As Berkshire Hathaway shareholders, we get an opportunity every year to hear what Warren Buffett is thinking from a layman’s perspective. In writing this annual letter he wants to explain concepts and actions in a way so that most any intelligent yet less financially involved outsider can understand. What he does not say is almost as important as what he does say in these shareholder letters. He will rarely mention companies where he is actively trying to acquire more shares. Recently mentions of Sirius XM and Liberty Media have been few and far between, while mentions of Chevron and Occidental Petroleum have consistently been more conspicuous. It may be that although Buffett is still buying energy companies, he feels what he has to say may have less impact in keeping him from buying more at good prices. What takeaways should we pull from what Warren has to say, reading between the lines, based upon what he explicitly had to say last week?

Cash is King

Buffett referred to the Financial Crisis of 2008 multiple times in last week’s shareholder letter. He noted that Berkshire’s cash and treasury bill position is larger than ever before, sitting at $168 Billion. He consistently mentioned how this cash position compared to 2008. He noted that he wanted to make sure he had plenty of dry powder available to purchase great companies at fair prices but has not been finding much at fair prices recently. Earning over 5% on cash, Buffett sees less need to deploy capital unless he finds more favorable large opportunities. He has noted that he does not like to see his cash and bond positions grow to over 20%, but given this percentage is now currently a third of the portfolio of companies not 100% owned by Berkshire, we can reasonably say that it may be a time to wait for a pullback and better values. Short term treasuries also seem to be a safe place to protect from possible black swans in hiding (see video below).

Is a Recession Imminent?

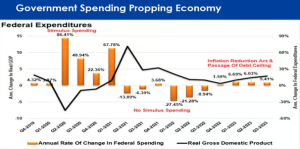

Buffett did not directly make any mentions of upcoming recessions or market crashes, but given the size of his cash and treasury bill position and his references to 2008-9 on multiple occasions, it seems he has readied Berkshire Hathaway for rough waters ahead. In 2023 the widely expected recession did not happen although, Germany, Japan and the U.K. have all officially declared that their economies are now in recession. Some believe that the recession in the U.S. was avoided or delayed due to the government spending made available through the Inflation Reduction Act and the Chips Act. We do not see much in the way of additional spending available for the U.S. government unless congress passes another bill soon or some emergency measures are enacted, however.

Janet Yellen is likely to continue issuing short term debt to fund the government until sometime past April 15th when tax receipts provide additional cash. What concerns us is that not many countries want our treasuries at current yields. The auction at the end of October 2023 was dangerously close to failing and there has been slippage in yields where the government has not been able to get yields as low as they would like. Most of the funds to buy treasuries have been coming from the banks as they have been selling down the dollars they have been holding in the Federal Reserve Reverse Repurchase program. At the current rate of drawdown, this source of funding is likely to run out in April.

Buffett is selling Technology Holdings?

Although Apple is currently Berkshire’s largest holding, it was mentioned very sparsely by Buffett. In the fourth quarter, reports show Berkshire was selling Apple and Hewlett Packard. It is likely this selling has continued into the first quarter of 2024 and Buffett is waiting as long as possible to disclose this. It is clear he believes that Apple is a great brand, but he may also believe that the company is too richly valued at these prices, especially considering growth has slowed recently. Likely Buffett believes that other more appealing purchases may present themselves over the next few months and he wants to be prepared. That said, it is highly unlikely the Apple position is abandoned or even reduced to anything less that the largest holding for some time.

Buffett prefers buying American

Occasionally Berkshire Hathaway has ventured into foreign markets, but these holdings have never become one of his top holdings. Currently, U.S. holdings make up over 90% of Berkshire’s publicly traded portfolio. Japanese investments have been increasingly mentioned in recent years but the portfolio concentration in the 5 companies originally bought in 2019 has not moved beyond 5% of the portfolio. In 2023, Buffett sold all of his holdings in Taiwan Semiconductor and Chinese battery maker BYD. At the time he mentioned that he felt the former was the best run semiconductor manufacturer in the world but that he was concerned about geo-political risks associated with China. We also like Taiwan Semiconductor but with shares hitting new highs, the market for semiconductors seemingly frothy, and concerns with China, we exited our position recently.

What about Banks?

From 2009 at the end of the Financial Crisis to 2014, Buffett was consistently growing his bank portfolio. In recent years he has been unloading bank stocks, hitting a long time low in holdings as a percentage of his portfolio as of the end of 2022. Over the last four years, this sector has shrunk from over 40% of the portfolio to now under a quarter. Berkshire Hathaway still owns positions in Bank of America, American Express, Jeffries and Ally Bank. He no longer owns any Wells Fargo, US Bank, JP Morgan, BNY Mellon or M&T Bank as he did prior to 2022. When Silicon Valley Bank, Signature Bank and others failed last year and the Fed came to the rescue, Buffett saw an opportunity to buy Capital One. (We were buying at that time as well). Buffett has always had a good feel for banking and financial services companies. When he is primarily selling and finding very few additional banks to buy, even when many drop to multi-year lows, it is likely because he has additional concerns. In early 2023 Buffett noted “I don’t like it when people get too focused on the earnings number and forget what in my view are basic banking principles. I did think that banking could get in a lot of trouble just because of the kind of things that they did,” he continued. “I didn’t like the banking business as well as I did before.”

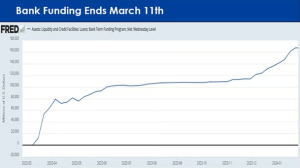

Another cause for concern for banks revolves around the expiration of the Federal Reserve Bank Term Funding Program. Many banks relied on the Fed for additional liquidity last March after the first round of bank failures. On March 11th the Federal Reserve will no longer be providing funds to banks through this program. Banks have increasingly been relying on the Fed to provide loans with treasury bonds as collateral for the loans. This was to allow banks to not need to sell treasuries at a loss as many banks were losing deposits. With interest rates at similar levels to March of 2023, it is likely that these banks may still have losses on their books. It’s likely chairman Powell has concluded that the failure of a few additional banks like New York Community Bank and others is acceptable as part of his “controlled demolition” initiative. Unfortunately, sometimes these things get out of hand and it is likely Buffett is wanting to keep his exposure at multi-year lows for this reason.

Prospects for Berkshire Hathaway’s Future

Buffett made reference to the fact that he believes Berkshire’s performance may not be as strong going forward because of size limitations. Most everyone else has an advantage over Buffet in one sense because with an investment portfolio worth over $500 Billion, the universe of investment opportunities that can make a significant impact to portfolio returns diminishes. That said, if we want to own some of the largest, best managed companies in the U.S., Buffet owns most of these and has proven himself over many decades.

Forbes Recognized Joe Franklin as one of the TOP Advisors in Tennessee

Franklin Wealth Management

4700 Hixson Pike

Hixson, Tn 37343

423-870-2140