It’s almost tax time. During April, many people take advantage of the opportunity to reduce taxes by funding a Traditional IRA. While that makes sense for some Americans, others may benefit by contributing to a Roth IRA that offers no immediate tax break, but has other tax advantages, such as tax-free growth potential and tax-free income during retirement. Some people may realize the greatest benefit by having both types of IRAs.

Many of our clients are unable to contribute and get a deduction for their IRAs because of income limits. Individuals with income over $116,000 and couples with combined income over $183,000 often believe that Roth IRAs are not available for them. They are unaware that non-deductible IRA contributions can be made and immediately converted to Roth IRAs regardless of income. Of course it is important to consider existing IRA balances when doing this, in that other rules can affect tax liability. For those without existing IRAs, these Roth conversions can be done immediately without having to pay any taxes. This is known as the “back door” Roth IRA strategy.

Unfortunately, IRS contribution rules limit investors, who are younger than age 50, to making contributions of just $5,500 to all IRA accounts during 2015 and 2016. If you’re age 50 or older, you can save $6,500. Before making a 2015 contribution, consider the advantages of Roth IRAs, including:

- Tax-free growth potential. You won’t get a tax break today, but any earnings in a Roth IRA growth tax-free.

- Tax-free income. Distributions taken from a Roth IRA are tax-free, too, as long as certain requirements are met. That means the income from your Roth IRA is protected from future tax increases.

- No required minimum distributions. You can leave the money in your Roth IRA until your heirs inherit it. You can’t do that with a Traditional IRA. At age 70½, you must take required minimum distributions (RMDs) from Traditional IRAs. Generally, RMDs are taxable and, if an RMD is not taken when it should be, a hefty penalty is assessed.

- Penalty-free early distributions. You don’t have to be age 59½ to take a penalty-free distribution from a Roth IRA as long as the distributions are used for higher education costs, qualified home purchases, unreimbursed medical expenses, or specific other expenditures.

- Improved tax diversification. When a portfolio is ‘tax-diversified,’ it includes taxable, tax-deferred, and tax-free accounts. Different types of accounts offer different kinds of benefits. For example:

- Taxable accounts offer immediate access to funds. Money that is saved or invested in taxable accounts – like brokerage or banks accounts – have already been taxed and can be spent at any time.

- Tax-deferred accounts offer tax breaks today. For instance, contributions to 401(k) and 403(b) plan accounts are made with before-tax money so the contributions are not included in taxable income today. The downside is IRS penalties may be assessed if the money in these plans is distributed before retirement. (Another potential benefit of tax-deferred accounts is employer-matching contributions, which can help you accumulate retirement assets more quickly.)

- Tax-free accounts offer a tax break in the future. For example, contributions to a Roth IRA are made with after-tax dollars but any earnings grow tax-free and distributions may be tax-free. Having tax-free income during retirement may help you stay in a lower tax bracket.

- Open an account at any age. Anyone, of any age, who has earned income, can open a Roth IRA. So, you can fund a Roth IRA for yourself any time. You can also fund one for a child or grandchild who works, and give him or her a head start on saving for retirement.

- Contribute as long as you work. While contributions to Traditional IRAs must stop at age 70½ (when RMDs begin), that is not the case with Roth IRAs. As a result, Roth IRAs provide legacy and estate planning advantages Traditional IRAs do not.

If you’re planning to open or fund an IRA before April 15 for yourself or someone you love, and you’re not certain whether a Traditional or Roth IRA is the right choice, talk with your financial professional. He or she can review your portfolio and help determine which may best suit your needs. Even if you think Roth IRAs are not available because your income is too high, there are ways to structure contributions and conversions so you can get funds working for you tax free. This loophole is still available and we will continue to use it until we see it taken away.

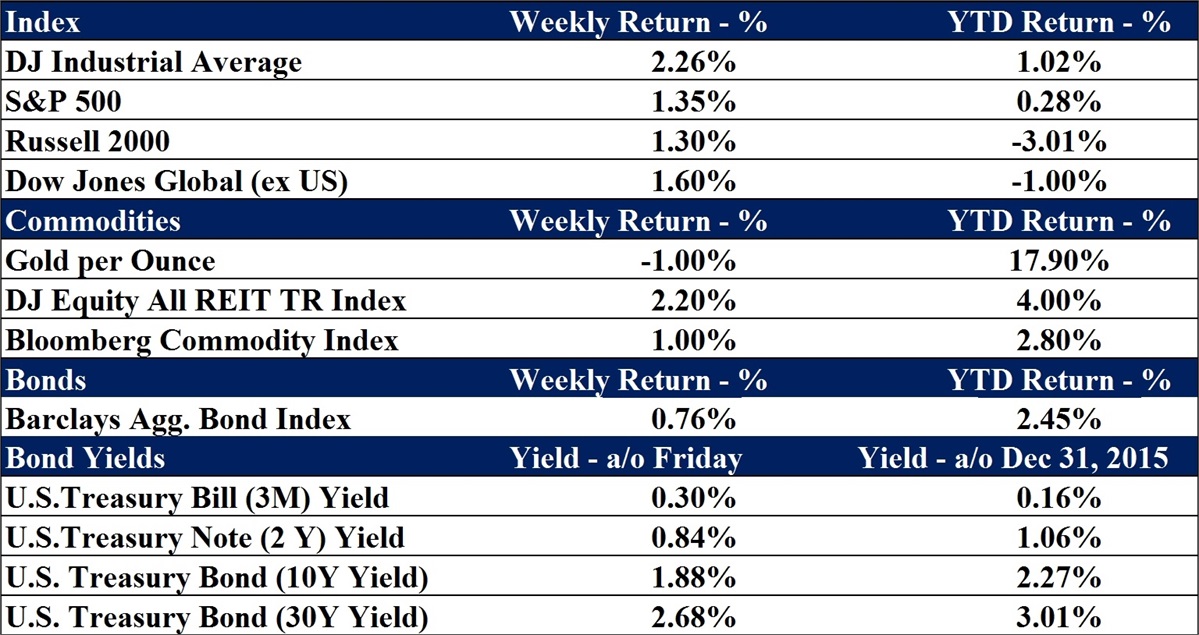

Data as of 3/25/2016

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, a registered investment advisory firm in Hixson, Tennessee. A 20-year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are unmanaged and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request