Several years ago, a long time client of mine passed away and left everything to the step mother of his children. The son, who is also a client of mine, spent many conversations with me detailing his thoughts with regard to how the estate was distributed.

The children were not near as concerned about the step-mother receiving financial assets as they were her decision to have an estate sale to liquidate the home and all the furnishings. If he or his sister wanted to retain toys from their childhood or other mementoes they would have to bid along with everyone else. They were not all that comfortable bidding, however.

These unresolved inheritance issues can cause rifts between family members even when both spouses are in their first marriage with relatively simple estates.

When you consider that nearly 65% of Americans do not currently have even a basic will, many estates end up going through lengthy probate procedures. Attorneys and court systems like to drag the process out, especially for larger estates. Many clients believe that once they get a will or trust drawn up that they can check these items off their list and all the work is done. Much more is required to make sure these documents prove effective and the decedents wishes are carried out. Having an unfunded trust is much like having a swimming pool without putting any water in it. Funding is the most important step.

Even properly implemented estate plans which have well drafted wills and funded trusts tend to focus on real estate and financial assets. For this reason, it is typically a good idea to consider drafting what many call a “Letter of Instruction” or a formalized version just for inheriting personal property called a “Personal Property Memorandum.”

What is the best way to insure that personal assets like, jewelry, automobiles, furniture and the like are inherited they way you wish them to? Typically these items are not included in a will because listing everything can get quite cumbersome and it does not make sense to pay an attorney every time you think of another item to be included. A ‘personal property memorandum’ is a legally binding document that is referred to in the will. It will contain all the personal property you wish to leave to your heirs and specifically designate these items. In order to be legally binding, it has to be allowed in your state of residence and be referred to in the will. However, you do not have to notarize this document or sign in front of witnesses, as you would with your will.

So if Jill thinks she should get the entire jewelry collection but your ‘personal property memorandum’ states that certain items go to Sue, there should be less bickering about these items when the personal assets are distributed. It is best to clearly describe items so they will not be confused with similar items. As with beneficiaries for other financial and real property assets, it is best that your executor or executrix has the correct information to get in touch with them.

A ‘letter of instruction’ is a non-legally binding document that will contain all the wishes you would like to communicate. In many cases you may not be able to create a legally binding document to bequeath personal property and may feel it is best to spell this out with all your other wishes. A personal property memorandum is legally binding in approximately 30 states in the U.S. In most Southern and Mid-Western States, these documents do not apply.

What would you include in a letter of instruction that might not be spelled out in a personal property memorandum? Typically these documents contain all that the former contain in addition to funeral wishes and detailed instructions for making the inheritance process run smoothly. Many think of letter of instructions as a “cheat sheet” to your estate. Below are a list of items you may wish to include:

- The location of important legal documents, such as your will, insurance policies, titles to automobiles, deeds to property, etc.

- All pertinent contact information for who they should talk to involving legal, tax and financial information and advice. Hopefully the heirs are familiar with and communicating with these individuals already.

- A list of financial assets, including savings and checking accounts, stocks, bonds, and retirement accounts (with beneficiaries). Be sure to include account numbers, PINs, and passwords where applicable. Other passwords and usernames to email accounts and other logins are also helpful. We provide software for our clients which can dynamically update the values of all the accounts on a daily basis and provide a net worth statement whenever the client wants to produce one.

- A list of pensions or profit-sharing plans, including the location of their explanatory booklets. These items would also be included on a net worth statement.

- The location of your latest tax return and Social Security statements.

- The location of any safe deposit boxes and their keys.

- A list of instructions for how insurance proceeds are intended for heirs, how to stretch out IRA assets over their life expectancy instead of receiving a large taxable amount all at once, trust provision explanations (in terms heirs can understand) and existing business succession plan summaries.

A letter of instruction is also a good place to leave additional special requests, such as burial or cremation wishes. You should consider giving the location of your cemetery plot deed, if you have one. You may even wish to specify which hymns or speakers you would like included in your memorial service. Prepaid funeral arrangements should also be included. Although a letter of instruction is not legally binding, your heirs will probably be glad to know how you would like to be remembered. It also may be helpful to leave a list of contact information for other people who should be notified in the event of your death.

Both ‘personal property memorandums’ and ‘letters of instruction’ are very easy to change. If you wish to make a change, you do not need to consult with an attorney, just create a new one and throw the old one away. We would recommend saving these documents in a safe place on your computer so that these changes can be made easily, signed and dated and the old version disposed of.

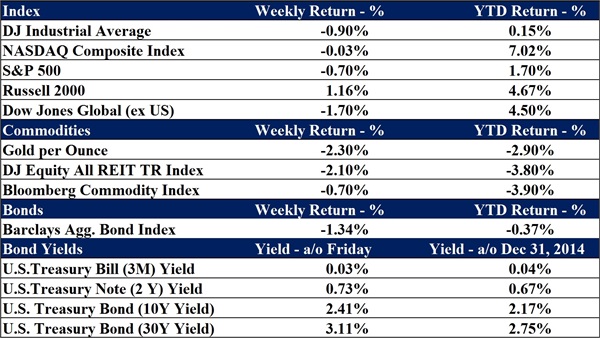

Data as of June 5th, 2015

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, a registered investment advisory firm in Hixson, Tennessee. A 20-year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are unmanaged and cannot be investedinto directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.