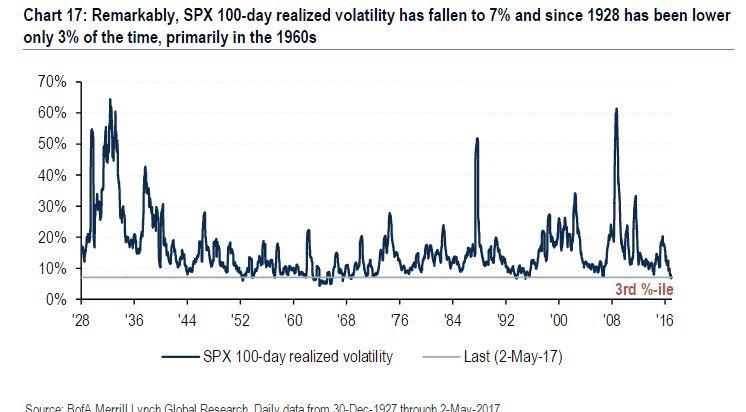

My children finished out their last days of school this week. Sydney will be heading off to middle school after the summer and all three of them are thinking much more about what fun they will have over vacation than anything else. The month of May usually starts off a summer period in the markets that leaves us with less to be excited about than other times of the year. Investors started off last week with few worries. It seems the average U.S. investor is extremely comfortable and when this is the case, we tend to get a little concerned. The VIX index (sometimes referred to as the “fear index”) measuring investor’s expectations for volatility in the S&P 500, closed at a new 20 year low earlier this month. All this changed mid-week , when reporters started predicting Tuesday evening that Trump’s decision would roil markets on Wednesday. While the politicos and the press salivated, investors reacted with a buy the dip mentality and volatility measures are now approaching new lows again.

How the market digests any new admissions in the days and weeks ahead is anyone’s guess. Like predicting the weather, it’s extremely difficult to accurately and consistently predict short-term market moves, but the markets are more rational over long time horizons.

It seems the market sees this as political noise and not really a serious economic event. It’s sort of like Syria, North Korea, or the recent French election…or the March failure by the House to pass health care reform…or its subsequent success in May. These political events have done little to impact the markets and it seems the markets are only concerned about one thing.

Corporate Earnings are Still Growing

Stocks soared last November amid expectations of business-friendly tax reform, more recently, a strong first quarter earnings season, upbeat forecasts, and stronger global growth have really picked up the slack. Low interest rates and low inflation generally support higher valuations as well.

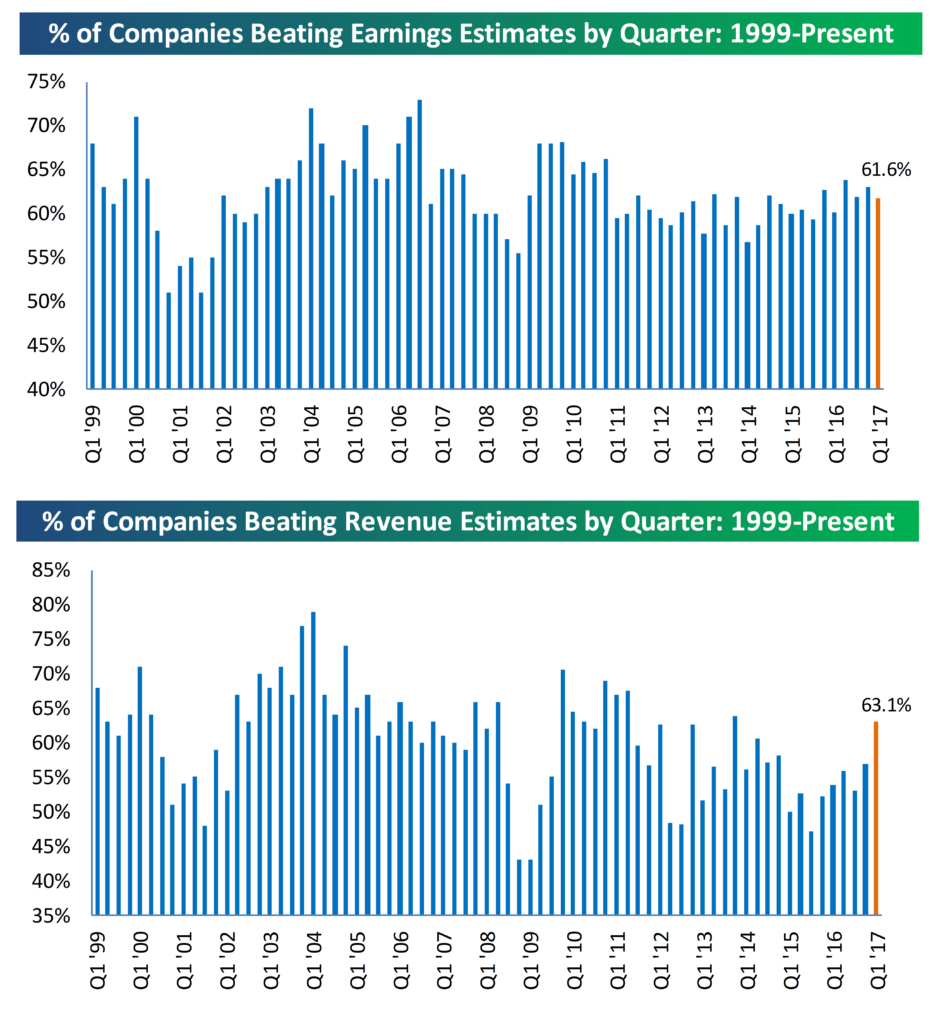

Earnings season ends next week with the Walmart report. With over 2,300 companies having reported, you can see the top chart showing earnings and the bottom chart showing revenue. The current readings are impressive with both earnings and revenues exceeding estimates at a clip of over 60%, as can be seen from the charts below, provided by Bespoke.

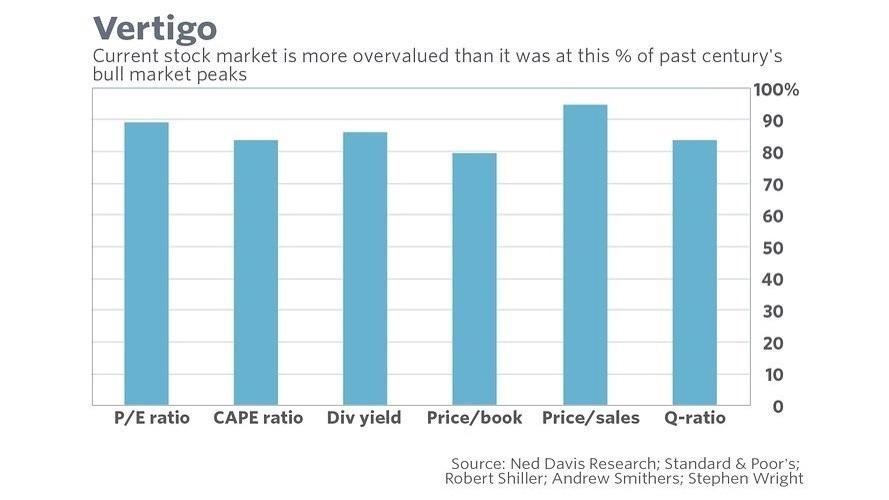

U.S. company valuations look expensive by almost any metric one can devise (see below) until we start thinking about how a corporate tax rate cut would immediately impact earnings. But, it seems most large multinational U.S. companies are already enjoying lower tax rates through overseas subsidiaries and the markets may already be pricing in these tax cuts.

Thoughts on the Trump Tax Plan

The plan only comprises one page but there is one very interesting component: the deductibility of state and local taxes. It bears watching which states have the highest state and local taxes because if residents in those states can’t deduct them anymore, we don’t see them being very happy.

According to TrendMacro, 50.5% of the aggregate tax deduction amount is shared by 6 states…California, New York, New Jersey, Illinois, Maryland and Massachusetts. Most of us know which way these states lean politically.

Since the Republicans in the Senate can pass tax changes for 10 years without a single Democrat vote, it’s possible that this becomes a huge negotiating point. The Republicans could offer to strip removal of state and local tax deductions out of the plan in exchange for votes. With 60 votes, the tax reform could be permanent without any sunset provisions in 10 years.

Many feel there is a good chance of permanent tax reform with 60 votes on a package that does not include the state and local tax deduction as these congressmen facing looking to get re-elected feel the pressure to save their constituants from losing these deductions.

Some would say that permanent tax reform could be a catalyst for the current rally to continue. Others might adhere to the “Buy the rumor, sell the news” mantra and be looking for a chance to invest elsewhere. We would be looking overseas.

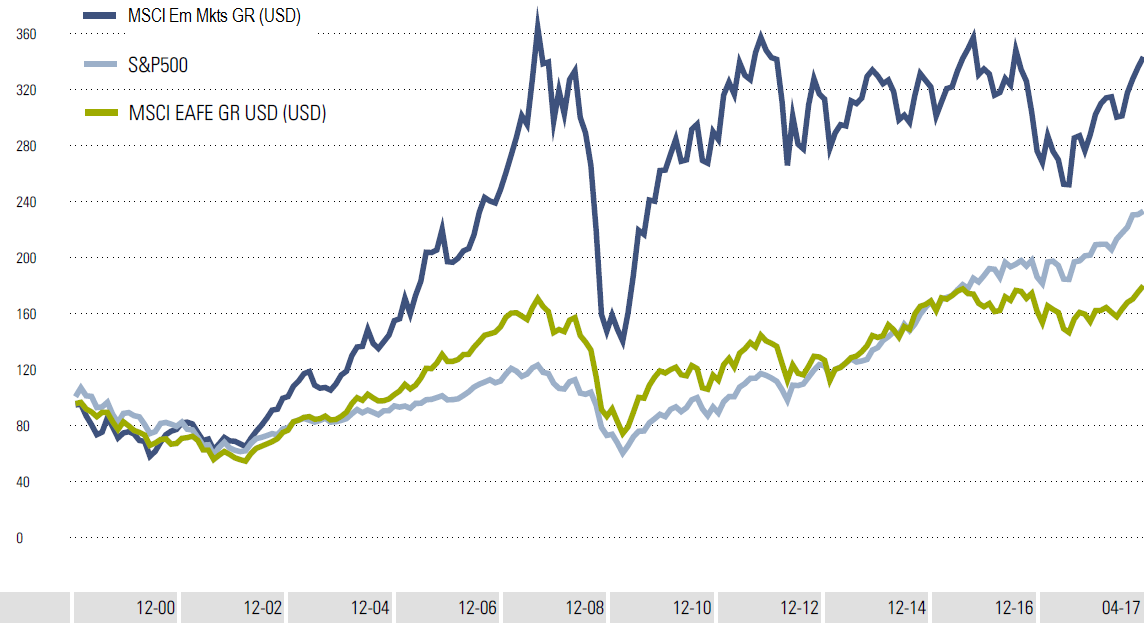

Emerging markets and non-US equities in general are starting to gain momentum. Overseas equity valuations have rarely looked cheaper relative to the U.S. When the dollar starts to weaken, it is likely we will see non-U.S. equities (green) outperform again like they did most of the previous decade. Jeffrey Gundlach, who some describe as the “new bond king” in his presentation to the Sohn Investor Conference earlier this month recommended going so far as to sell short the S&P 500 (light blue) and buying emerging markets (dark blue) noting volatility in U.S. equities was “insanely low” and emerging markets are “significantly cheaper”. He notes that with momentum picking up in areas such as India, China, Singapore and parts of Latin America, valuations should eventually re-align. We would tend to view the current situation similarly. While we do not necessarily believe emerging markets will appreciate as much as in the 2000-2007 era, we believe these markets should break out of their 10 year trading range and see more vigorous expansions.

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, and CEO of Innovative Advisory Partners, a registered investment advisory firm in Hixson, Tennessee. A 20+year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are unmanaged and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.