Last month I had a client ask me about a social security strategy that is going away on April 30th of this year. They wanted to explore the possibility of using the file and suspend strategy. In this case both spouses were 63 years of age. Of course, this issue is confusing because the file and suspend strategy is available to the spouse that is drawing the spousal benefit at any time after age 62 but is not available for the other spouse to file and suspend until full retirement age. The current administration and Congress made it all the more confusing by only allowing it to be used for a few months more.

The email read (with names changed to protect the innocent)

From what I’ve read, file and suspend has always been, and will continue to be, only available for those who are of full retirement age. I would have to be 66 by 04/30/16. (I’m now 63.)

I do have the option though of (my wife) filing for spousal benefits anytime after I file for my own benefits. She could then switch to her own benefits when she turns 70 and maximize her benefits that way. This “restricted application” by (my wife) will remain available for anyone who was at least 62 at the end of 2015. (I was 62 then, she was 63.)

If you read anything that contradicts this, please let me know!

My Answer:

You guys are partially correct. Restricted applications are available only for those of full retirement age though. The file and suspend strategy allows one spouse to draw after age 62 and get the spousal benefit, but the other spouse has to be full retirement age. She can file a restricted application at age 66 if you are already drawing. This allows her to draw half of yours while letting hers build.

Previously, if you were a bit older she could also draw if you filed and suspended after age 66, but it looks like we are not going to be allowed to do by the end of April (because you are too young to do this before the end of April).

This gets complicated, especially when we consider all the permutations with various ages of spouses etc…

MANY ARE STILL GRANDFATHERED FOR BENEFITS THAT OFFICIALS ARE TRYING TO DENY

Many people have been frustrated over the last few weeks in that some social security officials are now telling them that they can no longer file restricted applications.

A quick clarification on social security benefits for spouses.

If a spouse has a benefit which is less than ½ of the other spouses benefit, they can file to receive ½ of the spouses benefit (adjusted for age if less than 66) at any time after 62. This benefit would technically include all of their benefit and the difference between ½ the spouses benefit (adjusted) and their own.

If a spouse is full retirement age, he or she can file a restricted application and only draw ½ of the other spouses benefit. This is available for anyone who turned 62 by 1/1/2016 and should still be available if they are not 66 yet.

Many people in the social security offices are telling retirees otherwise and many in the social security offices have been giving inaccurate information on this for quite some time.

The Forbes article below describes which form is needed and how to fill it out. The other article should also prove helpful.

Click here to view the Forbes Article.

Click here to view another article from Money Magazine

WHAT CAN WE DO BEFORE TIME RUNS OUT ON APRIL 30th

The key issue now is that you CANNOT file a restricted application before full retirement age. If you try to do this you will not be able to let your own retirement benefit build to age 70 (or any other age past full retirement age).

If you already turned age 62 by January 1st of this year, you should still be able to file a restricted application when you reach full retirement age.

If someone tells you that you cannot file a restricted application and you are already full retirement age, we would advise finding someone else who can show you how you can do it.

A good question to ask would be, “If it was still possible to file a restricted application because I was born before 1/1/1954 how would I go about doing this?”

If you would like additional help making sure you are able to file a restricted application, please feel free to get with us on this.

In addition, we are having more sessions about this in the upcoming weeks so retirees can be educated and take action on these social security issues before their options run out on April 30th. Please check with us for availability to these workshops in early April.

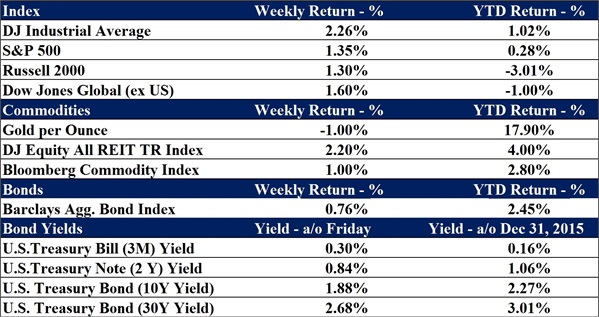

Data as of 3/18/2016

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, a registered investment advisory firm in Hixson, Tennessee. A 20-year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are unmanaged and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request