Do You Want Good, Better, Or Best?

Who is the True Bond King – Gross, Gundlach or Connery?

Last week gave us an opportunity to put more assets to work in stocks as the end of October ushered in what we expect to be a Merry Santa Claus Rally. Many were afraid to invest prior to Halloween, but it seems most of this fear has already dissipated as the AAII Bearish sentiment has shrunk from over 50% to under 30% in just a week. November and December are historically the best months to be invested. Absent any new concerns over global tensions or government upheavals, the end of the year tends to reward stock investors.

Stocks Continue to Look Less Attractive versus Bonds, However.

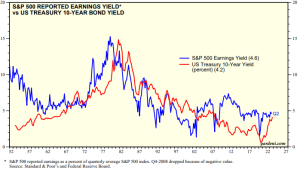

To compare stocks and bonds, some pundits use a metric called the earnings yield—the inverse of the S&P 500’s price-to-earnings (P/E) ratio. For the vast majority of the 2000s, it has been comfortably above Treasury bond and bill yields. Given the earnings yield is a rough approximation of stocks’ long-term expected price return, this means someone buying stocks could theoretically expect to return more than bond investors would receive in interest. However, in 2023, treasury yields have moved above the S&P 500 earnings yield. The S&P 500 earnings yield currently sits at 4.6% while yields from short-term Treasury bills exceeded 5.9% in May and 10 Year Treasuries exceeded 4.9% in mid-October and both currently have yields exceeding the S&P earnings yield. This means investors can expect higher returns from bonds than from stocks, assuming stock earnings do not grow over the next ten years.

Comparing companies’ borrowing costs to expected earnings yields gives a rough approximation of whether interest rates support investment. The same comparison can also show whether borrowing to fund a stock buyback is profitable (yes, after accounting for the US’s new 1% buyback tax.) With corporations facing potential debt refinancings at much higher rates, these companies suddenly become much less profitable.

The chart below shows the Earnings Yield versus the 10 year Treasury Yield through the end of the 2nd quarter of 2023. As of mid-October, 10-year bonds look the more attractive versus stocks comparing any time over the past couple of decades other than mid-2007 and early 2000-2001.

As can also be seen from the chart below. When treasury yields increase, it tends to force earnings yields higher as well. Earnings yields increase when earnings go up or when prices come down. Unfortunately, most of the time when interest rates are higher, prices are coming down more often than earnings are going up.

Taking a Page from Ray Dalio’s Playbook

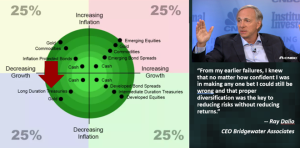

Ray Dalio popularized quadrant investing. He notes that it is difficult to predict which quadrant we are heading into and even more difficult to predict exactly when. If we know where we are going, we know historically which asset classes have performed best in the four scenarios below. As we have noted before, recessionary environments are characterized by lower growth, lower inflation, higher unemployment and tighter lending standards. Most indicators are showing us we are heading into the bottom left quadrant where Cash, Gold, Long-Term Treasuries perform best.

Cash is No Longer Trash?

The bond market tends to anticipate slow economic growth in the near future, many times as the Federal Reserve is raising short term rates. This tends to result in an inverted yield curve where short term CDs, Savings Accounts, Money Markets and Bonds of all shapes and sizes pay more than longer term fixed income investments. This is rare and is a good indicator of an upcoming recession as it has predicted every recession for the past 50+ years. A couple of years ago, Dalio was quoted over and over saying “Cash is Trash”. But this was when “Cash” was paying less than one half of one percent. Now that “cash” is paying over ten times what it was 18 months ago, “Cash is No Longer Trash”. Dalio has been telling us that “cash” is now a good investment and does not know how long bond prices may go as the treasury keeps issuing new debt and the Federal Reserve and other countries are no longer buying our treasuries.

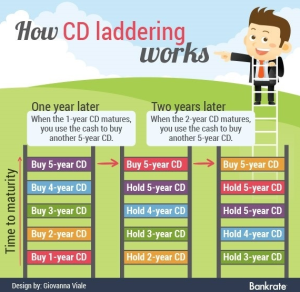

The Best Fixed Income Strategy Assuming Rates Rise or Drop

A CD / fixed rate ladder is a portfolio of CD / fixed rates with maturity dates that are evenly staggered so that a constant proportion of the CD / fixed rates can be redeemed at maturity each year. By holding these to maturity, investors may minimize the potential for losses caused by interest rate fluctuations and the markets. Generally speaking, there are two broad types of CD / fixed rate ladders. One can be implemented more or less perpetually for trusts, endowments, and other applications with extended planning horizons. Another form of CD / fixed rate ladder can be implemented for individuals whose personal financial plans might have a definite endpoint in mind.

Building a ladder provides some certainty, because investors know how much they will earn if they hold to maturity. Laddering is a strategy where investors purchase CD’s and fixed annuities with staggered maturity dates to maximize yield while maintaining scheduled liquidity. When short term CD’s from the low rungs of the ladder mature, the funds are reinvested at the top end of the ladder. As interest rates rise, investors may be able to increase their cash flow by seeking higher yields in longer maturities.

Being that longer maturity CD’s and fixed annuities generally have higher yields, staggering the maturity dates provides usually provides a higher overall yield than purchasing one CD every 6 months to two years. Additionally, with a CD maturing every year, a regular cash influx is created so that investors can potentially capitalize on any new investment opportunities.

The Best Fixed Income Strategy for Recessions

Conservative Investors have been able to realize yields in excess of five percent for most of 2023, but what happens if we head into a nasty recession and the Federal Reserve starts lowering rates aggressively? As of mid-mid 2023 the Federal Reserve was anticipating unemployment to increase from 3.4% to 4.1% by the end of the year and 4.5% at some point in 2024. We are currently sitting at 3.9% unemployment. They were showing federal funds rates to top at 5.6% and then drop to 4.6% in 2024 and 2.5% thereafter. Bond rates across the board should come down in this scenario. If we encounter more weakness in the economy than what the Federal Reserve is predicting, rates may drop further and faster, causing bond prices (especially long-term treasuries) to rise further. It seems most times we head into scenarios like these where the government and the media tells us that this time will be different, the economy suffers a hard landing that some anticipate but many try to talk out of existence, thinking if we say it is not there, many may not notice. Meanwhile, earnings soften, unemployment spikes and many companies go out of business.

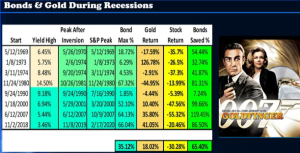

The chart below shows how treasury bonds have fared versus stocks and gold over the past fifty plus years. Since the early eighties, owning long-term bonds going into recessions has proven to be the best strategy, giving returns in excess of 50% during the past three recessions. Prior to this, owning short-term bonds proved the best strategy until the Federal Reserve was done raising rates and the yield curve returned to normal. Shifting to long-term bonds after the curve normalization paid off handsomely in 1980 to 1981.

During this most recent Fed. rate hiking cycle, the 1970s to early 1980s strategy has worked the best so far. It looks like we are soon to move to the second phase, where long-term bonds outperform. We anticipate this may happen within the next few weeks to months as this has been the longest lasting inversion in decades. When long- term bonds are once again paying the best interest, outsized returns are available by investing in these based upon how aggressively the Federal Reserve starts cutting rates.

Tune in for more on this when we release our video on “The Best of the Bonds” later this week.

Joe Franklin has been recognized by Forbes as one of the Top Advisors in Tennessee

Franklin Wealth Management

4700 Hixson Pike

Hixson, Tn 37343

423-870-2140