-870-2140