One of the world’s leading credit rating agencies, Standard & Poor’s, has downgraded the United States’ credit rating for the first time in almost 10 years.

The outlook on the new U.S. credit rating is “negative,” S&P said in a statement, indicating another downgrade was possible in the next 12 to 18 months. S&P cut the long-term US rating two notches to BBB, one notch above junk status earlier today.

The agency said the stimulus plan passed by the US Congress earlier this month did not go far enough to address the growing deficit even considering the plans to raise estate taxes and taxes on corporations, the wealthy, and oil imports.

Correspondents say the downgrade could erode investors’ confidence in the world’s largest economy. It is already struggling with huge debts, and fears of a possible double-dip recession, with worries about tax increases threatening to stifle spending.

The downgrade is a major embarrassment for the administration and could raise the cost of US government borrowing. This in turn could trickle down to higher interest rates for local governments and individuals.

‘FLAWED JUDGEMENT’

China, the world’s largest holder of US debt, had “every right now to demand the United States address its structural debt problems and ensure the safety of China’s dollar assets,” said a commentary in the official Xinhua news agency.

“International supervision over the issue of US dollars should be introduced and a new, stable and secured global reserve currency may also be an option to avert a catastrophe caused by any single country,” the commentary said.

S&P said in its report issued earlier today:

“More broadly, the downgrade reflects our view that the effectiveness, stability, and predictability of American policymaking and political institutions have weakened at a time of ongoing fiscal and economic challenges.”

The agency said it might lower the US long-term rating another notch if its deficit reduction measures were deemed inadequate.

“The political brinksmanship of recent months highlights what we see as America’s governance and policymaking becoming less stable, less effective, and less predictable than what we previously believed,” it added.

Treasury bonds, once indisputably seen as the safest security in the world, are now rated lower than bonds issued by countries such as Britain, Germany, France or Canada.

The downgrade also has implications for the country’s financial sector, ranging from insurance companies to government-related firms such as housing financiers Fannie Mae and Freddie Mac.

“At least initially, the impact on the market will be negative because there will some forced liquidation of U.S. assets”

The downgrade could add up to 2 percentage points to Treasuries’ yields over time, increasing funding costs for public debt by some $500 billion, according to SIFMA, a U.S. securities industry trade group.

IT’S APRIL 1ST, 2021, APRIL FOOLS DAY.

THIS STORY’S HEADLINE IS ENTIRELY FABRICATED.

Unfortunately, there is enough truth embedded in the story to make it plausible today. The S&P cut the United States credit rating for the first time ever on August 6th, 2011. They threatened cutting it again if our government did not institute adequate deficit reduction measures. Most of the quotes found in the “foolish” story above were taken directly from news sources from that time period.

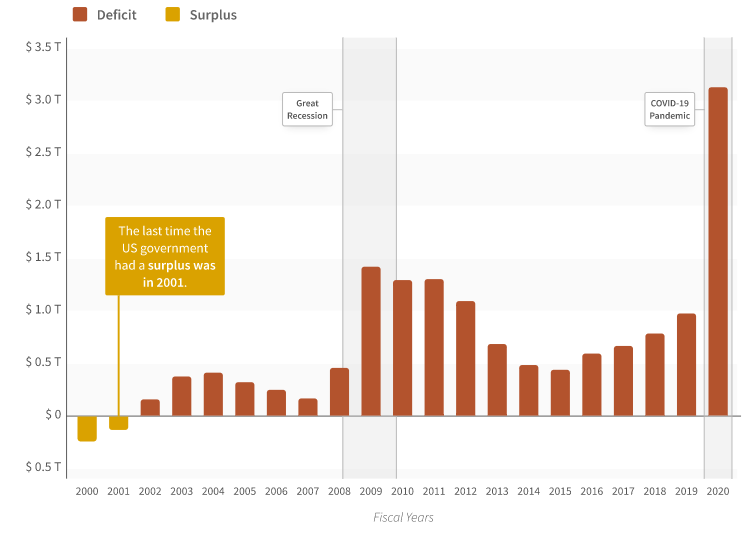

In 2020 the U.S. deficit expanded from roughly $1 Trillion to $3 Trillion. The size of the Federal Government deficit has doubled over the last decade to fight off the recessionary forces of the pandemic.

Who is not concerned about Inflation?

Over the last few months, we have written extensively about inflation concerns. With U.S. Government debt ballooning the Federal Reserve becomes less incentivized to raise interest rates and increase the countries debt service levels. But this may become necessary when the Treasury continues to print dollars aggressively, the dollar declines in value and the specter of 1970s style inflation rears its ugly head.

When inflation starts to look ugly, the U.S. will have less options than currently. Austerity measures, increased taxes or both will become more necessary to pay for government programs and reduce the debt.

For more on our views on positioning for inflation look to the articles below:

Is it Good to Lose Money Safely?

Preparing the Post-Election Portfolio

How do we prepare for these tax increases?

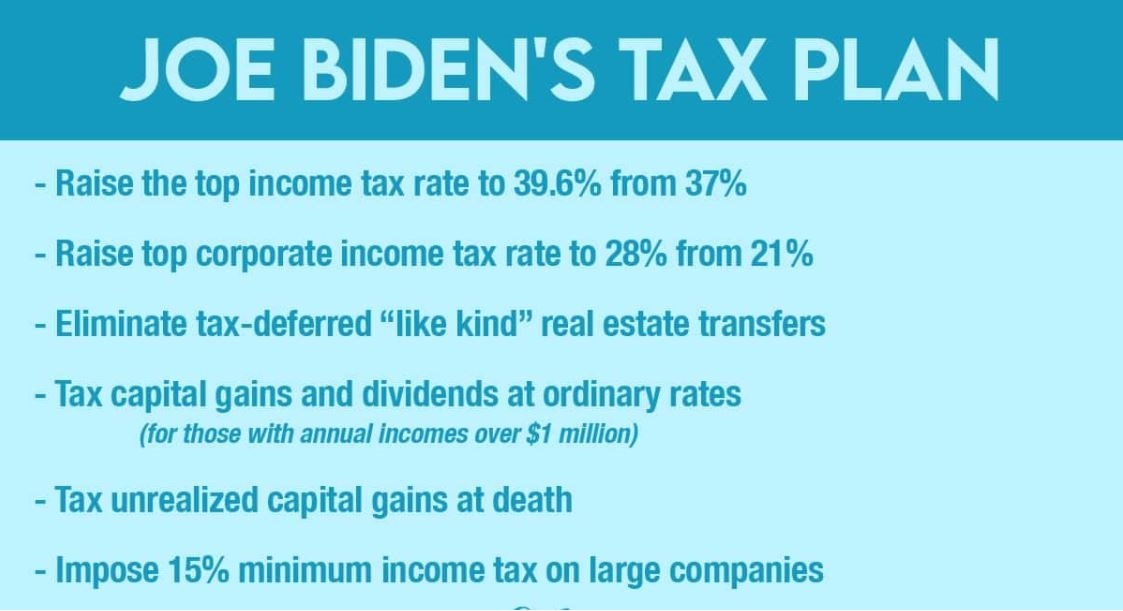

In our December Article, “Expect the Best, Prepare for the Worst” we outlined Tax Items to Watch Prior to 2021. At the time we communicated that oddsmakers were assuming there was a 15% chance of a “Blue Wave” taking over both Houses of Congress. We were strongly advising clients to be prepared for this higher tax scenario and we are still looking at options to stay ahead of the curve from a tax planning perspective.

For read this article please click on the link below:

Expect The Best, Prepare for The Worst

Let’s Focus on Capital Gains Taxes:

A capital gain is when an asset (think a stock, or business, etc.) grows in value from it’s purchase price – i.e. Stock ABC is purchased at $20 per share, and sold for $30 per share, a $10 per share gain. For assets held over 1 year, those gains are taxed at 0%, 15%, or 20%, depending on income.

Under the new proposal, capital gains would be taxed at income rates, which range from a proposed 10% -39.6%.Also, in current law, an asset that is passed to beneficiaries gets a “step-up” in basis. In other words, a $100,000 stock account that grows to $200,000 because of capital gains could be passed entirely tax free to beneficiaries, avoiding tax on the $100,000 of gain. The proposed plan would eliminate this option.

Do we want to take our gains now?

Historically we have been very careful with taxable accounts. We want to be wary of selling holdings that have appreciated significantly over time. Many times clients are very fond of these long held positions and wish to pass them on to the next generation. This has been a good strategy for a long time with the “step up” in basis allowing heirs to avoid any tax if they were to sell the holdings afterward.

With the potential for taxes on capital gains increasing up to 39.6% not including the additional NIIT (Net Investment Income Tax) of 3.8% tacked on top of this, continuing to hold onto some of these positions makes less sense. This is especially true if the portfolio is heavily weighted toward one stock and needs to be diversified or heavily weighted toward one type of company or industry.

Many clients are looking to reduce their exposure to these long-held securities as they expect the benefits of holding to be outweighed by the benefits of diversifying due the changes in the tax laws.

Do Structured sales still make sense?

Previously when someone retired with a large percentage of stock in one company or was looking to sell a business, one strategy that tended to make sense was to look at divesting of the company or business over time through a structured sale or multi-year liquidation plan. If the sale occurs over several years, we have typically been able to keep the capital gain tax rate lower as long as the amount to liquidate stayed in the low to mid seven digit range. What would have been a 20% capital gains rate was reduced to a 15% capital gains tax rate by doing this.

Now with the potential for capital gains greatly exceeding 20% for most people, this strategy may not be quite as beneficial. We anticipate it becoming much harder to keep the tax rates down in these instances unless we start the process BEFORE the capital gains tax benefit goes away.

Don’t Forget Carry Forward Losses

Many taxpayers are aware that they can use up to $3000 in losses every year as an offset against their income. Most are not aware that the entire amount of past losses can be used against future gains in any one year, however. If an investor is showing $150,000 in losses in 2020, that same investor can use these losses to offset all of their gains in 2021 up to $150,000. So if the 2021 capital gains are $200,000, the $150,000 in losses can reduce the taxable gains to $50,000.

Will this still be allowed in future years with the changes in the capital gains tax laws? We doubt that it will. The tax plan is already doing away with the step up in cost basis at death and is eliminating tax defered “like kind” real estate transfers (1031 exchanges) where real estate investors can keep from having to pay taxes for long periods of time.

Other Capital Gains Offset Strategies

So what can we do to help protect investment and real estate portfolios from excessive taxation on gains. The government seems to want to tax everything it can’t currently tax at the highest rates for successful investors.

Investors can still donate appreciated stock to charity. If you are looking to sell some stock but the tax bill is keeping you from doing so you may want to consider giving this stock to your church or favorite charity. If you are going to give anyway, gifting the stock will enable you to be charitable, allow for potential tax deductions and keep you from having to pay taxes when the church or charity sells the stock. Charitable institutions are not taxed on these sales either, so everyone wins.

Exchange Funds (also known as swap funds) could be an option. These funds allow investors to swap highly appreciated stock holdings for shares in ownership of the fund. The funds take the stock into their portfolio and allow investors to diversify to protect from potential losses from being overly concentrated. The taxes are also deferred because investors did not have to sell the stock when it was transferred into the portfolio.

Opportunity Zone investments have only been around since 2017 but are gaining popularity. Typically an investor has 180 days from the sale or exchange of appreciated property or stock to invest the realized capital gain dollars into a property in an Opportunity Zone or a Qualified Opportunity Zone Fund.

Benefits:

Taxes are deferred through 2026 or until the property or fund is sold.

Capital gains are also reduced from 10% to 15% depending upon the holding period.

There are NO capital gains on appreciation in the property or in the fund if held for 10 years or more.

We highly encourage investors to look at their taxable holdings now and start crafting strategies to reduce the tax burden, especially if there are significant unrealized gains in the portfolio. Unfortunately, those who wait too long will likely end up seeing their tax burden significantly increase.

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, and CEO of Innovative Advisory Partners, a registered investment advisory firm in Hixson, Tennessee. A 20+year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are un-managed and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.