Even when Not Playing Monopoly

Thinking more like a banker can provide us many benefits from a tax re-positioning perspective and a loaning vs borrowing / cash flow perspective.

Not too long ago, I and a client were interviewed by a reporter at Forbes about the benefits of making serial conversions to Roth IRAs over time and how his conversions were going to enable him to not only retain a stable income in retirement but also achieve tax free distributions from his retirement savings and reduced to potentially tax free Social Security income.

Click here to read The Road to a Tax-Free Retirement

We regularly recommend clients who are still working to save as aggressively as possible in their 401ks and Roth 401ks if available. Spending down taxable assets to do this even if cash flow is tight and enough savings are available works if clients are able to realize the retirement assets are accessible. If anyone has been able to save significant sums outside of their 401k and is not maxing out their 401k, this is a sign they are not taking full advantage of all the long-term tax savings the government allows. Jennifer and I also like to practice what we preach. Ever since establishing Franklin Wealth Management, we have continued to max out our 401k contributions for both of us.

Saving in retirement accounts decreases current and future taxes from taxable savings and also moves a greater percentage of assets to tax deferred and tax-free assets (Roth 401k). If a client is over 55, these assets in the 401k can be immediately available and should not be a deterrent to saving more aggressively to tax deferred or tax-free accounts in that they can be accessed in the event of an emergency. For those under 55, up to $50,000 can be borrowed from the 401k as well (When I was in my early 30s, I personally utilized this option once to assist with the purchase of our home but continued to save the maximum to optimize our long-term tax savings).

Many 401ks pay better rates in the “Guaranteed Interest Contracts” or fixed accounts than can be found in a money market, savings account or short-term CDs that many prefer in the taxable accounts. Why not think of a portion of the 401k as an emergency fund paying a higher interest rate than the bank if one is able to get penalty free withdrawals or loans where you pay yourself back with interest (also paid to yourself).

We typically advise clients to be debt free by the time they reach retirement. Owning everything outright provides a sense of accomplishment and greatly reduces stress going forward. Even if someone is completely debt free, we still recommend keeping a line of credit available. Having a low interest line of credit helps provide an even greater cushion if an emergency depletes more of the emergency funds than anticipated. Of course, anyone who receives this advice typically exhibits the financial discipline to be able to avoid tapping into this too often.

Borrowing money to invest or utilizing leverage when investing can reduce opportunity costs and prove catastrophic when taken to extremes. Warren Buffet commented on this phenomenon last year in his letter to shareholders and advised avoiding borrowing money to buy stocks.

Click here to read Warrens thoughts on Liquor, Ladies & Leverage.

Yet borrowing at a low rate to loan at a higher rate is exactly what banks do on a regular basis. Banks will borrow from depositors paying some interest on checking and savings accounts and slightly better rates on money markets and CDs. The same banks will then lend money at a higher rate to earn a spread that allows them to profit over time. As interest rates continue to rise, these banks are growing their profits as the spread between the lending rate and the borrowing rate grows.

Those with low interest rate mortgages can also act much like a banker. If a couple borrows at 3.5% and loans funds at a starting rate of 3.75%, a 0.25% starting spread is locked in that can grow over time. The couple can loan money by letting the bank borrow from them by buying a CD or letting a corporation or the government borrow from them by buying an investment grade bond.

Our current thinking remains that most retirees should look to bring their debts down to zero, knowing that a misstep is much harder to overcome without any employment income. However, with some locking in mortgage rates at all-time lows and rates starting to rise, why not look at being more like a banker?

Many have locked in mortgage rates at anywhere from 3.25% to 4% currently and it is not excessively hard to find CDs and investment grade bonds paying more than this. In a flat to rising interest rate environment, matching the repayment of mortgage interest with the payment of higher interest CD and bond payments and maturities can allow an investor to earn a spread much like a banker.

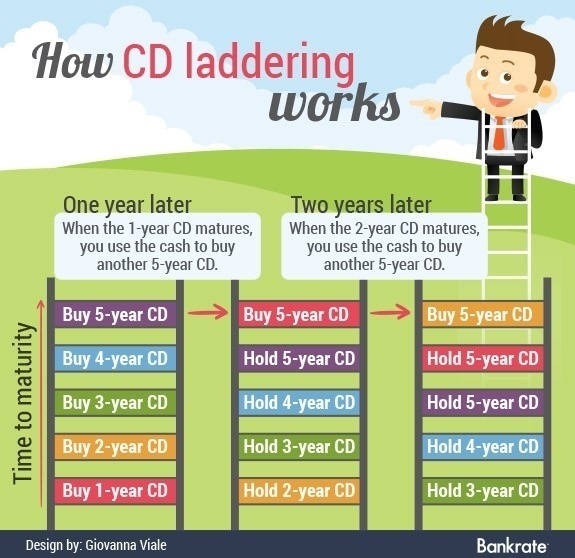

The best way to ensure a rising income over time is by utilizing a bond ladder. As we have explained in past articles, in a flat to rising interest rate environment, a CD / bond ladder will be constantly replacing lower interest maturing CDs & bonds with longer term, higher interest CDs & bonds. Income consistently increases over time if interest rates are stable or increasing (and potentially even if decreasing at a slow rate).

Follow this link to fine our article on Laddering Bonds & CDs

If we are able to structure a ladder of CDs and relatively safe bonds with income greater than the mortgage payments, we should come out ahead in the majority of cases. But what starting interest rate should we look to get from our CD/bond ladder?

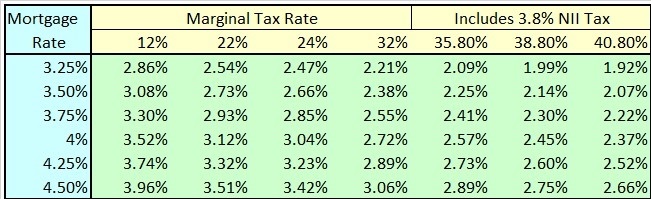

Tax rates for most individuals and families are going to decrease in 2018. A married couple with an income between $77,000 and $165,000 will have a marginal tax bracket of 22% starting this tax year. We need to figure the rate to achieve a positive spread after adjusting for mortgage deductions (assuming the couple is itemizing their deductions going forward).

If this couple ends up with a mortgage rate as high as 4.5%, we only need to achieve an average rate of slightly more than 3.5% from the CD/Bond Ladder to come out ahead in the first year. Considering the ladder provides more income over time in a flat to rising interest rate environment, we could look at starting with a lower starting rate, but why not be cash flow positive coming out the gate?

Once again, we like to stress that for many retirees, especially those who are more risk averse or in lower tax brackets, paying off all debts and creating more certainty is the safe and many times optimal solution. But for some, playing the part of the banker, may prove to be the better option in some circumstances, after doing the math.

Of course, it is always good to talk with your Certified Financial Planner about the best course going forward and let them help you work through the math of your personal situation.

A bank is a place that will lend you money if you can prove that you don’t need it. – Bob Hope

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, and CEO of Innovative Advisory Partners, a registered investment advisory firm in Hixson, Tennessee. A 20+year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are unmanaged and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.