Over the past month we have seen a resurgence of “meme” stocks and “penny” stocks. Some of the favorite stocks of Wall Street Bets and Reddit online chat sites have started to gain attention again. One of the most recognizable bloggers from the 2021 craze came back to life and posted about GameStop once again. This contributed to share prices for this company shooting up from $17.50 on Friday the 9th to over $60 at one point the following Tuesday. Shares of AMC Theaters and other heavily shorted stocks made similar moves as institutional investors who had sold these shares short were once again forced to buy back in the face of margin calls and heavy losses. The personality known as “Roaring Kitty” had struck again.

This past month the best performing stocks have mostly been smaller companies with market capitalizations of less than $250 Million. Most of the biggest winners were trading for less than a dollar at the beginning of the month and about a third are up due to institutional sellers that have been forced to buy. Some may continue to do well for some time to come, but we would recommend caution when seeing “penny” stocks and “meme” stocks performing as they have recently.

Other Signs of a Top:

- One sign of a top is when the average investor grows increasingly optimistic about the markets. When bullish sentiment exceeds bearish sentiment by a wide margin, the markets tend to underperform over the coming months. Sentiment levels were at rarely seen extremes just a few weeks ago in March.

- Low volatility tends to lead to high volatility and market downturns as well. Currently the volatility index sits at levels we last saw in November 2019, just before the pandemic started.

- When the market gets to the point where the largest most popular companies make up an unprecedented percentage of the total market and we have something akin to the dot.com frenzy of the late nineties or the nifty fifty of the late sixties, we may be close to a top. The video above shows what Warren Buffett, Howard Marks and others have to say about this and how current valuations look eerily similar to the late 1990s.

- Another sign is when the leverage in the system hits new highs with people taking out margin loans to buy. The first signs of this toward the tops can be seen when institutional investors who have borrowed to sell short are forced to buy during short squeezes like we saw earlier this month. Other signs of leverage show when options volume rises. Many are not borrowing to buy yet but may soon be borrowing when options they own are exercised, or options they have sold force shares to be put to them as prices drop.

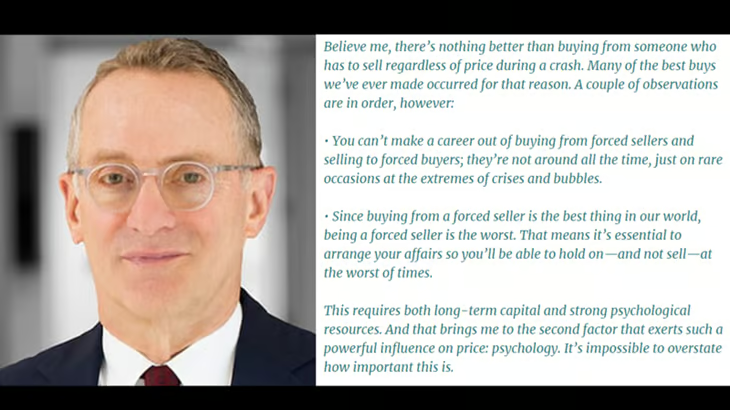

- Howard Marks, the billionaire founder of Oaktree Capital Management, likes to say that the best time to buy is when others are forced to sell and conversely the best time to sell is when others are forced to buy. He says that these opportunities are only around on rare occasions at the extremes of crises and bubbles. Currently we may be at one of these rare extremes where we want to free up some cash.

Example of a Short Squeeze

The past month’s biggest winner, Farraday Future Intelligent Electric Vehicles has only sold 10 cars through the end of 2023 since its founding in 2014. Just a few weeks ago it was in danger of being delisted by the Nasdaq stock exchange and is seemingly still having issues maintaining its listing. Currently over 85% of its shares are on loan to be sold short by institutional investors primarily. The company had a market capitalization of less than $3 million 30 days ago and many are anticipating the price going back down below 10 cents a share. But the share price is up over 2000% over the last month, causing those who were betting against them a month ago to lose over 20 times what they sold short. This is what we call a “short squeeze” with mostly institutional investors being forced to buy. This is exactly the setup that Howard Marks terms a bubble where we have a great opportunity to sell. But those who want to sell this company short could still lose a lot in the short term only to be proven right a month or a year from now. This seems to be a great example of a company on its last legs getting a shot in the arm. Maybe they will also file a stock offering to raise cash and extend their life span at the expense of shareholders.

Follow the “Smart Money”

- When the companies themselves are selling shares to the forced buyers we like to be on the side of the sellers. If a company like AMC completes a shelf offering of $250 million or GameStop sells over $900 million in shares in short order during a buying frenzy, the top brass at the company is screaming that the stock is overvalued. The company gets cash to make acquisitions or pay down debt, but the existing shareholders suffer as their shares get diluted. If the number of shares doubles and the value of the company does not change, the value of the shares gets cut in half.

- We like to buy when the CEOs are buying and sell when they are selling. The officers typically have to announce a sale and sell at a more measured pace to avoid insider trading concerns. Jaime Dimon, the longtime CEO of JP Morgan is a prime example, having announced his intention to sell over 1 million shares in the behemoth bank late last year. These types of announcements may signal that those who know the most about the company feel that the company they run is overvalued.

- Some like to follow politicians and buy what they are buying. We would rather follow the most experienced and successful investors and listen to what they have to say. Even more importantly, we like to follow what they are doing, especially if they hold an abnormally large position in any one company. We can easily see what they are buying and selling by following the reports these investors are required to file through the SEC and by reading letters to investors and shareholders.

What are the Largest Positions of Buffett and others?

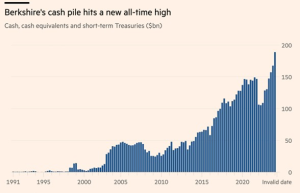

During the Berkshire shareholders meeting earlier this month, Buffett noted that the cash and treasury bill position is even larger than before sitting at close to $190 Billion. He consistently mentioned in his letter how this cash position compared to 2008. He noted that he wanted to make sure he had plenty of dry powder available to purchase great companies at fair prices but has not been finding much at fair prices recently. Earning over 5% on cash, Buffet sees less need to deploy capital unless he finds more favorable large opportunities. He has noted that he does not like to see his cash and bond positions grow to over 20%, but given this percentage is now almost 40% of the portfolio of companies not 100% owned by Berkshire, we can reasonably say that it may be a time to wait for a pullback and better values. He noted that even if Treasuries and other cash equivalents were earning one percent that he would still not be a buyer of most companies at these prices.

Buffett is Still Selling Technology?

Apple is still Berkshire’s largest holding, and he was asked several questions about why he was selling. To date he has sold close to $20 Billion of Apple over the last couple of quarters. It is likely that Buffett is continuing to sell Apple as he has not said much about why he is selling or that he is finished selling. He mentioned taxes as one of the reasons and said that Apple is one of the companies he intends to hold for a long time. But if taxes are the primary reason, why is he not selling a lot of his other holdings? It is clear he believes that Apple is a great brand, but he may also believe that the company is too richly valued at these prices, especially considering growth has slowed recently. Likely Buffett believes that other more appealing purchases may present themselves over the next few months and he wants to be prepared. That said, it is highly unlikely the Apple position is abandoned or even reduced to anything less than the largest holding for some time. Chemath Palihapitiya during the All-In Podcast noted several concerning things about Apple with data to back it up in a recent episode. The video below contains some of what he and others are noticing.

Franklin Wealth Management

4700 Hixson Pike

Hixson, Tn 37343

423-870-2140