“It’s the lens through which your brain views the world that shapes your reality. And if we can change the lens, not only can we change your happiness, we can change every single educational and business outcome at the same time.”

― Shawn Achor, The Happiness Advantage

This past week Tyler and I had the opportunity to visit Chicago, catch up with several industry peers and learn the latest strategies and thoughts from many wealth managers and portfolio managers around the country.

In our conference, the first keynote speaker of the morning was Shawn Achor. Some of you may already be familiar with him in that he gave a talk at a TED conference a couple of years ago that has since become one of the twenty most viewed talks in the history of the conference. He is also the author of the book The Happiness Advantage and definitely made an impact on myself and several others a few days ago. So much so that I decided to write this weeks blog on happiness.

Mr. Achor showed us how the typical formula for creating happiness in our lives is clearly flawed as he relates below:

The formula is clear: Work harder, then you’ll be successful, then you’ll be happier. When I asked some of my Harvard students, their answer was easy: “I’m working my butt off now so I can be happy when … [fill in the blank with a six figure banking job, make a scientific breakthrough, get into medical school, etc.].”

But here’s what these brilliant students often forget: Getting into Harvard was supposed to make them happy. How many of them in high school thought they’d be happy once they got in? Why didn’t the success then happiness formula work?

It’s hard to find happiness after success if the goalposts of success keep changing.

Now for the good news. Based on the findings in “The Happiness Advantage,” If you reverse the order of the formula, you end up with greater happiness and greater success rates. Happiness and advantage, and the precursor to greater success.

Every single relationship, business and educational outcome improves when the brain is positive first. If you cultivate happiness while in the midst of your struggles, work, at school, while unemployed or single, you increase your chances of attaining all the goals you are pursuing, including happiness.

So how can we pursue happiness right now? When I was counseling overwrought Harvard students, one of the first things I would tell them is to stop equating a future success with happiness. Empirically, we know success does not lead to happiness. Is everyone with a job happy? Is every rich person happy?

Then, step one is to stop thinking that finding a job, getting a promotion, etc. is the only thing that can brings happiness. Success does not mean happiness. Check out any celebrity magazine to look for examples to disabuse you of thinking that being beautiful, successful or rich will make you happy.

Second, realize that happiness is a work ethic. Happiness is not a mystery. You have to train your brain to be positive just like you work out your body. We not only need to work happy, we need to work at being happy.

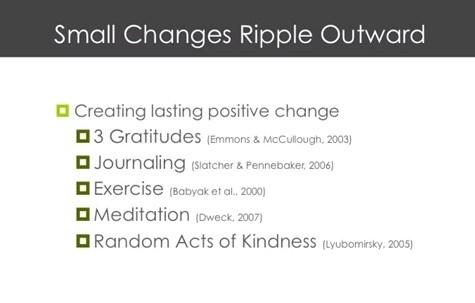

In our office we try to emphasize that the first step to changing your state of mind is to change your physiology. Smiling, acting enthusiastic, walking tall and sitting up straight can all do wonders for improving someone’s outlook. Why not try incorporating these other habits into our daily lives. Can you see how incorporating these habits into our daily lives can have a high likelihood to help almost everyone feel better in the short term and over the long run?

Mr. Achor recommends trying one or more of the five researched habits above and doing them for 21 days in a row to create a positive new habit. You may be surprised how you feel.

To see Mr. Achor’s TED talk, click here.

To see Mr. Achor’s recipe for happiness, click here .

AND THE CURRENT TREND CONTINUES?

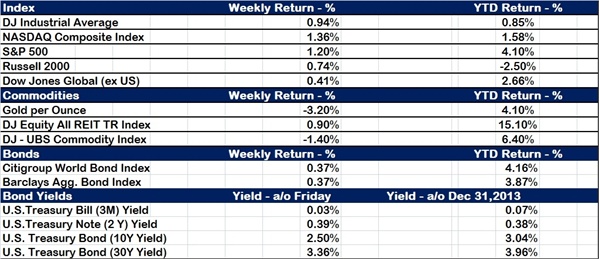

The large companies continue to lead the way with the S&P 500 posting four record highs in five trading sessions last week. The number of new highs being recorded by individual stocks has also improved significantly. The Dow Industrials and the Dow Transportation average also posted new highs last week.

However, it’s not all coming up roses. The Nasdaq and especially the Russell 2000 continue to lag. The Russell 2000 is close to 6 percent below its March 4th highs. The US Equity Market has had a bumpy ride so far this year. REITS, master limited partnerships, non-US stocks, bonds and commodities are all still outperforming US Equities as a whole. This is a complete divergence from last years market dynamics as we expounded upon a few weeks back.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are un-managed and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.