When I was a boy, we used to travel up to the family farm in Kentucky every few months to visit my grandparents. I remember playing checkers with my grandfather Franklin. He would never let me win but I grew more patient and disciplined with my play over time and was finally able to beat him when I was about the same age my middle son Jack is now.

My other grandfather was a collector. He would teach us about how some rare coins and stamps were much more valuable than the more common ones. He also collected clocks and antique phonographs. We have many in our home today and I am glad that my wife does not insist on keeping them all running. I remember how it was troublesome getting to sleep at the farm when all the clocks would chime late at night. If some were running a little fast or slow, the chiming would last a good half hour.

The year 2021 may be remembered by many as the “Binge” Year. Since everyone who desired a vaccine has seemingly received one, it seems that demand for all things has gone through the roof and supply shortages have sent prices markedly higher. It seems almost everything has become a collectible with used cars and boats sometimes selling for more than new ones.

We covered this in more detail in our Halftime Webinar recently, to access this click here.

I was talking with a client this past week who used to work for the Federal Reserve about these inflationary concerns. She expressed that the increase in rental prices is what has her most concerned. Food and energy prices can go up and down, homes and car prices can also go back down. But wages and rental price increases tend to stick and are anything but “transitory.”

For this reason we continue to believe in owning a good percentage in “scarce assets” that can protect from inflation. I cannot remember when our commitment to “scarce assets” has ever been higher.

These scarce assets are items that are in limited supply. Real estate, collectibles, artwork, jewelry, precious metals and to some extent commodities may all be considered in seeking to protect from inflation. We believe suitable investors may want to consider increasing exposures here as they grow more valuable because of currency debasement.

Why not just own equities?

Equities have proven to have appreciated faster than currencies have lost value, most of the time. This has tended to be the case except when we’ve encounter runaway inflation like we have seen previously in Venezuela, Zimbabwe, or pre World War II Germany. When companies and citizens have conducted financial transactions in currencies that were rapidly losing value, we note that the currency took the companies down with them unless significant amounts of treasury assets and payments were received in more stable currencies. This is why many countries over time have pegged their local currencies to the dollar.

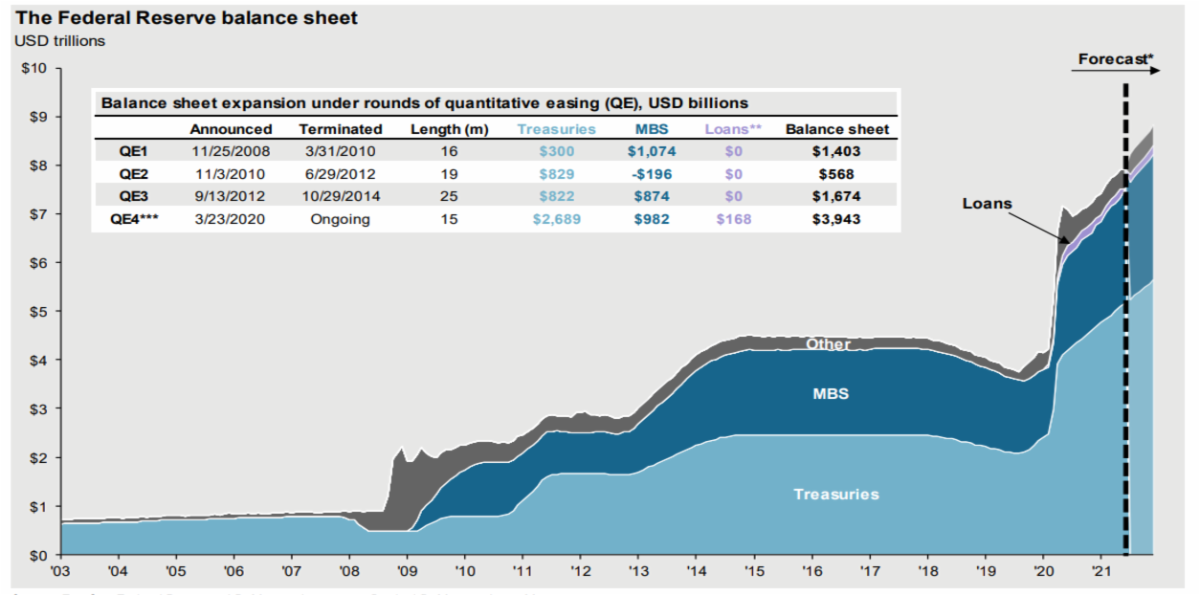

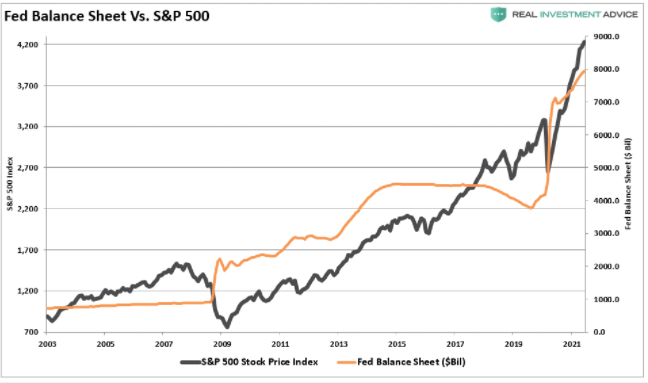

With the rapid expansion of the federal reserve balance sheet and the U.S. money supply, many currently feel that U.S. stock exposure may not do enough to protect from some of these inflationary pressures. However, owning stock in companies that mine, drill or somehow benefit from the rising price of “scarce” assets may benefit as currency values continue to wane.

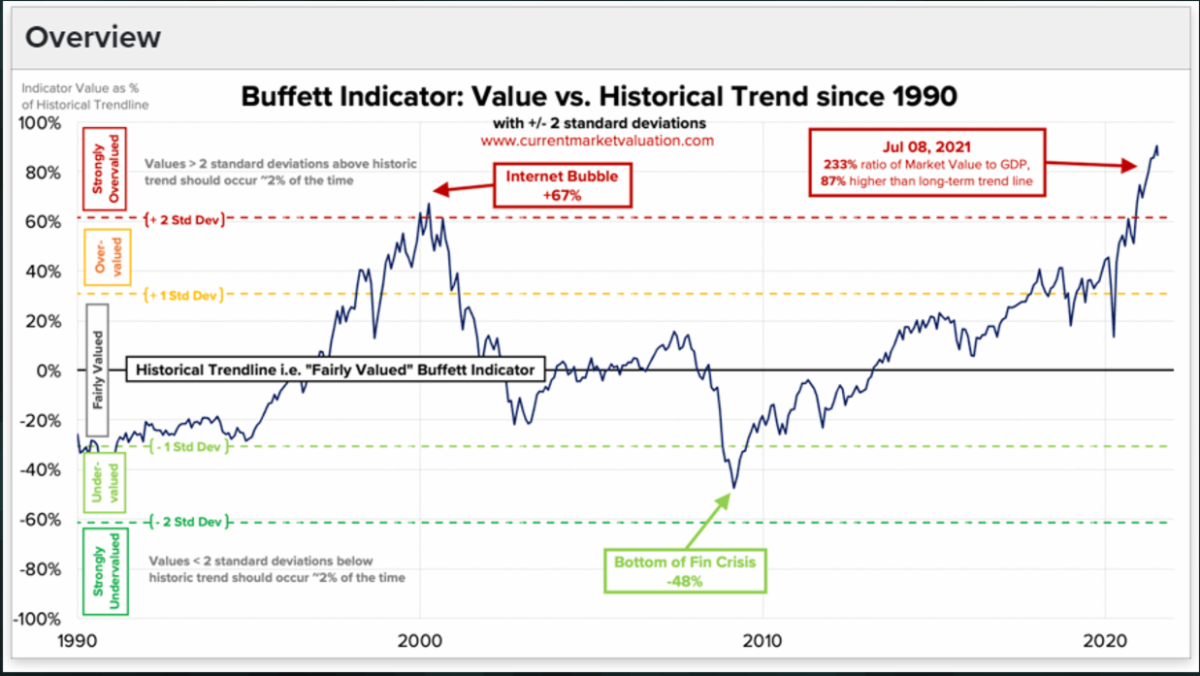

We have continued to grow more concerned as U.S. stock valuations achieve highs rarely seen and in some cases never experienced before. Warren Buffet’s favorite metric for valuing the U.S. Stock Market ballooned to a level never seen before since the government started providing these Gross Domestic Product statistics in 1947.

When Does It Make Sense to Start Reducing Equity Exposure?

In the past we have written about seasonality factors and how it makes sense to rebalance portfolios to take advantage of the historical good months (November through April) and protect during the historically bad months (May through October). Adjusting in May and November to get back to the “strategic allocation” allows us to reduce equity exposure after a good period (typically May) and increase equity exposure after a bad period (typically November). We like to look for times where markets are starting to transition around these time periods.

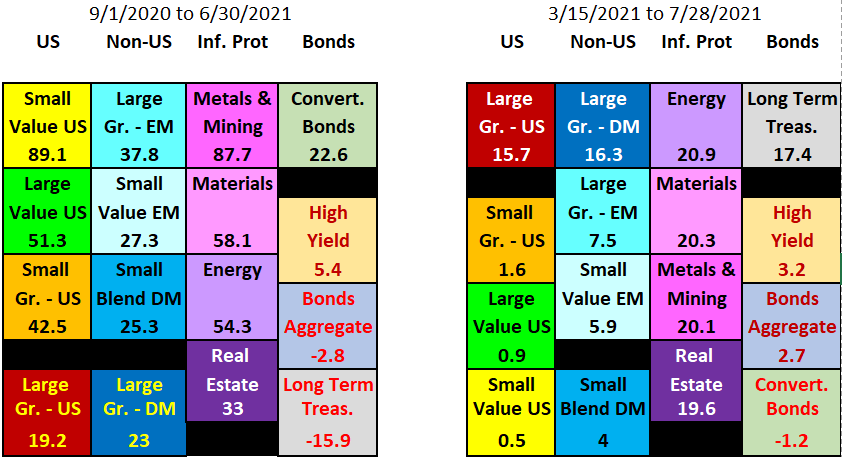

As can be noted in the chart below, as we approached the election and the economy started to open up again last year, value oriented recovery stocks and smaller companies performed much better here in the U.S. Emerging markets outperformed developed markets internationally and holdings that provide inflation protection performed exceptionally well.

Just after congress passed the stimulus bill in March, we started to see another transition back into those holdings that performed the best going into and coming out pre-pandemic panicked markets. Long-term treasuries have outperformed all well known stock indices and most asset classes with notable exceptions being those that provide inflation protection. The chart below shows how the 25+ year treasury bonds have outperformed both the Dow and the S&P 500 since mid-March.

Should Long-Term Treasury Outperformance Cause Concern?

Long term treasuries hold their value well when panic sets in and the stock market crashes. We typically see these bonds start to rally and interest rates come down just prior to a selloff. In fact, one of the best predictors of a recession is when longer term term treasuries are paying less interest than shorter term treasuries. This yield curve inversion predicts recession with 80%+ accuracy over the last 50 plus years.

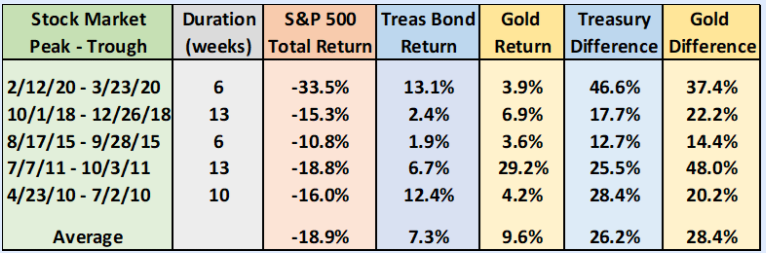

Increased exposure to treasuries while the economy has been going into a recession and the market selloff that has typically preceded one, has tended to be a good strategy. The chart below shows how Treasury Bonds and Gold have tended to protect portfolios during many nasty stock market selloffs.

Some might question why we want to own anything but long-term treasuries when they have been performing better than most stock holdings. We ask ourselves the same question, especially when equity valuations seem so rich. The primary issue is that although we are concerned about U.S. equity valuations, we have stated we are somewhat more concerned about bond valuations. But this market is being influenced by factors other than a free economy and it is most important to consider these factors.

One Percent Mortgages and Bonds with Negative Yields?

By now most of us have learned not to “fight the Fed”. When the federal reserve is stimulating the economy and expanding its balance sheet it is trying provide wind in the sails of the economy and asset prices almost always appreciate. Lately we’ve found that monetary stimulus has not been as effective for the economy unless coordinated with fiscal stimulus checks and government spending. These measures are much more effective in raising asset prices than getting banks to lend and the public to spend.

When we consider interest rates and the sheer volume of bonds being issued we do not have to look far to know who is now buying most of these bonds. Its our Federal Reserve Bank. They are driving bond prices lower and over time we may end up with rates much like those in most of Europe and Japan where rates have been zero or below zero for many years now.

But forcing interest rates closer to zero would likely cause the dollar to lose its reserve currency status and the U.S. to lose significant influence around the globe. We want to watch our government leaders carefully to determine to what degree they are going to continue to prop up this manufactured economy. We have less to worry about as long as they are providing more stimulus and the economy continues to receive oxygen from the Federal Reserve. We want to be extra vigilant to take note when the life support is removed.

Don’t Fight the Tape. Don’t Fight the Fed. – Marty Zweig

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, and CEO of Innovative Advisory Partners, a registered investment advisory firm in Hixson, Tennessee. A 20+year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog

Please remember that past performance may not be indicative of future results. Indexes are un-managed and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.