WHAT HAPPENED TO OUR LOST LUGGAGE? &

WHY I SPEND OVER $50K A YEAR ON COACHING.

Last month we visited Germany to attend the Rotary International conference and spent a few extra days to enjoy the culture and the sights. We enjoyed ourselves immensely, but we also had our share of scares during the week. One particular day we had been exploring a new city and we headed upstairs to get our bags at the train station. My wife, Jennifer finds our locker to get our bags. She inserts the key, opens the door and IT’S EMPTY!

Jennifer calls me over and shows me the locker. Someone has taken our bags. “Did you lock it!” she asks. “Of course, you can’t take the key out without it locking.” We notice the cameras located directly across from the lockers and realize that somewhere there must be a recording. We notice a security guard close by and get his attention. Unfortunately, he does not speak good English but takes us to “Go see Police”.

We walk back downstairs and start listing off all the things that we are going to need to replace, people we will need to call and files we will need to recover. We reach an open area to “wait for the police”. I finish my drink while Jennifer heads inside with the security guard.

As I’m throwing away my drink Jennifer steps out and drags me into the building and pointing up to a shelf in the back. There is our stuff. But we notice these are not police we are talking to. This is an information station. The people behind the desk tell us, “In Big Trouble. Cannot leave bags alone. Need to See Police” We let them know how we thought we locked the locker and are willing to answer any questions. “Police Come. Big Trouble” We’re ready for them to arrive, but they never do. It seems the Germans are playing a joke on us, but we don’t get it. They give us our bags and a toy to give our kids. We’re just happy to have our bags back. “So they were joking?” we ask each other, and the guard from upstairs says, “Ya, Joke.” We thank him as best we can and go find the platform for our next train.

Money can buy you a fine dog, but only LOVE can make him wag his tail.

Kinky Friedman

Over the week we were impressed with the friendliness of the German people and Rotarians in particular, meeting a variety of new friends. We could definitely feel the LOVE among fellow Rotarians and the people we met as a whole.

The second day of the Conference was themed Rotary Leadership Around the World and one of the speakers of the day was Steve Farber, Founder & CEO of the Extreme Leadership Institute. He shared with us his formula for Extreme Leadership as found in his book “The Radical LEAP”, and the foundation of his formula is LOVE.

Jennifer and I were surprised at the quality of all the speakers on “Leadership Day”. Mr. Faber and the other speakers led me to think about how to best impact others with LOVE and inspired wisdom and how others, including my father had mentored me over time. Three concepts that I learned from my father early in life were 1) Not to be afraid to take risks and make mistakes 2) Learn from these mistakes and find ways to not repeat them 3) Learn from others and find mentors so we can benefit from their experience; their past successes and failures with help overcoming our personal setbacks.

Because of these three foundational concepts, I have long been a big believer in C.A.N.I. (Constant and Never-Ending Improvement), reading books and listening to coaches, emulating them to achieve the goals I, our family and our team are working toward.

It’s hard to name a top professional in any sport or profession that has not benefited from coaches or mentors along the way. Tiger Woods was already a champion but worked with Hank Haney in the late 90s and early 2000s to be able to dominate the sport of golf. It’s unlikely Michael Jordan, Tom Brady, Bill Russell or Bart Starr would have won nearly as many championships without Phil Jackson, Bill Belichik, Red Auerbach or Vince Lombardi as their respective coaches.

Coming out of college I must have listened to Brian Tracy’s “Psychology of Achievement” tape series at least 100 times and I still have my journal from when I originally went through the Tony Robbins Personal Power tape series. It’s fun to look back through what my 20+ year old self was thinking and goals that have been attained since then.

When I entered the Financial Planning industry, I gravitated more toward climbing the learning curve as fast as possible buying books, listening to tapes (later CDs) and buying office management software/systems to benefit from other’s experiences.

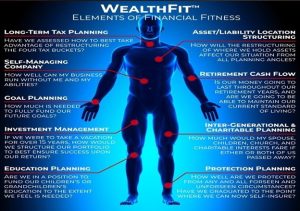

Over the last few years, I have been with Tony Robbins and his other coaches in Chicago, Palm Springs, San Diego and Fiji. Tony has personally coached CEOs and Presidents, such as Bill Clinton, Ray Dalio, Marc Benioff (CEO of Salesforce), but I’m not ready to pay for what he charges. Our WealthFit™ process was born out of the concept of success conditioning brought up at many of these Tony Robbins conferences, and this has been the focus of our practice ever since.

I have been involved with more individual coaches and attended industry specific conferences all across the country over this time. I’ve found I’ve gained more from association with individual coaches as well as other top performers by talking through issues and learning directly from their insights. Others can see what I cannot see and can point out things I’ve been missing.

More recently I’ve been involved with an organization called Strategic Coach, meeting in Toronto quarterly. This association has allowed me to network with other top quality entrepreneurs in our industry and others. It has further refined my thought processes, jump started our journey to develop a top quality unique ability team to transform Franklin Wealth Management to a self managing company. It’s put more fun into our daily lives, celebrating wins and continued growth. Through this organization, I’ve also met other people that I have engaged with to help me identify blind spots, find strength in vulnerability, express feelings, face uncomfortable truths and enjoy the successes.

Why am I currently spending over $50 thousand a year on coaching and mentoring? I don’t feel I’d be where I am today without the mentoring I’ve received over time, the insights and experiences of others to help me, our family and our team along our journey.

“Surfing is an extreme sport because the wipeout is part of it. All extreme sports have that in common. And leadership – is an extreme sport too.”

Quote from “The Radical LEAP”

I was not anticipating such good speakers that Monday morning in Germany. Mr. Farber shared how the extreme leader consciously and intentionally cultivates love in order to generate boundless energy and inspire courageous audacity. We’ve all heard the saying, “people do not care how much you know until they know how much you care.” He shared many inspiring examples of how extreme leaders (not necessarily in a position of authority) loved their customers and inspired others.

For me it’s easy to love my family. It’s also easy to love clients and friends. In most cases clients become friends over time. I’ve been frustrated with vendors and regulatory necessities from time to time and found myself rejuvenated by spending time with family, friends and clients. Unfortunately, I have found myself not expressing enough love to team members at times when dealing with some of these inflexible vendors and procedures. I want to be more consistent in showing them how much I care.

When I was younger, I was motivated by competition and the next level of achievement. Today I’m motivated primarily by helping others succeed whether they be my children, team-members, others in our industry or clients / friends. Giving back has become a much bigger part of what I am about, especially with children (where I feel I can have the biggest impact). Lately, I realized that I need to focus more on helping those closest to me find their own path and achieve what they want rather than what I think they should want.

For those who are not yet retired, Steve Farber recommends – “fall in love with your work again, revitalize your energy, be audacious to be able to show proof through glorious failures that eventually leads to phenomenal success. Do what you love in the service of people who love what you do.”

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, and CEO of Innovative Advisory Partners, a registered investment advisory firm in Hixson, Tennessee. A 20+year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are unmanaged and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.