To build a championship team, what players do we select first?

Last week, the NFL draft drew stellar numbers of viewers tuning in to see which players would go to their favorite teams. The Jacksonville Jaguars chose quarterback Trevor Lawrence from Clemson with the first pick of the draft. While it is true that the quarterback runs the offense and winning without a great signal caller under center is exceedingly difficult, a new quarterback rarely turns around a struggling franchise.

In most cases the quarterback position is the final piece of a championship team rather than the first piece. We only have to look at the tenure of highly touted quarterbacks who were added to struggling franchises like the Browns, the Jaguars or the Jets over the past decade to see that these players are highly reliant on their offensive line to protect them and the running backs and wide receivers to provide them an outlet for their throwing talents. Its hard to make a play when you are consistently on your back and/or no-one is catching passes.

Over the last 25 years, linebackers are the players who most consistently deliver value based upon draft order, followed by safeties and linemen. The skill positions are less consistent with the quarterback being the position most likely to bust. All too often teams reach for a marquee name without building a team around them first. Tom Brady had his choice of teams to pick from before deciding on Tampa Bay. He wisely chose a team with a compatible coach, a lot of great pieces already in place and a desire to win. He was the final piece for an already talented team ready for a championship.

Defense Wins Championships

The same could be said about Peyton Manning’s Broncos team in 2013. The offense broke multiple scoring and yardage records during the season, but they came up short in the end. It was only after they dramatically improved their defense over the following couple of years that they won the Super Bowl Championship. Some teams have stellar offenses and great quarterbacks without a defense to match. Dan Marino and Jim Kelly have five Super Bowl appearances between them with high flying offenses but neither managed to win the championship.

In football, a great defense allows teams to stay in the game (stopping the opposing team) and maintain solid field position. This is oftentimes more important than how many yards are gained or how many points are scored. A great defense and solid unsung players in the trenches may be more important than the players in the limelight. The benefits of these “foundational” players largely go un-noticed by most fans, but the best franchises know their value and pay them well.

I want to do for rebounds what Michael Jordan did for dunks. – Dennis Rodman

In basketball, great offensive players also get more attention but everyone plays defense as well. Dennis Rodman has always been a curious case. Rodman is (sadly) best known for his flamboyant behavior, tattoos, piercings, weird haircuts, and gonzo diplomacy to North Korea. He once wore a wedding dress to a press conference, dated Madonna, and sang “Happy Birthday” to Kim Jong-Un.

Rodman is currently the lowest scoring inductee in the Basketball Hall of Fame. Many question whether he is deserving of the honor. All of these facts obscure an important truth about Rodman. Modern statistical analysis makes a compelling case that, despite never averaging more than 11 points per game, Rodman was one of the greatest to ever play basketball. Hard to believe? Rodman is, arguably, a top 20 player of all time, and easily one of the best of his era. Before you stop reading because you think this is crazy, let’s take a look at the hard statistics to understand Rodman’s underrated impact on the game.

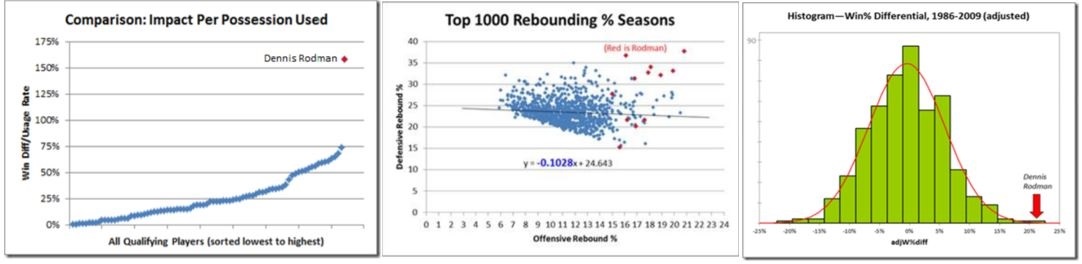

Rodman was better at rebounding relative to his peers than any other player at any other skill, including points and assists. At 6’7’’ in an era of powerhouse 7’+ centers, he garnered a remarkable and statistically unmatched 30% of the defensive rebounds, and 17% of offensive rebounds, while simultaneously guarding anyone from Magic Johnson to Shaq. He led the league in rebounding a record seven consecutive years. At his peak, he was over six standard deviations better at rebounding than anyone else in the league. In one game Rodman single handedly outrebounded the opposing team. No other player has ever achieved this degree of statistical separation in any other skill, even his teammate, Michael Jordan.

Rodman dominated the game without scoring by dramatically improving the statistical efficiency of his teammates via rebounding and defense. His rebounding prowess on both ends of the floor resulted in countless second chance scoring opportunities and higher per possession utility. How many Michael Jordan jump shots, Isaiah Thomas layups, or David Robinson dunks began from a Rodman rebound? Rodman had a measurable impact on the per-possession efficiency of his team when played. Counter-intuitively, his team’s shooting percentages improved dramatically when Rodman was on the floor despite the fact that he was a terrible shooter himself and rarely needed to be guarded!

Rodman tops the list of players with positive team margin of victory differential with him in the lineup vs. without him. Rodman could not shoot consistently outside of five feet and was incapable of carrying a team’s offense by himself, however when paired with efficient scorers he amplified team offensive efficiency to a higher level. Rodman dramatically improved the win-loss record of every team he joined (vice versa for those he left) including a record setting 72 win 1995-1996 Chicago Team. In total, he was a key member of five championship teams, two of which are widely considered among the best ever.

History and data show that great defensive players like Rodman are the difference between mediocre and championship teams.

A great defensive player can dramatically increase the per possession efficiency of a team’s offense, even if that player is subpar offensively.

What players do we want in our portfolios?

When we talk about portfolios most people think of investments, first. Oftentimes, minimizing taxes over the long term makes more of a difference than earning an extra percent or two. Protecting assets from Uncle Sam, law reforms, litigiousness, inflation, market bubbles and debt defaults comprises the defense that wins championships. Proper planning helps protect from some of the most wealth damaging risks, which have little to do with actual investment portfolios.

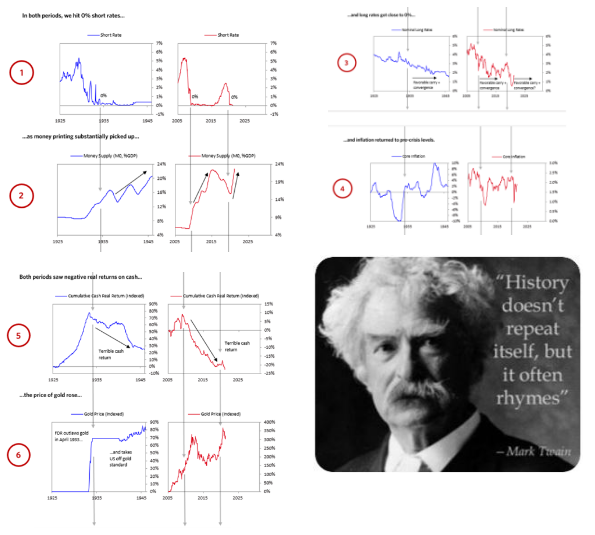

The defensive players in our investment portfolios have grown increasingly unpopular and unattractive over the last decade. Interest rates in most of the developed world are currently negative with U.S. treasury rates hitting all time lows in 2020. Many people consider equities to be expensive by most measures but note they look cheap compared to bonds. We have noted several times that stocks look expensive, but bonds look more expensive. However, they make a good diversifier in a market panic, alongside gold. Treasury bonds have historically protected portfolios during market downturns, but they are hard to hold when yielding so little with negative real returns after inflation.

The problem with owning bonds now is that outside of these brief periods, we are losing purchasing power owning such low yielding assets. The entire developed world is printing currency. Scarce assets are becoming more valuable as can be seen by increasing values for real estate, precious metals, artwork, and commodities of all types. We expect scarce assets to continue to command increasingly high prices until the bubble the Fed is feeding eventually pops.

Avoiding round trips and short-term devastation enables you to be around for the long term. – Seth Klarman

The market dynamics today look exceedingly like those of the early thirties. The similarities are noted below:

Rodman’s Paradox

Rodman’s Paradox describes hidden benefits when adding a nonconformist asset amplifies the output of a portfolio. The sum is greater than the parts. The same way Dennis Rodman improves the efficiency of his teammates by rebounding their misses, the combination of inflation protections and positions that may rally during market panics can protect purchasing power and keep powder dry for the recovery. Most NBA general managers passed on selecting Rodman and many investors have passed on inflation hedges, non-US investments and market panic protection over the last few years. But the 20s was nothing like the 30s, the 60s was nothing like the 70s and the 90s was nothing like the 2000s. We expect the 2020s to be nothing like the 2010s.

Rodman was a second-round draft pick (27th overall), his unusual talents overlooked by countless teams that prioritized mediocre scoring over the intangibles of defense and rebounding. If the 1986 draft class was re-done, ex-post, experts agree he would have been the unanimous top pick. At the time, selecting Rodman as the #1 pick, a player who could not even score, was laughable. Perhaps as laughable as holding an un-correlated asset that has not held up to the S&P 500 for years on end. Nobody was laughing when Rodman helped Chicago and Detroit win five championships. After the next lost decade, I doubt people will be laughing at those very holdings that held up so well in the 1970s and the 2000s but fell flat during the second longest bull market in history.

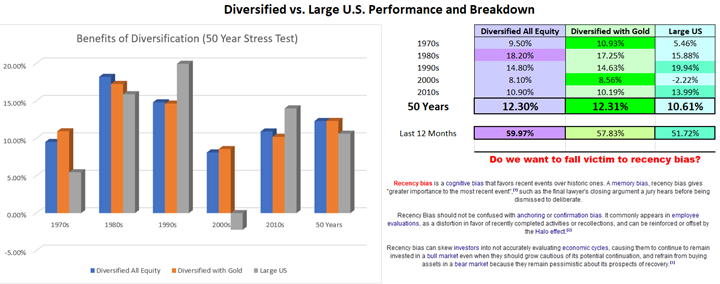

Stress Testing the Portfolio

History does not repeat itself exactly. New technologies are invented, countries and currencies rise and fall. Cycles tend to repeat themselves. A typical portfolio today is comprised of mostly large companies, many times concentrated in growth stocks dominated by Facebook, Amazon, Apple, Netflix and Google. A portfolio like this underperformed by a significant margin in the 1970s and lost money during most of the 2000s. Those who fail to learn from history are doomed to repeat it. The V Deca stress test above shows how this currently popular portfolio would have also underperformed over the last 50+ years. Adequate diversification, like a good defense, tends to protect from the worst excesses investors bring upon themselves.

Wrapping Up

Say what you will about Dennis Rodman – you cannot deny the fact he was a winner.

Rodman was a core contributor on five championship teams. He dominated the game without scoring, but his basketball genius and value transcended box scores and simple statistics. In the same way, the value of diversifying into assets that will help protect against downturns and inflationary pressures may not be readily apparent currently.

Defense, intangibles, and diversification are sometimes less popular than a high scoring offense, a flashy player or what has done well recently – in sports and in investing. Investors like to pick portfolios full of quarterbacks instead of focusing on the core holdings first. Some have trouble staying diversified at times; the same way NBA teams have trouble selecting a player that can’t hit free throws or three-pointers and NFL teams have trouble building a foundation before adding a marquee player.

A defensive superstar alters the game, not by scoring, but rather by improving the efficiency of the scorers around him or her. A foundational player may not be as exciting, but oftentimes we have to put aside excitement to win.

Diversification into alternative assets alters a portfolio, not by making money all the time, but by improving overall makeup of the portfolio and creating new opportunities in bear markets.

Investors are well served by paying more attention to defense in their planning and in their portfolios. For those who are skeptical, a portfolio stress test may make a lot of sense. Feel free to contact us to look at a Deca V stress test on your portfolio or stress test your financial plan more comprehensively.

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, and CEO of Innovative Advisory Partners, a registered investment advisory firm in Hixson, Tennessee. A 20+year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are un-managed and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.