Many of today’s investors are too young to remember the speculative excesses of 1999 and early 2000. Tech IPOs, dot.com, media companies and the most popular and largest companies saw their valuations reach the stratosphere. Much of this was driven by Y2K concerns as individuals and companies upgraded their systems to minimize disruptions when we entered the twenty-first century.

Today we see speculative excesses with investors bidding up the prices of bankrupt companies. They piled into Hertz late last year and failed to notice when the company tried to issue more worthless stock. Hoards of speculators are currently trying to “stick it to the man” by bidding up the price of companies institutional investors expect to fail. Enough speculative buying can force investors who shorted the stock to buy back at higher and higher prices in a buying panic. Examples of companies attacked include GameStop (up from 2.5 in April to over 480 this week), Bed Bath and Beyond (up from 3.5 to over 53) and Blackberry (up from 2.70 to 28).

None of these companies has turned a profit in almost three years and have little prospects of doing so anytime soon. At current valuations, Gamestop could very well issue additional shares and go on an extensive spending spree at the expense of shareholders. They could get smart and invest the funds in more viable businesses and turn themselves around, but this does not in any way make the shares a more reasonable investment at these prices.

Tesla (up from 70 to 900) on the other hand is now turning a profit, but is currently assumed to be worth more than Toyota, Nissan, Honda, BMW, Diamler, Volkswagen, GM and Ford combined. Last year Tesla sold $28 Billion worth of cars while the eight above sold over $1.2 Trillion. Tesla is trading like a software company and is assumed to be collecting a treasure trove of data. But is Tesla’s driving data from the 500,000 cars sold last year worth more than the data from Facebook’s 2.7 billion users?

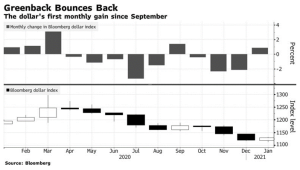

Valuations exceed those seen in early 2000 by many measures. However, as long as bond rates stay at or close to zero, with Congress and the Fed stimulating, these metrics are less useful. The party will likely last as long as stimulus and money printing continues. Rates may stay at near zero levels with continued dollar weakening for some time. From the March highs to the end of the year, the dollar lost approximately 10% of its value as seen in the chart below. Few seem to recognize the implications of this.

Where are the Opportunities?

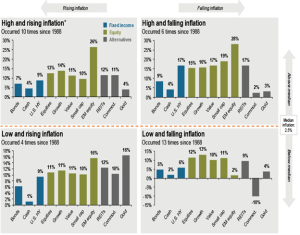

A weakening dollar tends to force up asset prices as well as the price of most everything else. Holding cash and debt at near zero interest rates makes little sense with the dollar losing 5% to 10% in value per year. Foreign investment, especially in emerging markets, makes more sense in this scenario. Holding real estate and precious metals makes more sense as well. But the average household now holds more cash than ever before, losing out to these inflationary forces. Close to zero interest rates can become a significant negative real return in these environments. “Zero” would become anything but a “hero” in the face of significant inflationary forces.

In the face of low and rising inflation, emerging markets, real estate, commodities and precious metals do particularly well. If inflation gets high and continues higher, emerging markets, real estate and commodities continue to do well although many countries start to put restrictions on ownership of precious metals. Hopefully, average households will grow more confident so the government feels less need to stimulate, borrow and print money.

Prices at the pump are heading up again now that US oil production is expected to be reduced. Higher gas prices leads to higher transportation prices which leads to higher prices for imported goods.

After the Saudis flooded the oil markets in 2020 as world consumption plummeted during the early months of the lockdown, oil prices plummeted. The price of Texas Crude actually dropped below zero in the futures market as no one wanted to take delivery of real barrels. Recently the Saudis have decided to cut production. With the Biden Administration also passing laws to effectively cut US production and transport of fossil fuels, energy prices are rising again. We would normally assume energy would be a good value currently, but is the U.S. energy sector going to be as profitable going forward? I would say energy companies in Canada, Latin America and even Russia may be safer investments.

Usually, one of the top reason investors avoid foreign investment is political risk. Currently, not as many countries have more political risk than the U.S. with political leaders on both sides of the isle talking about a revolution of sorts.

It is likely the excesses of today will lead to a scenario similar to 2000-2002. As can be seen above, the Nasdaq lost over 70% of its value over this period. However, those who were diversified in foreign investments, inflation hedges, and temporarily unloved, smaller companies avoided the worst of this tech and dollar devaluation.

As Jeremy Grantham wrote recently,

“As often happens at bubbly peaks like 1929, 2000, and the Nifty Fifty of 1972 (a second-tier bubble in the company of champions), today’s market features extreme disparities in value by asset class, sector, and company. Those at the very cheap end include traditional value stocks all over the world, relative to growth stocks. Value stocks have had their worst-ever relative decade ending December 2019, followed by the worst-ever year in 2020, with spreads between Growth and Value performance averaging between 20 and 30 percentage points for the single year! Similarly, Emerging Market equities are at 1 of their 3, more or less co-equal, relative lows against the U.S. of the last 50 years. Not surprisingly, we believe it is in the overlap of these two ideas, Value and Emerging, that your relative bets should go, along with the greatest avoidance of U.S. Growth stocks that your career and business risk will allow.”

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, and CEO of Innovative Advisory Partners, a registered investment advisory firm in Hixson, Tennessee. A 20+year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are un-managed and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.