“FLAWED JUDGEMENT” Revisited

Earlier this month many of you read our April Fools fictionalized narrative detailing how the S&P credit rating agency had once again cut the credit rating of U.S. Treasuries due to concerns regarding the growing government debt, and increased deficit spending. We received a higher-than-average number of responses from readers who were seriously concerned and then relieved when they learned that this had not transpired yet.

The S&P cut the United States credit rating for the first time ever on August 6th, 2011. They threatened cutting it again if our government did not institute adequate deficit reduction measures. Most of the quotes found in our “April Fools” story were taken directly from news sources from that time period.

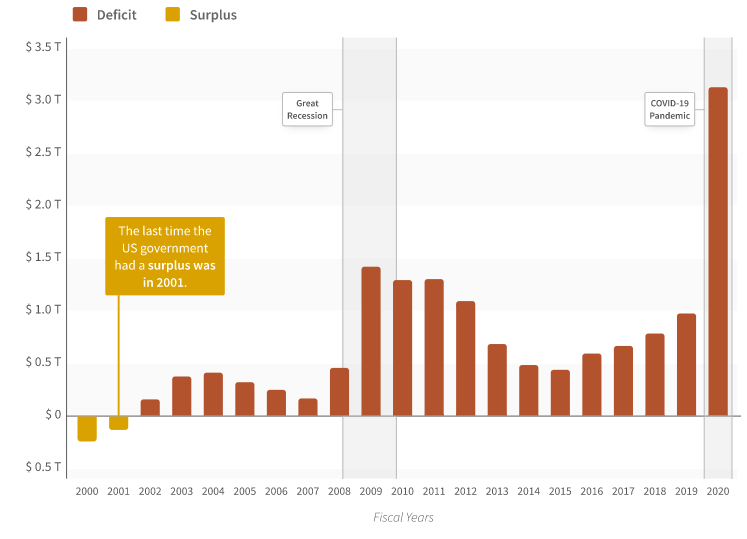

In 2020 the U.S. deficit expanded from roughly $1 Trillion to $3 Trillion. The size of the Federal Government deficit has doubled over the last decade to fight off the recessionary forces of the pandemic.

Will the S&P and other credit agencies cut the credit rating again? We believe that it is likely if politicians start to place blame on the agencies for a collapse in the bond market (which has not happened recently). Otherwise, we feel the agencies will do everything short of cutting ratings because doing so may be damaging to their bottom line.

As we have noted several times, we feel there are two primary ways the U.S. government will seek to reduce the relative size of the debt: Printing dollars and increasing taxes.

With regard to the taxes, we felt it was best to expand upon what we touched on earlier this month.

How do we prepare for these tax increases?

In our December Article, “Expect the Best, Prepare for the Worst” we outlined Tax Items to Watch Prior to 2021. At the time we communicated that oddsmakers were assuming there was a 15% chance of a “Blue Wave” taking over both Houses of Congress. We were strongly advising clients to be prepared for this higher tax scenario and we are still looking at options to stay ahead of the curve from a tax planning perspective.

For read this article please click on the link below:

Expect The Best, Prepare for The Worst

Expanding upon Capital Gains Taxes:

A capital gain is when an asset (think a stock, or business, etc.) grows in value from it’s purchase price – i.e. Stock ABC is purchased at $20 per share, and sold for $30 per share, a $10 per share gain. For assets held over 1 year, those gains are taxed at 0%, 15%, or 20%, depending on income.

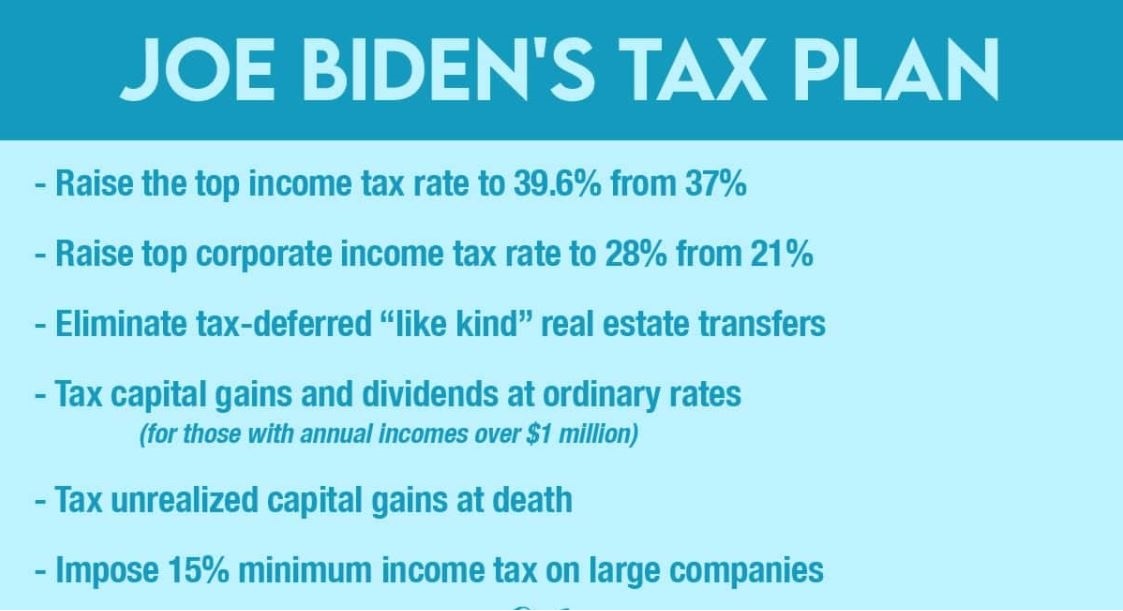

Under the new proposal, capital gains would be taxed at income rates, which range from at a proposed 39.6% rate, not including the 3.8% net investment income tax.

We would not be surprised if this capital gains tax impacted individuals with gains less than $1 million a year. It all depends upon who the lawmakers eventually decide is “the rich”. Some definitions currently define “the rich” with incomes over $1 million while others define “the rich” with incomes over $400 thousand.

Also, in current law, an asset that is passed to beneficiaries gets a “step-up” in basis. In other words, a $100,000 stock account that grows to $200,000 because of capital gains could be passed entirely tax free to beneficiaries, avoiding tax on the $100,000 of gain. The proposed plan would eliminate this option.

Do we want to take our gains now?

Historically we have been very careful with taxable accounts. We want to be wary of selling holdings that have appreciated significantly over time. Many times clients are very fond of these long held positions and wish to pass them on to the next generation. This has been a good strategy for a long time with the “step up” in basis allowing heirs to avoid any tax if they were to sell the holdings afterward.

However, this “step up” in basis for heirs is also on the chopping block. We see this as being extremely touchy for heirs if this comes about. Many individuals are hesitant to sell holdings because they cannot find their cost basis (what they paid for the stock or other holdings). If the basis cannot be determined, the IRS automatically assumes it was acquired at a $0 cost basis. Getting rid of the step up in basis seems like a great way to tax the next generation, much like the elimination of the “stretch IRA” last year.

With the potential for taxes on capital gains increasing up to 39.6% not including the additional NIIT (Net Investment Income Tax) of 3.8% tacked on top of this, continuing to hold onto some of these positions makes less sense. This is especially true if the portfolio is heavily weighted toward one stock and needs to be diversified or heavily weighted toward one type of company or industry.

Many clients are looking to reduce their exposure to these long-held securities as they expect the benefits of holding to be outweighed by the benefits of diversifying due the changes in the tax laws.

Structured Sales Even More Beneficial, But for How Long?

When someone sells a business or retires with a large percentage of stock in one company, they may wish to look at divesting of the company or business over time through a structured sale or multi-year liquidation plan. If the sale occurs over several years, we have typically been able to keep the capital gain tax rate lower as long as the amount to liquidate stayed in the low to mid seven digit range. What would have been a 20% capital gains rate was reduced to a 15% capital gains tax rate by doing this.

Now with the potential for capital gains greatly exceeding 20%, this strategy may be beneficial for a greater number of businesses. This is especially true if the capital gains increase impacts more than just those showing income over $1 million a year. We anticipate it becoming much harder to keep the tax rates down in these instances. For now this strategy is still an option, but we do not know how long this may last. Once we disallow reduced taxes applied to capital gains for some, it may not be long before it is disallowed for many more.

We don’t know when the timing of these changes will take place quite yet—if at all. However, if you have the ability to sell your business now, consider doing so. Just know that this doesn’t eliminate the potential of a higher tax bill as Congress does have the ability to enact legislation in 2021 and make it retroactive to January 1, 2021.

Don’t Forget Carry Forward Losses

Many taxpayers are aware that they can use up to $3000 in losses every year as an offset against their income. Most are not aware that the entire amount of past losses can be used against future gains in any one year, however. If an investor is showing $150,000 in losses in 2020, that same investor can use these losses to offset all of their gains in 2021 up to $150,000. So if the 2021 capital gains are $200,000, the $150,000 in losses can reduce the taxable gains to $50,000.

Will this still be allowed in future years with the changes in the capital gains tax laws? We doubt that it will. The tax plan is already doing away with the step up in cost basis at death and is eliminating tax deferred “like kind” real estate transfers (1031 exchanges) where real estate investors can keep from having to pay taxes for long periods of time.

Other Capital Gains Offset Strategies

So what can we do to help protect investment and real estate portfolios from excessive taxation on gains. The government seems to want to tax everything it can’t currently tax at the highest rates for successful investors.

Investors can still donate appreciated stock to charity. If you are looking to sell some stock but the tax bill is keeping you from doing so you may want to consider giving this stock to your church or favorite charity. If you are going to give anyway, gifting the stock will enable you to be charitable, allow for potential tax deductions and keep you from having to pay taxes when the church or charity sells the stock. Charitable institutions are not taxed on these sales either, so everyone wins.

Exchange Funds (also known as swap funds) could be an option. These funds allow investors to swap highly appreciated stock holdings for shares in ownership of the fund. The funds take the stock into their portfolio and allow investors to diversify to protect from potential losses from being overly concentrated. The taxes are also deferred because investors did not have to sell the stock when it was transferred into the portfolio.

Opportunity Zone investments have only been around since 2017 but are gaining popularity. Typically an investor has 180 days from the sale or exchange of appreciated property or stock to invest the realized capital gain dollars into a property in an Opportunity Zone or a Qualified Opportunity Zone Fund. Unfortunately, very few Opportunity Zone Funds have much of a track record. Current attractive options are somewhat limited.

Benefits:

- Taxes are deferred through 2026 or until the property or fund is sold.

- Capital gains are also reduced from 10% to 15% depending upon the holding period.

- There are NO capital gains on appreciation in the property or in the fund if held for 10 years or more.

We highly encourage investors to look at their taxable holdings now and start crafting strategies to reduce the tax burden, especially if there are significant unrealized gains in the portfolio. Unfortunately, those who wait too long will likely end up seeing their tax burden significantly increase.

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, and CEO of Innovative Advisory Partners, a registered investment advisory firm in Hixson, Tennessee. A 20+year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are un-managed and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.