Nothing Can Replace Meeting Face to Face

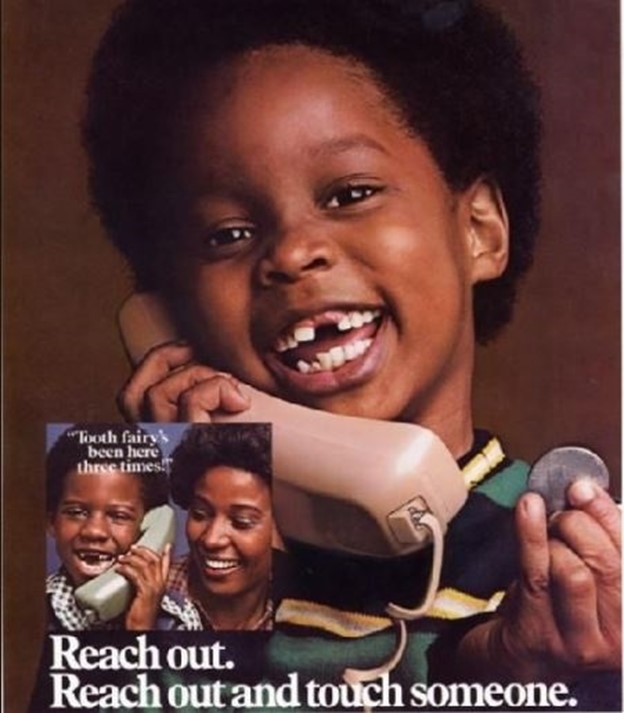

Growing up in the 1970s and 1980s, I remember the old commercials that promoted keeping up with family and other loved ones. The commercials were designed to inspire us to grow closer together through the use of the telephone. When my grandparents were still living, we would talk on the phone but these memories are not nearly as vivid as trips up to the farm in western Kentucky and time spent with family over the holidays.

Technology makes communication much cheaper and easier than ever before with cell-phone, email, text and social media communication becoming more and more prevalent. No longer do we regularly visit with family via long distance phone calls. Skype, Zoom or Facetime have become more common for more meaningful family interactions.

But it is also harder to communicate because we are bombarded constantly by unwanted interruptions. Emails arrive by the hundreds over the course of a business day and it becomes more and more imperative to find ways to weed out the less desirable emails (unfortunately sometimes the spam filter is too aggressive). Robo-calls cause individuals to be more guarded with incoming calls. Texting and social media messages seem to be the medium of choice for the younger generation.

What we seem to be losing is the art of one on one human interaction. Most would agree this is the best way to communicate, and if we truly want to get the most out of an interaction or meeting, we get together in person.

I personally read a lot of books, blogs and articles on how to improve our business, lead people and personal effectiveness. But I gain at least 10 times more insight from attending quarterly coaching classes with top notch entrepreneurs from all over the country and learning in person.

When we teach a class or a workshop, people always seem to get more out of the class if it is in person rather than a recording they might listen to afterward. People can ask questions and pick up much more when all their senses are engaged.

Benefits of Financial Progress Meetings

Likewise, we know that those clients who are truly committed to getting into shape financially and staying in shape financially are the ones we meet with regularly.

A few years back we developed our WealthFit™ process to enable us to better serve our clients and keep better tabs on how they are continually improving their financial situation. Change is the primary constant in all of our lives and finding the best way to adapt to this change and be proactive is paramount for success.

We tend to provide the most value for clients when they are going through some sort of life transition, whether it be selling a business, retirement, or losing a loved one to death or divorce. The initial planning work we do for clients is where we are heavily involved on the front end, getting to know them, helping them get organized, clarifying goals and dreams, detailing all the areas for incremental improvements and developing a long term implementation plan to help transform their lives coming out of the transition

But it is the ongoing work that we feel is potentially even more important:

- Most clients engage with us on long-term tax planning to be able to get assets into more efficient tax-buckets over time. Getting together toward the end of the year to look at potential tax-loss opportunities, conversion opportunities and especially tax efficient distribution strategies tend to make a big difference.

- We have been able to get ahead of many of the tax law changes over the last 18 months. Those clients who attended our classes and met to make proactive changes also seem to be better off than those on auto-pilot. Education planning has also changed significantly over this same time-frame.

- Since 2016 there have also been many changes to the Social Security laws and we are working with clients to take advantage of them before time expires. This year is the last year to utilize some of these strategies.

- Currently we are meeting with many clients with regard to changes in Tennessee Estate planning laws as it relates to Personal Property Memorandums and ensuring we keep Powers of Attorney on file.

- Lastly, we have adjusted the way we work with clients as it relates to their investments so that they have more input into how we adjust risk over time. Within all of our models we still rebalance the portfolios during inflection times to reduce risk. However, we prefer to not make the full adjustments we used to make for clients without meeting and discussing how their portfolio would be impacted. We have found it best to make sure everyone is engaged and understands the basic reasoning behind these risk adjustments. In order to best address these rebalancing periods, it is best to review things on a semi-annual basis.

People know that as they approach full retirement age, it is good to make sure we review our strategy to Maximize Social Security Income. They know that when they get to age 65 that it is time to sign up for Medicare and look at options related to these. They know that when they get to age 70.5 that they need to start taking required distributions, utilize strategies to reduce the impact in the preceding years or use other charitable options to reduce the taxes. But some do not always recognize all they should be thinking about and reviewing on a regular basis. It is for this reason we recommend you reach out and touch your favorite Certified Financial Planner.

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, and CEO of Innovative Advisory Partners, a registered investment advisory firm in Hixson, Tennessee. A 20+year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are unmanaged and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.