Many have increasingly become concerned over the national debt, increasing political divisiveness, rising inflation and a 2nd pandemic wave. But where are we really safe if the worst transpires?

Why Are Americans Losing Faith in the U.S.A.?

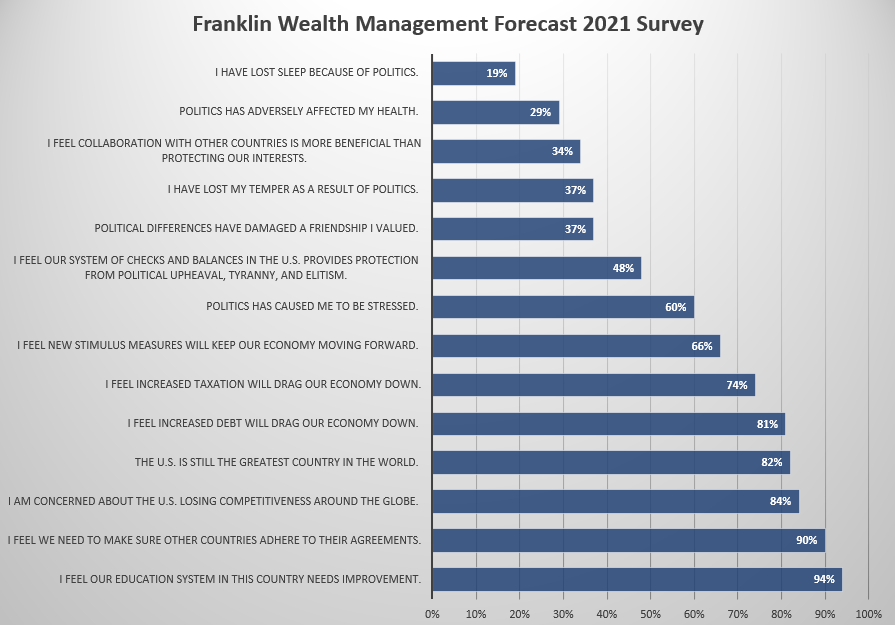

We recently surveyed clients prior to our Forecast 2021 webinar, and it seems most are even more concerned about the political climate now than in the months before the election.

What most interested and surprised me was that our survey shared that the need for education improvement was the single item that everyone seemed to agree upon and unfortunately a growing percentage feel that the U.S. is no longer the greatest country in the world.

Many believe that our democratic system has grown less effective at protecting the country from tyranny, elitism and political upheaval. We wrote about this many months ago in our Politics and Populism article. You can read further about this by clicking here.

How do the Root Causes Differ from the Symptoms?

The wealth, opportunity and values gaps we wrote about in the Politics and Populism article will hopefully be dealt with in an effective and inclusive way. Will our elected officials work together to help alleviate this issue and find common ground to create opportunities for all? Many feel that access to better education for all may be the best way to close the opportunity gap, but this cannot happen overnight.

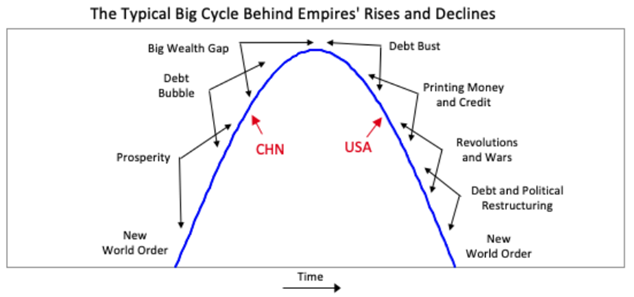

There is also a rising great power in China to challenge the existing power of the United States. Will this be well handled? I was somewhat surprised the survey below showed that most did not want to collaborate with other countries as much as they wanted to make sure the United States protected her interests. While history has shown that increasing combativeness leads to less desirable outcomes many feel that other countries, especially China, have been cheating by not adhering to agreements. Unfortunately, trade wars taken to greater and greater extremes lead to real wars. Hopefully, relations between countries will improve with less combativeness and more fair dealing.

Third, there’s a debt-money cycle. What is the value of money? What will happen to the debt? Will the dollar retain its value? Who is going to pay for it? How? What will work? In our article, Preparing the Post-Election Portfolio we discussed much of our thinking for overcoming the large and growing national debt. You can read this article by clicking here.

Will All This Stimulus Really Make a Difference?

We have found over the last couple of decades that the Federal Reserve has lost its ability to heat up or cool down the economy through interest rate policies alone. As interest rates have trended closer to zero, these strategies lose their effectiveness, and it becomes more necessary for the Federal Reserve to buy assets (primarily bonds) in the open market. There is a saying over the last few years is that the “Fed is where all the worst bonds go to die” and this monetary stimulus was very effective coming out of the financial crisis in 2008-2009.

Unfortunately, monetary stimulus has ceased to be as effective without accompanying fiscal stimulus. Congress approves this spending for things like infrastructure, direct payments to the most needy, forgivable business loans and the like. Like running a business and looking at any investment, we might want to consider what the return on this investment is with regard to the fiscal stimulus and what will be the most effective in increasing productivity. Is the stimulus money to be used to buy votes or improve the economy? To the extent it is used for the latter, we feel the stimulus will be effective.

When investors try to bet against the Federal Reserve, they tend to lose. There is a saying, “Don’t Fight the Fed!” They have more influence, more control over the economy and more purchasing power than any other person or entity. If they are tightening, it is better to de-risk portfolios. If they are stimulating, it is better to be more fully invested.

At What Point Does Stimulus and Money Printing Stop Working?

If the U.S. continues to grow her debt beyond her ability to pay, the country is likely to start seeing demands on the debt in the form of increased selling activity. This will drive down bond prices, drive up interest rates and increase the cost of servicing the debt. Luckily most of the debts are dollar denominated and the U.S. can print money and devalue the dollar to owe less relative to other currencies and 2020 dollar values. This is the easiest way to effectively reduce the inflation adjusted debt and much more popular compared to raising taxes or cutting government spending.

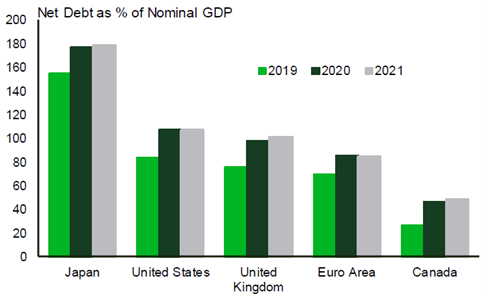

Typically, when government debt exceeds 90% of nominal GDP, country growth rates slow significantly. The U.S. is now exceeding these levels as can be seen below.

‘I am so afraid of democracy getting the idea where we can just print money to solve all problems and eventually that will fail’ – Charlie Munger

Americans look at the value of everything in U.S. dollars, but they don’t look at the value of the dollar. We’re in an environment where we have to be cautious about that, because the easiest way out for government is to do what the U.S. is doing, which is to borrow and print a lot of money. The population doesn’t pay much attention to the debt and the printing of money. They all appreciate the giving of money. So you hear the population say, “I need more money,” and get angry if they don’t get it. So you’ve got to give them more money, and it’s easier not to take it away from someone else.

Some people are fond of saying that all this increased debt hasn’t hurt us yet and if we keep interest rates low, we can still easily afford the increased debt. This has not worked well for Japan however. Furthermore, if the U.S. creditors become overly concerned about the return on and the return of their money, we run the risk of and are increasingly likely to see the dollar lose reserve currency status. If and when this happens, the U.S. will start to look like a weaker, diminished version of her former self. The most recent example of this is the decline of the British empire.

What is the Best type of “Safe” Investment to Hold in the Barn?

With many clients we like to help them think in terms of our Retirement Income Harvesting Strategy. Clients want to make sure they have assets that produce enough income to provide for them now and throughout their lifetime. Sometimes this can be done solely through income producing assets but many times the need for future income necessitates we own more growth oriented assets in the portfolio. Others are almost solely focused on growth and not as concerned about income producing assets.

Much like an apple orchard, income producing assets are like more mature trees that are fruitful and produce the most apples. Growth oriented investments are like the younger saplings that can later grow into more mature trees. Much like we want to store apples for future consumption in the barn at the orchard, we may want to store cash or other types of “safer” investments to provide for us during market selloffs and troubled times.

More on the Retirement Income Harvesting Strategy can be found on this strategy by clicking on this link.

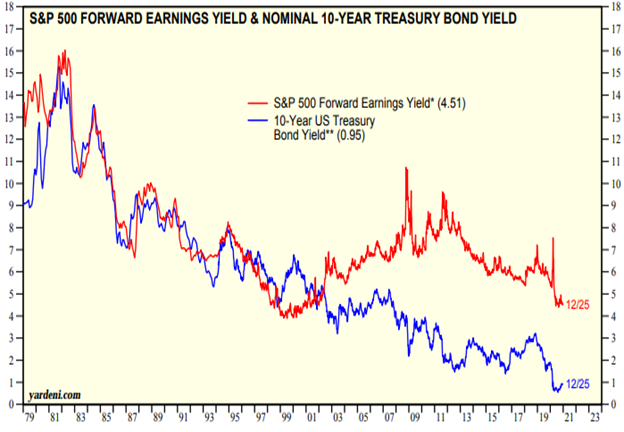

We have recently been stressing we believe that stocks, especially the largest most popular companies, are looking increasingly expensive. With companies like Tesla and GameStop trading at what some could consider “ludicrous” levels, we start to wonder when the bubble is going to pop. But when comparing to bonds, stocks still look cheap. This can be seen in the difference between bond yields and earnings yields below. Our contention is that equities look expensive, but bonds look even more expensive.

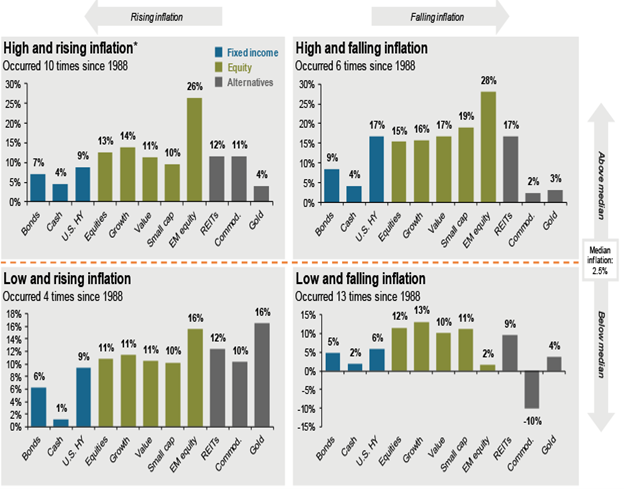

We also want to take a look at what may transpire if we see increasing inflation and a continued devaluation of the dollar over the next few years. If inflation rises, emerging markets tend to do well. If inflation is high and either rising or falling, emerging markets also do well. When inflation is low and falling like it was from 2012 until 2020, emerging markets tend to not do as well. Most of what we have just detailed leads us to believe that inflation will continue to rise and the dollar will continue to decline in value versus other currencies. For this reason, we want to be wary of having too much in dollar denominated assets. Only in America do investors tend to invest only in their own currency. Other countries are much more aware of how changes in currency values can substantially impact the value of their holdings.

‘Worry as much about the value of your money as you worry about the value of your investments.’ – Ray Dalio

Below is what Ray Dalio, the CEO of the worlds largest hedge fund, suggested we own.

“I believe that increasingly there will be questions by bondholders who are receiving negative real and nominal interest rates, while there is a lot of printing of money, about whether the debt assets they are holding are good storeholds of wealth. I believe that cash, which is non-interest-bearing money, will not be the safest asset to hold.”

“We’re going to have larger deficits which we’re going to print money for,” Dalio said. “At a point in the future, we still are going to think about what’s a store holder of wealth. Because when you get negative-yielding bonds or something, we are approaching a limit that will be a paradigm shift.”

“You have to have balance … and I think you have to have a certain amount of gold in your portfolio,”

“Most investors are underweighted in such assets, meaning that if they just wanted to have a better-balanced portfolio to reduce risk, they would have more of this sort of asset. For this reason, I believe that it would be both risk-reducing and return-enhancing to consider adding gold to one’s portfolio.”

“China, where ‘almost everybody’ is underweight, has fallen out of favor, but deserves more exposure, beginning with a diversified approach to investments in the region. That means to achieve the right kind of balance of assets in China, our approach is, we call it all-weather approach, it’s a certain balance in which you achieve balance without lowering the expected return. From that, you want to make the tactical moves.”

“First, worry as much about the value of your money as you worry about the value of your investments. The printing of money and the debt should make you aware of that. That’s why financial asset prices have gone up — stocks, gold — because of the debt and money creation. You don’t want to own the thing you think is safest — cash.

Second, know how to diversify well. That includes diversification of countries, currencies and assets, because wealth is not so much destroyed as it shifts. When something goes down, something else is going up so you have to look at all things on a relative basis. Diversify well and worry about the value of cash. “

“The period we are entering into is unlike what most of us have experienced in our lifetime. Since 1945, the dollar has enjoyed reserve currency status and this has given the U.S. a distinct advantage. Unfortunately, it seems we are on the wrong side of the debt cycle curve and may be on the path to losing this advantage. Wise investors may wish to do what they can to protect themselves not just from market declines but from the dollar decline as well.”

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, and CEO of Innovative Advisory Partners, a registered investment advisory firm in Hixson, Tennessee. A 20+year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are un-managed and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.