THOUSANDS SAVED ANNUALLY THROUGH YEAR END TAX STRATEGIES

Most years, my wife and I enjoy visiting with clients as we make deliveries to clients and play Santa Claus at Thanksgiving. We enjoy not only giving gifts but spending time chatting with clients and sharing all that is going on with our families and plans for the future. This period sets up a time for lots of parties and get-togethers, but also a lot of planning as we head into the new year.

With the end of the year rapidly approaching, there are many clients who are asking what they should be doing now to save on taxes before time runs out and we enter 2024. Even though some are still hurting from the 2022 downturn, clients may end up paying capital gains taxes on long-term holdings and need to find ways to offset these. Below are some strategies we typically utilize this time of year.

YEAR END CAPITAL GAINS OFFSETS

Tax loss selling is a strategy that many fail to fully utilize. Many people understand that they can offset all gains in any year by finding losses in their portfolio and selling the losing securities. Taking these losses now can keep them from having to pay a potentially significant capital gains tax. If all capital gains are offset by capital losses, a taxpayer can utilize up to $3000 per year to also offset other income.

What many fail to realize is that losses incurred in a previous year can be carried-forward to offset future gains as well. Failure to realize the losses may keep someone from fully realizing future tax benefits. It is also likely that losers will continue to drop at least until the first of the next year. A smart individual once said “An object in motion tends to stay in motion unless acted upon by an outside force”. This tends to be true with stock prices, especially toward the end of the year when portfolio managers and those getting rid of losers for tax purposes tend to lighten their portfolios. After January 1st, sometimes the trend changes as investors buy these securities back after 31 days, although others may find more appealing replacements before then. Please keep in mind that you may not repurchase a previously sold security and maintain the tax loss if the purchase is made before 31 days has expired.

OPPORTUNITY ZONES AND 1031 EXCHANGES

Most accountants understand what it means to defer the capital gains with 1031 exchanges for properties. Not as many are familiar with deferring capital gains using Opportunity Zone funds in client portfolios. We’ve been able to explain that this is very similar to deferred payments via a 1031 exchange on properties. The difference is that the Opportunity Zone deferral is allowed for gains on any asset. In contrast, the deferral with a 1031 exchange is only allowed to defer payments on the property if later invested in a “like-kind” investment property. This flexibility allowed us to defer significant capital gains for several clients on sales of stock in portfolios and other asset gains, since this became available a few years back.

When looking for holdings that we can sell to offset gains in taxable portfolios, sometimes it is harder to find holdings to sell at a loss. When this happens it may make sense to purchase Opportunity Zone Property or an Opportunity Zone fund. The tax filing might not be familiar to many CPAs, but this strategy allows gains made in one year to be deferred over several years and save or defer thousands to millions depending on the year.

For more please click the link on Deferring Capital Gains through Opportunity Zones.

CHARITABLE GIFTS

Many times clients like to make gifts of appreciated stock to qualified charities. This allows for the charitable tax deduction. It also helps avoid having to pay taxes on the gains when the stock is sold by the charity. If an individual has been looking at reducing his or her exposure but is subject to a significant tax burden upon sale, this strategy may be beneficial. Those holding shares of stock in one of the “Magnificent Seven” may find this a good strategy to reduce their exposure without the tax burden associated with the capital gain.

CAPITAL GAINS TAXES ON LOSING INVESTMENTS

It seems that every year in December we get a multitude of calls from clients regarding a pretty common occurrence for certain types of investments. This month, most mutual funds pay out their capital gains to shareholders and the value of the associated account falls for a few days until the money is reinvested or paid out. Even if a fund is down it may still be scheduled to pay out capital gains. When this occurs, you may notice that the investment paying out the capital gain will decline in value by an amount equal to the capital gain to be paid. Within a few days, the capital gain will be credited to the account. While generally speaking, a capital gain means an investor made money on an investment this is not always the case with those who have held the investment for only a short period of time.

For more on limiting these capital gains, please feel free to click the following link:

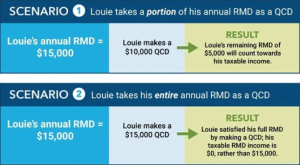

REQUIRED MINIMUM DISTRIBUTIONS AND QUALIFIED CHARITABLE DISTRIBUTIONS

Clients 73 or older must take a Required Minimum Distribution from their IRA and/or their Qualified Retirement Plan for the 2023 tax year. All distributions must be taken by December 31, 2023, with the exception of RMDs for clients who turned or will turn 73 during this calendar year. These clients may defer their first distribution until April 1, 2024, although we commonly recommend clients take this first distribution during the year they turn 73 to avoid a larger distribution amount and higher taxable income. Failure to bite the bullet can cause an individual to end up in a higher tax bracket and not taking this distribution altogether may result in a 50% IRS Penalty on the amount not withdrawn.

Avoiding the tax on this distribution is possible for some charitably minded individuals. Any amount up to $100,000 given directly to a charity does not count toward 2023 taxable income if the funds are taken out before December 31st and are sent directly from the IRA custodian to the qualified charity. Only IRAs and inactive SEP IRAs / Simple IRAs are eligible for this planning strategy. Retirement accounts with a previous employer like 401ks do not allow for these “QCDs”. Using this strategy has been more advantageous in recent years as more people have a standard deduction which exceeds their itemized deductions. This is likely to be the case at least until 2025 when itemized deductions are likely to be cut in half with the sunset of current tax schedules.

For more read: Beat The Clock -Last Minute Qualified Charitable Deductions

WHAT ABOUT ROTH IRAs?

It is worth noting that Roth IRAs are not subject to these pesky Required Distributions (unless inherited). Contributions to and Conversions into Roth IRAs are never taxed again as long as the five year holding period is satisfied and the distribution is after age 591/2. Many people try to get their IRAs converted to Roth IRAs, just to avoid the Required Minimum Distributions but enjoy additional benefits such as potentially reducing the taxation of Social Security and longevity of assets. It is striking how over a 30 year retirement, tax free distributions can allow for significantly more income over time than distributions out of taxable retirement plans. We have seen instances where the total income is twice as much or greater. With the repeal of “re-characterization” or the “do-over rule” it makes more sense to wait until the end of the year to make sure this is a good idea. Down markets, lower taxable retirement income, and long time horizons with anticipated tax-free growth make this strategy more appealing, especially toward the end of the year.

To read an article in Forbes on Tax-Free Retirement, please feel free to follow the following link:

- The Road to a Tax Free Retirement – Forbes.com, March 12, 2015

If you would like to talk about any of these tax strategies before the end of the year, please feel to give our office a call. More can be done before Christmas rolls around than after the New Year.

Joe Franklin has been recognized as one of the TOP ADVISORS in Tennessee

Franklin Wealth Management

4700 Hixson Pike

Hixson, Tn 37343

423-870-2140

www.franklinwealth.com