Founder and former CEO of Netflix, Marc Randolph spoke at to a group of us last week about the power of ideas and entrepreneurism at the annual Excell meeting in Las Vegas. It was refreshing to hear which experiences have shaped his thinking and most importantly how he has learned much more from his failures than his successes. It was most interesting to learn how they scrapped the most profitable segment of the business at the time (video sales) to focus on rentals and transform the industry.

Marc shared with us the power of ideas, how the ability to be nimble and provide choice to the public created a much better solution for everyone. The false starts they encountered trying to do things like the industry leader, eventually led to phenomenal growth because they started trying something new and didn’t know any better.

The outlook for Netflix at one point was so bleak that Blockbuster rejected an offer to buy them at what they considered a laughable valuation. At one time Netflix had gross revenues of $5 million with $50 million in debt and it didn’t look like the company was going to survive the next payroll. But they managed to stumble upon the eventual recipe that allowed them to outflank Blockbuster and drive them out of business.

Marc shared with us how they became extremely efficient at testing new ideas and theories for what the public was going to gravitate toward. They progressed from where they could run a test once a week to multiple times a day and they kept throwing things against the wall until eventually three things finally stuck.

1) Subscriptions, 2) No Late Fees, 3) The Que

Today we all know the success of those three foundational ideas. The “Subscription Based Model” combined with “No Late Fees” allowed them to effectively warehouse all their inventory at customer’s homes. The “Que” was an even better discovery in that combined with the subscription model they didn’t have to worry about customers ordering again because as soon as the DVDs were shipped back to Netflix they already had the next one ready to arrive.

Customers no longer needed to rush to the video store to return a movie before they were hit with an onerous late fee. They now had more choice with a much greater variety of content, unlimited viewing times and the flexibility to never have to leave their home.

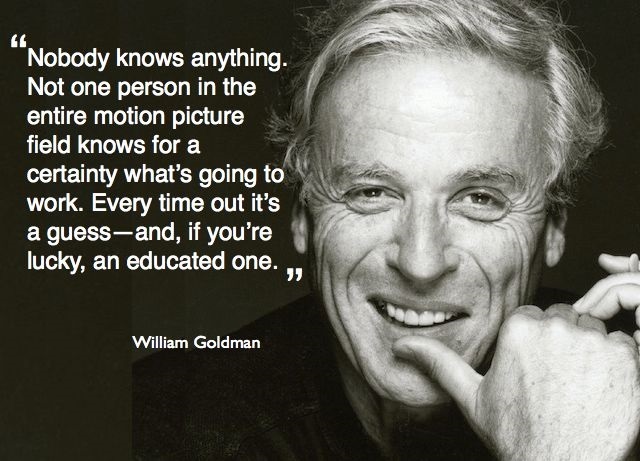

For Netflix, they did not have a clue what was going to work until they tried it, but they became extremely efficient at trying something new and kept throwing things against the wall until something stuck and luckily it eventually stuck in a BIG way!

Marketplaces are changing at a rapid pace today. The financial industry is no exception and it’s those that will be able to capitalize on ideas, embrace technology, and maximize human capital that will come out on top.

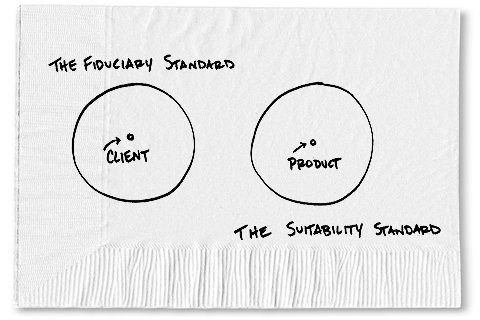

Two key themes we are stressing within our organization to better serve clients are technology utilization and flexibility. When we originally formed Franklin Wealth Management we looked for a custodial firm that would allow us to be the most flexible providing what was in the best interest of the client while keeping client assets under one roof. As we have grown, we realized that by utilizing multiple custodial firms, we could provide a much richer experience for the clients in that some types of offerings are much better suited for clients at one firm than another. Technology at one firm may be a better fit for a given client or certain solutions may be more readily available at firm A rather than firm B. As a Registered Investment Advisor acting as a fiduciary, we owed it to our clients to allow them to work with the custodial firm that was in their best interest or multiple ones in some cases. We have also been able to advocate for better pricing for our clients over time by being multi-custodial as well.

If an advisor maintains a securities license, he or she is required to disclose personal assets or outside client assets at other custodial firms for supervisory purposes, but we are very fortunate that we are able to shop for the best solution in multiple stores for the best interest of our clients rather than being forced to only be able to visit the “super-store”. We want to free our clients from proprietary products and programs and free advisors ready to break away from the chains of the “super-stores”. We have the freedom from being forced to sell mortgages, firm services and other items that is clearly in the best interest of the store rather than the client and we feel other advisors should have the same freedoms.

I was also blown away with some of the new technological marvels Howard Tullman (The head of the Chicago based think-tank 1871) shared with us. Imagine running out of detergent and being able to press a button and have your favorite brand delivered within the hour or being able to go to the store and having a scanner check you out as you are leaving. Imagine being able to walk to the local parking lot, pick the car you want and only pay for the miles you drive that day. Imagine being able to digitally print parts at less than shipping costs or being able to wear earbuds that translate to your native language when in a foreign country. These things are all available today and the pace of change is expanding exponentially.

Click the picture above to view another recent talk from Mr. Tullman at the University of Chicago.

Click the picture above to view another recent talk from Mr. Tullman at the University of Chicago.

We as a company have positioned ourselves to be able to better take advantage of these new options by offering more flexibility and continually working to improve. We feel it is in the best interest of our clients to be able to be free from the pressure to push proprietary products and be able provide a full smorgasbord of technological and service offerings. Likewise we feel that advisors, if they truly want to make a difference for their clients should do what they can to be able to shop outside the “super-store” to find best in class solutions. The client should be what is most important, not the store.

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, and CEO of Innovative Advisory Partners, a registered investment advisory firm in Hixson, Tennessee. A 20+year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are unmanaged and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request