“We believe it is important to stay fit physically and financially. Our Wealthfit™ process is at the core of everything we work with clients to accomplish over their lifetimes.” – Joe D. Franklin – CFP®

I still remember how everything was turned upside down in September of 2008. Freddie Mac and Fannie Mae were placed into conservatorship on the 6th and Lehman brothers was allowed to collapse on the 15th. The markets were falling apart. My brother and I suffered a personal tragedy when my father passed away in a high speed car accident early the next morning.

Not only did we suffer a punch to the gut from the market collapse, but we were caught unawares by a deadly uppercut that could have put us down for the count when our father passed away. We had to work with the probate courts to unwind his medical practice, other business partnerships he had supported, deal with the divorce proceedings with his ex-wife / our step mother and fight off people we hardly knew who took from his house and fought for pieces of his estate.

The funny thing was that dad had done an admirable job planning for the future and getting his ducks in order at one point. But his financial fitness had been allowed to deteriorate due to lack of cooperation with key partners and lack of attention to some details that are all too often overlooked. It did not help that he was going through a divorce at the time. He had made some bad (some would consider crazy) decisions throughout the period that coincided with the divorce proceedings.

We had to get special permission from the courts during this time to be able to pay estate taxes because even though we had already divided out part of the estate to his ex wife, we were still fighting a battle with a lady we hardly knew who claimed she was a beneficiary to the estate. Probate costs were tens of thousands of dollars, next to no value was derived from the medical practice because his succession plan had fallen apart and the life insurance trust that was supposed to pay estate taxes actually caused more taxes because certain parties refused to cooperate to make sure the trust was actually funded.

All of these issues could have been and should have been avoided if my father had worked to make sure that once he gained financial fitness he had mechanisms in place to make sure he was able to maintain his financial fitness.

Part of this process involves making sure that we make good financial decisions on an ongoing basis by understanding ourselves and knowing what types of bad behaviors are most likely to cause the most harm. We wrote about this in Did you Miss the Gorilla? a few months back. Annual reviews of our financial plans and periodic updates also help avoid these well laid plans from becoming outdated and ineffective.

A Revelation

A few years back I heard Tony Robbins relate how he had helped someone quit smoking but this same person had come back years later to tell him that he had quit for five years but this cure “did not work” because he started smoking again. Tony related that he could help achieve a goal or a cure but continual conditioning was required to make sure those same people’s cures were maintained. I thought back to the issues with my father primarily but also other clients whose financial plans needed revisiting and came up with the idea of WealthFit™ to help make sure our clients maintain their financial fitness. It is not enough to get financially fit, we need to work to stay financially fit and make continual improvements. This has become the focus of everything we now do at Franklin Wealth Management. This is why I believe it is of utmost importance to make sure we are as thorough as possible and learn all we can about our clients personally and financially so we can advise what is best for them. It takes extra work on our part, but we want to make sure our clients and their families do not have to suffer as our family did a few years back.

We have been able to develop plans that are dynamic, updating over time and review these periodically. We focus on five primary areas rather than just looking at rates of return and what the market did yesterday. “One bad year in the market does not destroy a lifetime of good decisions.” But a few bad decisions or lack of attention can destroy good decisions that have been made in the past and I am passionate in making sure clients do not get derailed by bad decisions made in times of personal weakness or crisis. That is why maintaining Financial Fitness through our WealthFit™ process is such a big part of our practice.

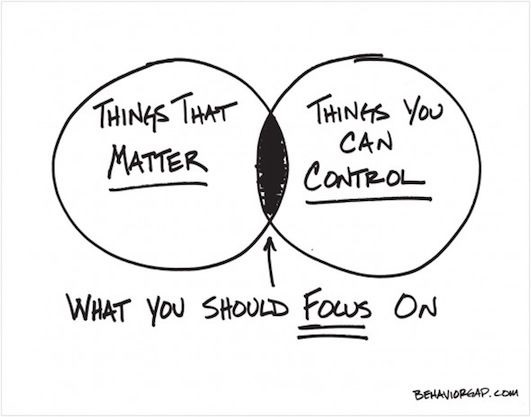

We can control most of what we are working toward with regard to the WealthFit™ process. Over time, clients get a sense of accomplishment as they continue to work toward 100% completion of the WealthFit™ chart. Like the weather, the markets are fickle. We do not always get the weather we wish or expect, and I can say that my crystal ball is not always 100% accurate. What we can control and what we work toward is making sure all clients are as financially fit as possible and stay as financially fit as possible. It is an ongoing process that takes work on all of our parts and sometimes requires course corrections that are not always fun. The end result is worth it, however.

The benefits of working with a Wealth Manager:

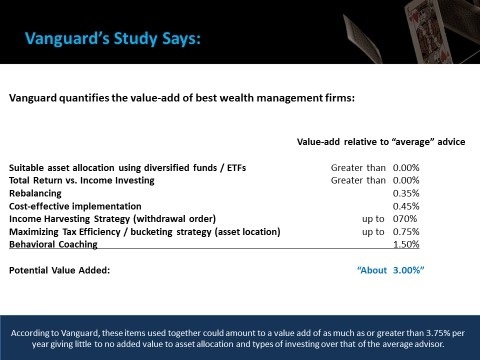

Buffett says, “If your wife is going to have a baby, you’d be better to call an obstetrician than do it yourself. If your pipes leak, you should call a plumber. Most professionals add value beyond what the average person can do for themselves.” The good news for investors in the coming years is that the government is requiring advisors be held to the Fiduciary Standard and put their client’s welfare ahead of their own. So where does an “above average” advisor add value. According to Vanguard, they feel that the added value is not in investment strategy or choosing the best allocation of investment products.

Follow this link for the full study.

The findings from their research can be found below:

One reason we developed our WealthFit™ program was to focus our activities on where we continually add value for clients and provide better tracking for where clients currently stand in their continual path to improved financial fitness. All of the items noted by Vanguard in their study are part of our WealthFit™process, but the study limits itself to primarily to investments, cash flow management and touches on long term tax minimization planning. Estate planning, protection planning and other items are not even taken into consideration. In fact, when running stress test for clients, we find that social security maximization, asset location for long term tax benefits, income harvesting strategies and other items make a bigger difference for clients over time than taking more risk to earn an extra percent or two.

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, a registered investment advisory firm in Hixson, Tennessee. A 20+year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are unmanaged and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.