If the short term gain is stimulus for pocketbooks and progressive programs, what can we do to protect from the long term pain? Will debt levels incurred through stimulus lead to continued dollar devaluation, inflation and higher taxes? The video above shows some of what happened the last time the dollar weakened over a multi-year period.

In talking with friends and clients, everyone seems to be starting to get together, go out to eat, and plan vacations again. In short, people are starting to spend.

There is plenty of stimulus left in the pipeline from last year’s pandemic rescue programs. Personal savings hit new highs last year as government stimulus checks were saved and not spent because of the lockdown. As the lockdowns are winding down, more rounds of government stimulus programs this year are likely to cause a boom that overheats the post-pandemic economy, which might result in higher inflation. The government’s extended unemployment benefits could also frustrate policymakers’ goal of achieving full employment while driving up wage inflation.

In our article, “Preparing the Post-Election Portfolio” we outlined the possible unintended consequences of more stimulus. We still anticipate persistently low interest rates, a weaker dollar and possible inflation in the years to come as the debt bubble is set to grow by another $1.9 Trillion to $3.4 Trillion over the next few months. Our thinking has changed very little since last August.

Click here to read “Preparing the Post Election Portfolio”.

Too much of a good thing is often just too much. We seem to have become addicted to stimulus over the last decade. The economy is hot and will likely get hotter with the bonfire of fiscal and monetary mad money. But just like any high, it is almost always followed by a depression or a hangover. We do not know when the high will reach its zenith, but we have seen many similar cycles before.

What might save us from the specter of inflation?

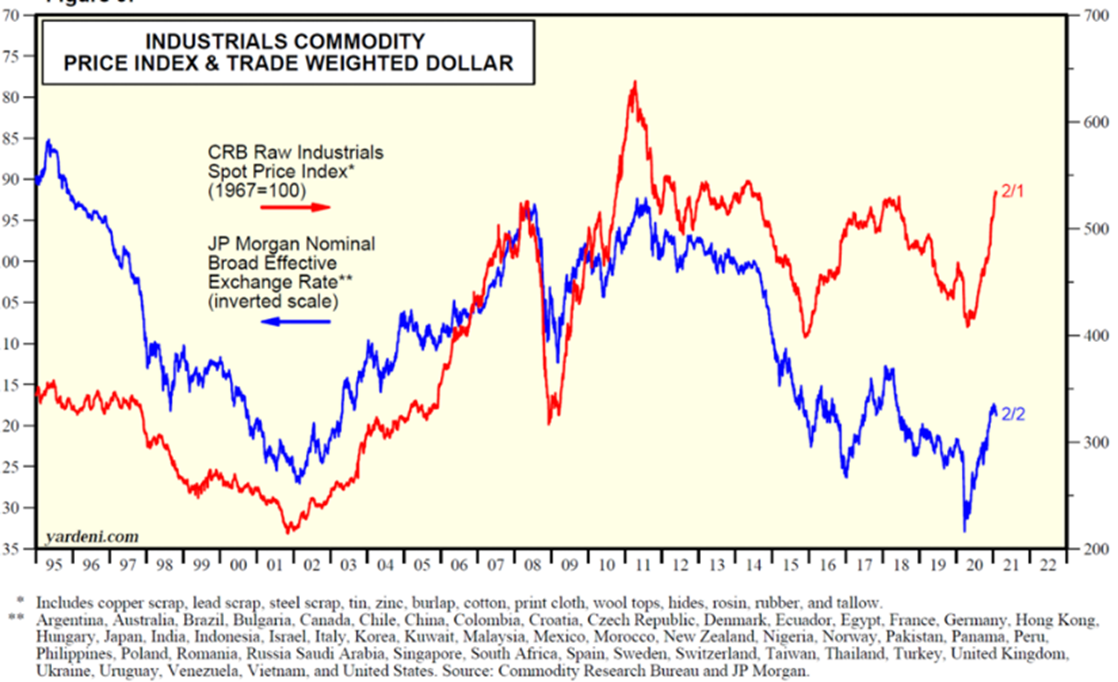

As can be seen in the chart below, it looks like the value of the U.S. Dollar peaked in March of 2020 and has been losing value consistently since then. As the U.S. government continues to print dollars to help pay down the debt, we expect this to continue. We have seen prices for gas, materials, precious metals and other assorted commodities increase significantly over the last year. Many are growing concerned, but this also provides an opportunity for those who can allocate to areas that will do well in inflationary times with dollar declines.

Ed Yardini recently wrote a book in which he outlines four factors which he feels will continue to work against inflationary pressure in the coming years. Below is some of what he recently wrote regarding these four factors which he refers to these as his four Ds.

“The question is whether the 4Ds have met their inflationary match in the extraordinary monetary and fiscal policy responses to the pandemic. Most of those expansions occurred since the week of March 23, when the Fed and the Treasury essentially embraced Modern Monetary Theory and morphed into “T-Fed” in response to the pandemic.

Contrary to Milton Friedman’s claim that inflation is essentially a monetary phenomenon, it has remained subdued ever since the financial crisis (2008) notwithstanding the ultra-easy monetary policies of the major central banks. We soon should find out if money matters to the inflation outlook given that the pandemic has resulted in ultra-easy monetary policies on steroids and speed combined!

Our money is on the 4Ds. They should continue to keep a lid on inflation. Here is our current bottom lines on each of the 4Ds:

Détente – In the grand sweep of economic history, inflation tends to occur during relatively short and infrequent episodes, i.e., during war times. The more common experience has been either very low inflation or outright deflation during peacetimes.

Periods of globalization follow wartimes. During peacetimes, national markets become increasingly integrated through trade and capital flows. The result is more global competition, which is inherently deflationary. The worsening Cold War between the US and China is a threat to globalization, but probably won’t heat up to the point of causing inflation now that a regime change is coming to Washington.

Technological Disruption – Nevertheless, recent global trade tensions and the pandemic are likely to cause businesses to diversify their offshore supply chains away from China and to onshore more of them. That could be costly and inflationary. It could also be cost effective now that labor shortages attributable to global demographic trends are stimulating technological innovations in automation, robotics, artificial intelligence, and 3D manufacturing. These all enable onshoring and boost productivity to boot.

We are expecting a secular rebound in productivity growth during the Roaring 2020s. I believe that the pandemic accelerated the pace of applying new technologies to boost efficiency and profit margins.

Demographics – Fertility rates have plunged below population replacement in recent decades around the world as urbanization has changed the economics of having children. Instead of being an important source of labor and elder care, as they were in agrarian communities, children are all cost in urban settings. Nursing homes have few vacancies, while maternity wards have plenty. Increasingly geriatric demographic profiles are inherently deflationary.

Debt – During the 1960s through the 1980s, debt was stimulative; more of it stimulated more demand and added to inflationary pressures. Now, easy credit conditions aren’t as stimulative to demand as in the past because so many consumers have so much debt already. However, easy monetary conditions are a lifeline to zombie companies, enabling them to raise funds to stay in business and add to global supplies of goods and services, which is deflationary.”

The Verdict

Can the four Ds do enough to stop the decline of the dollar and the specter of inflation? Time will tell, but we want to protect ourselves, nonetheless.

The trend since the inflection point in March 2020 has been toward dollar devaluation and inflation. We expect the trend to continue.

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, and CEO of Innovative Advisory Partners, a registered investment advisory firm in Hixson, Tennessee. A 20+year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are un-managed and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.