The Franklin Family at the base of the Statue of Liberty, Facing the Freedom Tower.

Last month, Jennifer and I took the family to New York and Philadelphia, the birthplace of our nation’s independence. We always like to take the kids places to see first-hand what they have been studying in school. Being a part of the Normal Park Museum Magnet community, we have seen what a difference some of these learning expeditions can make for making history, science, and art real for our children. I particularly enjoyed Philadelphia and visiting all the sites that were tied to my “great uncle” Benjamin Franklin. The kids were especially fond of visiting the storytelling benches and seeing all that “Uncle Ben” had accomplished throughout his life. We felt visiting the Liberty Bell was a great preamble to celebrating our nation’s independence and looked forward to showing them more when we made it to New York.

We wanted to show the kids much of what we were impressed with when visiting New York a couple of years ago. One thing that is exceedingly evident is how the new Freedom Tower stands out above the rest of the New York skyline. Standing at 1776 feet to commemorate the year of our country’s birth, the Freedom Tower is currently the tallest building in the United States. The tower is especially striking when standing at the site of the original World Trade Center buildings. The memorial takes your breath away with the water falls spanning the base of the original buildings where you can honor the fallen victims and heroes of the attacks almost 15 years ago, before any of our children were born.

The tower is a symbol and a testament to how our country has overcome fear and terror to rebuild and grow to greater heights. Looking back to the weeks following the attacks, the S&P 500 fell to 945 immediately after the markets were reopened on September 17th and drifted lower for over a year afterward. This past week we have seen similar fears manifest themselves at the beginning of the week, to dissipate toward the end of the week. The media tried to get us to focus on the fear and uncertainty of the “Brexit” vote, but many Americans seemed to realize that the vote coverage was just another way to get us worry and tune in.

Faith is the opposite of fear. It is a deep understanding that something is true even though there may not be physical evidence or a way to prove it to others. It is beyond positive thinking. Faith carries action. If you truly believed you were going to move, wouldn’t you start packing? If you truly believed your significant other loves you, and you love them, wouldn’t you trust them? If you believed you were having someone over for dinner, wouldn’t you prepare a space for him or her?

Faith will guide your life rather than control it (as fear can). The deep knowledge of truth assures you that even though things don’t appear to be going the way you want, in the end the outcome will be how you are picturing it. It builds your confidence. If you walk into an interview knowing you will be hired, and if not the right job for you will come along, your confidence will be evident. Fear will take away from your confidence and cause doubts. Faith will encourage you to move forward, while fear will cause you to be discouraged and slow you down.

If you work toward eliminating your fears and building your faith, you will enjoy life more. It won’t happen overnight; you have to work at it. After a while, you will have more confidence and you will feel more free. Not only will you live a more happy fulfilled life, but your finances will look more healthy when you have faith to follow and stick to a well thought out plan over time.

Our country over the past century has enjoyed the “Roaring Twenties”, “The Swinging Sixties” and the “Technological Boom of the Nineties”. These boom times were followed by busts such as the “Great Depression”, the malaise of the Seventies and the “Lost Decade of the 2000s”. Each time we have come back stronger than before, we’ve just needed someone or something to help renew our belief in ourselves and our country. The Dow Jones Industrial Average peaked at 381 in 1929 before falling to 41 in 1934. The Dow closed at 17,939 on Thursday, June 30th, 2016. $100,000 invested in the Dow at the low in 1934 has grown to over $40 million over the last 80 years, recovering from each setback over this period of time. For those with bad timing that bought at the top in 1929 and were able to hold on, $100,000 has grown to over $4.5 million.

We showed our kids as we stood at the base of the Statue of Liberty that Lady Liberty has shackles around her feet that are broken. For those of you that are shackled by fear, anxious of a new chapter in life, or worried about what may come, keep in mind that faith has overcome fear time and time again for those that embrace it. I encourage all of you to break the shackles of fear in your own lives and embrace faith as well.

We hope you enjoy another celebration of our country’s independence this weekend.

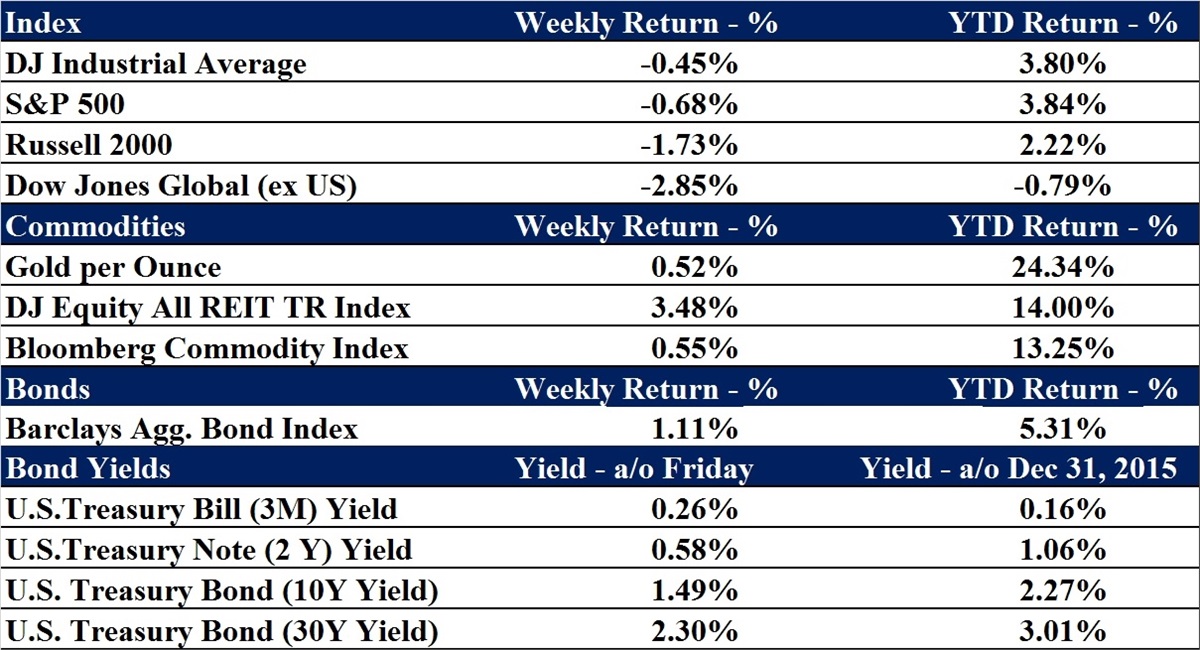

Data as of 6/30/2016

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, a registered investment advisory firm in Hixson, Tennessee. A 20+year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are unmanaged and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.