Buffett’s 2024 Shareholder Letter – Banks and Black Swans

Using the Portability Rule to Save Taxes

Pitfalls of Holding Assets Jointly

How does adding children as joint tenants mess up estates? What is the difference between Community property states and other states? When do you not want to default to tenants in entirety when holding assets jointly? In this video we answer these questions AND MORE.

12 Days of Christmas – Finance Style

Give Yourself a Tax Break for Christmas

How to Plan for the 2025 Tax Increase

Reasons to NOT Roll your 401k into an IRA

A Great Opportunity for those Anticipating Large Capital Gains

An Opportunity to Help my Mother My mother has been filing taxes on her own over the last few years. Even with my step-father passing away in 2020, she did not have many issues filing taxes until this year. In 2021, we were able to defer six months of the gains in her portfolio […]

Year-End Selling Strikes Again

We only have a couple more weeks to profit from various Year-End Portfolio Strategies. Investors looking to improve their overall portfolio returns often turn to tax-loss harvesting as an end-of-the-year opportunity. This amounts to selling some stocks or assets that have fallen in value and using the losses to help offset capital gains tax liability, […]

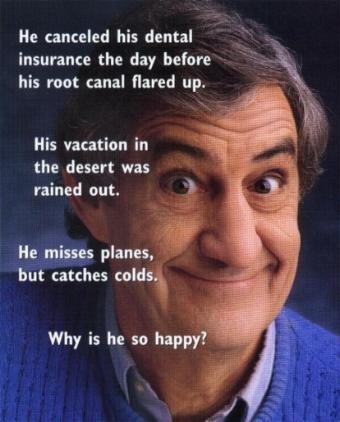

Tax Strategies for Year End – So Even Louie the Loser can Win!

With the end of the year rapidly approaching, there are many clients who are asking what they should be doing now to save on taxes before time runs out and we enter 2019. Even with the markets currently down for many stock indices, some clients may end up paying capital gains taxes on long term […]